FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

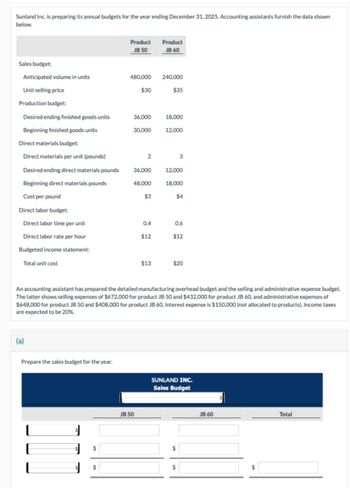

Transcribed Image Text:Sunland Inc. is preparing its annual budgets for the year ending December 31, 2025. Accounting assistants furnish the data shown

below.

Product

JB 50

Product

JB 60

Sales budget:

Anticipated volume in units

480,000

240,000

Unit selling price

$30

$35

Production budget:

Desired ending finished goods units

36,000

18,000

Beginning finished goods units

30,000

12,000

Direct materials budget:

Direct materials per unit (pounds)

2

3

Desired ending direct materials pounds

36,000

12,000

Beginning direct materials pounds

48,000

18,000

Cost per pound

$3

$4

Direct labor budget:

Direct labor time per unit

0.4

0.6

Direct labor rate per hour

$12

$12

Budgeted income statement:

Total unit cost

$13

$20

An accounting assistant has prepared the detailed manufacturing overhead budget and the selling and administrative expense budget.

The latter shows selling expenses of $672,000 for product JB 50 and $432,000 for product JB 60, and administrative expenses of

$648,000 for product JB 50 and $408,000 for product JB 60. Interest expense is $150,000 (not allocated to products). Income taxes

are expected to be 20%.

(a)

Prepare the sales budget for the year.

|

E

$

JB 50

SUNLAND INC.

Sales Budget

$

JB 60

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How do I prepare the selling and administrative expense budget for the quarter ended March 31, 20X1?arrow_forwardCurrent Attempt in Progress Sheridan Construction Company determines that 58000 pounds of direct materials are needed for production in July. There are 4200 pounds of direct materials on hand at July 1 and the desired ending inventory is 3000 pounds. If the cost per unit of direct materials is $5, what is the budgeted total cost of direct materials purchases for the month? ○ $296000. ○ $156000. O $284000. ○ $192000. Save for Later Attempts: 0 of 1 used Submit Answerarrow_forwardAm. 308.arrow_forward

- Kipp Industries has the following production budget for 2022: 2022 Quarter 1 3,000 Units 2022 Quarter 2 8,000 Units 2022 Quarter 3 5,000 Units 2022 Quarter 4 6,000 Units 2023 Quarter 1 5,000 Units Each unit requires 2.5 hours of direct labor and workers are paid $20 per hour. Prepare a Direct Labor Budget for each of the quarters of 2022. (No need to show the total for the year).arrow_forwardPrepare the sales budget (in dollars) for 20x0. light coils, heavy coils and projected sales.arrow_forwardYou have been presented with the following information by the Budget Committee of the organization in which you work: Sales forecast January – April 2020 Details Study lamps Accent lights Expected selling price per unit $300 $500 Sales Volume forecast: January 2 000 units 1 000 units February 2 500 units 1 500units March 3 000 units 1 000 units April 2 000 units 1 200 units Additional information: (i) Beginning inventories: study lamps 300 units; accent lights 200 units. (ii) The ending inventory for each product at the end of each month is to be maintained at 20% of the budgeted sales for the next month. (iii) To make one study lamp, four (4) units of raw material lumber are used, while five (5) units of raw material aluminum are used to make one accent lights. Required: The Sales Budget for both products for January to March 2020. The Direct Material usage budget.arrow_forward

- Selected information from the direct materials budget of Perry Incorporated is provided here: First Second Third Fourth Required production in units of finished goods 15,000 12,500 7,500 15,000 Units of raw materials needed per unit of finished goods 4 4 4 4 Units of raw materials needed to meet production 60,000 50,000 30,000 60,000 Desired units of ending raw materials inventory ? ? ? 24,000 Total units of raw materials needed Units of beginning raw materials inventory 16,000 ? ? ? Units of raw materials to be purchased ? ? ? ? Unit cost of raw materials $ 5 $ 5 $ 5 $ 5 Cost of raw materials to be purchased ? ? ? ? Perry, Incorporated desires to maintain the ending inventory of raw materials at 40 percent of the next quarter's raw material needs. What is the cost of raw materials to be purchased in the first quarter? multiple choice $300,000 $320,000 $380,000 $400,000arrow_forwardQuarter 1 Quarter 2 Quarter 3 Quarter 4 Total Units to be produced 7,680 8,480 8,860 8,860 33,880 Direct material per unit 2 2 2 2 2 Total pounds needed for production 15,360 16,960 17,720 17,720 67,760 Add: Desired ending inventory 4,240 4,430 4,430 3,600 3,600 Total material required 19,600 21,390 22,150 21,320 71,360 Less: Beginning inventory 4,240 4,430 4,430 Pounds of direct material purchase requirements 19,600 17,150 17,720 16,890 71,360 Cost per pound $1.50 $1.50 $1.50 $1.50 $1.50 Total cost of direct material purchase $29,400 $25,725 $26,580 $25,335 $107,040 Total $107,040 Direct Labor Budget For the Year Ending Dec. 31, 2018 Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Units to be produced 7,680 8,480 8,860 Direct labor hours per unit 0.75 0.75 0.75 0.75 0.75 Total required direct labor hours 5,760 6,360 6,645 6,645 Labor cost per hour $25 $25 $25 $25 $25 Total direct labor cost $144,000 $159,000 $166,125 $ $635,250arrow_forwardanswer in text form please (without image)arrow_forward

- 5. Archer's cost accountant prepared the following static budget based on expected activity of 4,000 units for the May 2022 accounting period: Sales Revenue $64,000 Variable Costs (34.000) Contribution Margin $30,000 (20.000) $10,000 Fixed Costs Net Income a. If Archer's sales manager were to prepare a flexible budget for expected activity of 4,300 units, budgeted net income on this flexible budget would be? b. If Archer actually produced and sold 4,300 units at $20 each, what is the sales revenue activity/volume variance? Indicate favorable / unfavorable variances c. If Archer actually incurred the following costs during May 2022: Sales Revenue Variable Costs Contribution Margin $49,000 Fixed Costs $86,000 (37.000) (22.000) $27,000 Net Income The flexible budget variance for: Indicate favorable / unfavorable variances i. Fixed costs: ii. Variable costs:arrow_forwardGive answer as per requiredarrow_forwardpossible Orange Corporation has budgeted sales of 26,000 units, targeted ending finished goods inventory of 8,000 units, and beginning finished goods inventory of 7,000 units. How many units should be produced next year? O A. 34,000 units B. 27,000 units O C. 26,000 units O D. 41,000 units Next Galculatorarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education