Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

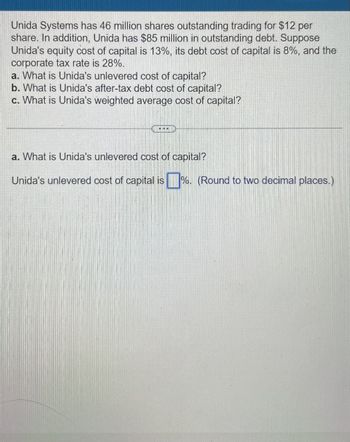

Transcribed Image Text:Unida Systems has 46 million shares outstanding trading for $12 per

share. In addition, Unida has $85 million in outstanding debt. Suppose

Unida's equity cost of capital is 13%, its debt cost of capital is 8%, and the

corporate tax rate is 28%.

a. What is Unida's unlevered cost of capital?

b. What is Unida's after-tax debt cost of capital?

c. What is Unida's weighted average cost of capital?

a. What is Unida's unlevered cost of capital?

Unida's unlevered cost of capital is %. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Yyristki Inc. has an equity market value of $4,750,390 and debt market value of $3,379,920. The cost of equity capital is 11.58% and the cost of debt capital is 6.21%. What is the firm's Weighted Average Cost of Capital (WACC)?arrow_forwardK Pfd Company has debt with a yield to maturity of 7.01%, a cost of equity of 14.51%, and a cost of preferred stock of 9.92%. The market values of its debt, preferred stock, and equity are $10.3 million, $2.7 million, and $14.6 million, respectively, and its tax rate is 30%. What is this firm's after-tax WACC? Note: Assume that the firm will always be able to utilize its full interest tax shield. Pfd's after-tax WACC is %. (Round to two decimal places.)arrow_forwardCliff Corp (CC) has assets of $300 million including $25 million in cash. CC has 1 million share of stock outstanding and $70 million of debt. Assume capital markets are perfect. What is CC’s current debt-to-equity ratio? What is CC’s current stock price? If CC distributes $18 million in dividends, then what is the new ex- dividend share price? If instead of paying the dividend CC repurchases $18 million of stock, then what will be the new share price? What is the new debt-to-equity ratio after the payout?arrow_forward

- Please solve step by step for clarity, thank you!arrow_forwardA levered firm has a pretax cost of debt of 6.8 percent and an unlevered cost of capital of 14 percent. The tax rate is 21 percent and the cost of equity is 17.7 percent. What is the debt-to-equity ratio? O 0.65 0.47 0.41 O 0.52arrow_forwardThe Tailgate Store has a cost of equity of 8.6 percent. The company has an after-tax cost of debt of 4.5 percent, and the tax rate is 39 percent. If the company's debt-equity ratio is .65, what is the weighted average cost of capital? 8.85% 9.10% 6.55% 7.15% 6.98%arrow_forward

- Cullumber Co. has a capital structure, based on current market values, that consists of 40 percent debt, 19 percent preferred stock, and 41 percent common stock. If the returns required by investors are 9 percent, 11 percent, and 15 percent for the debt, preferred stock, and common stock, respectively, what is Cullumber’s after-tax WACC? Assume that the firm’s marginal tax rate is 40 percent. - After tax WACC = ?%arrow_forwardSodaFizz has debt outstanding that has a market value of $3 million. The company’s stock has a book value of $2 million and a market value of $6 million. What are the weights in SodaFizz’s capital structure?arrow_forwardGamma Inc. has a weighted average cost of capital of 18.60%. The firm’s cost of equity is 24.40%, and it’s cost of debt is 15%. The tax rate is 34%. What is Gamma’s debt-to-equity ratio?arrow_forward

- The X corporation has unlivered cost of equity of 10%.the company wants to expands its operations by issuing new debt.if the cost of the debt of the company is 6% and the cororate tax is 30%.what is the debt equity ratio of the company if the target cost of equity is 12%.arrow_forwardPfd Company has debt with a yield to maturity of 7.4%, a cost of equity of 14.2%, and a cost of preferred stock of 9.4%. The market values of its debt, preferred stock, and equity are $11.5 million, $3.5 million, and $15.1 million, respectively, and its tax rate is 21%. What is this firm's after-tax WACC? Note: Assume that the firm will always be able to utilize its full interest tax shield. Pfd's WACC is __ % ? (Round to two decimal places.)arrow_forwardWhat is its cost of equity if there are no taxes or other imperfections? The firm has a debt-to-equity ratio of 0.60. Its cost of debt is 8%. Its overall cost of capital is 12%. A) 18% B) 14.4% C) 10%. D) 13.5%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education