ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

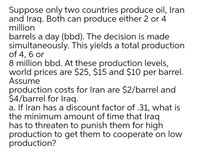

Transcribed Image Text:Suppose only two countries produce oil, Iran

and Iraq. Both can produce either 2 or 4

million

barrels a day (bbd). The decision is made

simultaneously. This yields a total production

of 4, 6 or

8 million bbd. At these production levels,

world prices are $25, $15 and $10 per barrel.

Assume

production costs for Iran are $2/barrel and

$4/barrel for Iraq.

a. If Iran has a discount factor of .31, what is

the minimum amount of time that Iraq

has to threaten to punish them for high

production to get them to cooperate on low

production?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- What would be the effect of ANWR production on the world price of oil given that ɛ = - 0.50, 1 = 0.40, the pre-ANWR daily world production of oil is Q, = 82 million barrels per day, the pre-ANWR world price is p, = $100 per barrel, and daily ANWR production would be 0.8 million barrels per day? For simplicity, assume that the supply and demand curves are linear and that the introduction of ANWR oil would cause a parallel shift in the world supply curve to the right by 0.8 million barrels per day. Determine the long-run linear demand function that is consistent with pre-ANWR world output and price. The long-run demand function is Q = 123 – 0.41p`. Determine the long-run linear supply function that is consistent with pre-ANWR world output and price. The long-run supply function is Q = 49.2 + 0.328p`. Determine the post-ANWR long-run linear supply function. The long-run supply function with ANWR oil production is Q= 50 + 0.328p'. Use the demand curve and the post-ANWR supply function to…arrow_forwardIf firms are in a competitive market, firms use marginal cost=price as a price-setting rule. Why multinational firms do not follow the price-setting rule like the firms in the competitive market (or why exporting firms do not follow the price-setting rule)? Your answer should be based on the characteristic market and the internal economies of scale. What is the price-setting rule for multinational firms?arrow_forward(h) Suppose you conduct an opinion poll among individuals at Home, in which you ask them whether they have benefitted from international trade. What do you predict the response would be? Is this consistent with the empirical evidence we observe about people’s support for free trade in reality?arrow_forward

- Question 2 Suppose that the demand for rice in Japan is given by the function Q = 100 -p and the domestic supply is Q = p. Suppose that the inverse world supply function is p = 30. (a) What would be the change in domestic producer surplus if imported rice is banned? (b) What would be the change in consumer surplus if a $5 tariff is imposed on imported rice? (c) What would be the change in imports if a $5 tariff is imposed on imported rice? (d) What would be the smallest tariff to completely eliminate imported rice? (e) A $5 per unit tariff has the same effect on producer and consumer surplus as a quota ofarrow_forwardPlease answer number 4arrow_forwardQ)Why does russia have the comparative advantage in oil? Explanation it correctly and in detailarrow_forward

- As you may have heard, Russia decided to invade its neighbor, which has led to international condemnation (albeit not on all fronts). The EU, a former major importer of gas from Russai, went ahead with sanctions. Imagine, if you will, that the respective heads of state get together and try to negotiate a trade agreement to end sanctions. They each have three possible choices: (a) Maintain tariffs against the other nation (T); (b) Seek mediation from the WTO, which would implement an international trade agreement at a small cost (M); (c) Unilaterally remove tariffs (F). The payoff matrix is as given below. Is there a dominant strategy for either player? Find all the (pure strategy) Nash equilibria in the game. How would this change if, instead, the mediation is costless and yields a payoff of 50 to each nation (assuming mutually successful mediation) and a payoff of 0 (if the other nation chooses otherwise)? **arrow_forwardWhich of the following is a preferential agreement? the Trans-Pacific Partnership (TPP) O the Transatlantic Trade and Investment Partnership (TTIP) O the Caribbean Basin Initiative (CBI) O the Asia-Pacific Economic Cooperation (APEC) O None of the above.arrow_forwardSuppose you have the following for white t-shirts market:Market demand is P=125-(3/8)QMarket supply is P=5+(1/8)Q. Suppose it is now possible to obtain white t-shirts from the rest of the world at $15 per item at anygiven quantity. In other words, there is now a global supply that is horizontal at $15.a. Obviously the world price and domestic price will now be $15. Calculate the quantityproduced and demanded domestically. Calculate the difference as imports from the rest of theworld.b. Calculate the CS (Consumer Surplus) and PS (Producer Surplus) under free trade. Who gainswith free trade? Who loses?Hint: Use graphs first.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education