ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

URGENT!!!!! please help me! thank you so much!! :)

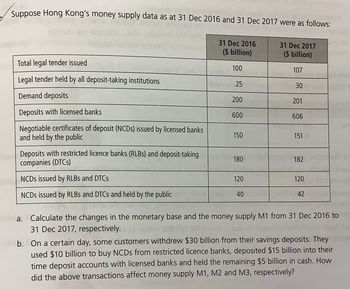

Transcribed Image Text:Suppose Hong Kong's money supply data as at 31 Dec 2016 and 31 Dec 2017 were as follows:

31 Dec 2017

($ billion)

107

30

Total legal tender issued

Legal tender held by all deposit-taking institutions

Demand deposits

Deposits with licensed banks

Negotiable certificates of deposit (NCDs) issued by licensed banks

and held by the public

Deposits with restricted licence banks (RLBS) and deposit-taking

companies (DTCs)

NCDs issued by RLBS and DTCs

NCDs issued by RLBS and DTCS and held by the public

31 Dec 2016

($ billion)

100

25

200

600

150

180-19

120

40

201

606

151

P182

120

42

ad elds

teha. Calculate the changes in the monetary base and the money supply M1 from 31 Dec 2016 to

31 Dec 2017, respectively.

b. On a certain day, some customers withdrew $30 billion from their savings deposits. They

used $10 billion to buy NCDs from restricted licence banks, deposited $15 billion into their

time deposit accounts with licensed banks and held the remaining $5 billion in cash. How

did the above transactions affect money supply M1, M2 and M3, respectively?

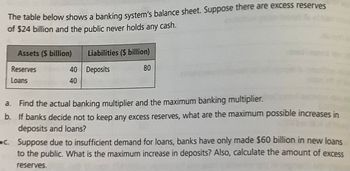

Transcribed Image Text:The table below shows a banking system's balance sheet. Suppose there are excess reserves

of $24 billion and the public never holds any cash.

Assets ($ billion)

Reserves

Loans

40

40

Liabilities ($ billion)

Deposits

80

a. Find the actual banking multiplier and the maximum banking multiplier.

b.

If banks decide not to keep any excess reserves, what are the maximum possible increases in

deposits and loans?

C.

Suppose due to insufficient demand for loans, banks have only made $60 billion in new loans

to the public. What is the maximum increase in deposits? Also, calculate the amount of excess

reserves.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 25 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 32. The seasonal indices of the sales of garments of a particular type in a certain shop are given below: Quarter Seasonal index Oct.-Dec. Apr.-June 85 July-Sept. 83 Jan.-March 97 135 If the total sales in the first quarter of a year be worth $15,000 and sales are expected to rise by 4% in each quarter, determine how much worth of garments of this type be kept in stock by the shop-owner to meet the demand for each of three quarters of the year.arrow_forwardA79. Which of the following is the most likely consequence of implementing the ‘Unified Payments Interface (UPI)’? (a) Mobile wallets will not be necessary for online payments. (b) Digital currency will totally replace the physical currency in about two decades. (c) FDI inflows will drastically increase. (d) Direct transfer of subsidies to poor people will become very effective.arrow_forwardOnly typed answer and please answer correctlyarrow_forward

- Only typed answerarrow_forwardSav Blundell Biotech. Blundell Biotech is a U.S.-based biotechnology company with operations and earnings in a number of foreign countries. The company's profits by subsidiary, in local currency (in millions) along with the average exchange rate for each year, by currency pairs, are shown in the table for 2013 and 2014. Use these data to answer the following questions. a. What was Blundell Biotech's consolidated profits in U.S. dollars in 2013 and 2014? b. If the same exchange rates were used for both years-which is often called a "constant currency basis-what was the change in corporate earnings on a constant currency basis? c. Using the results of the constant currency analysis in part (b), is it possible to separate Blundell's growth in earnings between local currency earnings and foreign exchange rate impacts on a consolidated basis?arrow_forwardS LO 20 # 3 PRICE (Dollars per hot dog) 5. History Bookmarks People Tab Window Help 令) 71% Mind Tap - Cengage Learning /index.html?deploymentld%359828119415547787292595253&elSBN=9780357133606&id%3D1069413986&snapshotid%-D2211990& * CENGAGE MINDTAP Q Search this course Homework (Ch 15) 5. Monopoly outcome versus competition outcome Consider the daily market for hot dogs in a small city. Suppose that this market is in long-run competitive equilibrium with many hot dog stands in the city, each one selling the same kind of hot dogs. Therefore, each vendor is a price taker and possesses no market power. The following graph shows the demand (D) and supply (S = MC) curves in the market for hot dogs. %3D Place the black point (plus symbol) on the graph to indicate the market price and quantity that will result from competition. Competitive Market +. 4.5 PC Outcome 3.5 3.0 2.5 S=MC 1.5 0.5 D. 120 140 160 180 09 QUANTITY (Hot dogs) 40 PI MacBook Air DA DD F8 F6 F5 F4 F2 %24 6. 7. 8. 9- 4. 2.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education