FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

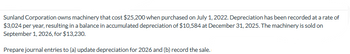

Transcribed Image Text:**Sunland Corporation’s Machinery Depreciation and Sale:**

Sunland Corporation owns machinery that cost $25,200 when purchased on July 1, 2022. Depreciation has been recorded at a rate of $3,024 per year, resulting in a balance in accumulated depreciation of $10,584 at December 31, 2025. The machinery is sold on September 1, 2026, for $13,230.

**Tasks:**

1. **Update Depreciation for 2026:**

- Prepare the necessary journal entries to account for the depreciation expense up until the sale date in 2026.

2. **Record the Sale:**

- Document the journal entries required to record the sale of the machinery.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On December 31, 2022, Tamarisk Inc. owns a machine with a carrying amount of $744, 000. The original cost and accumulated depreciation for the machine on this date are as follows: Machine S 1,320, 000 Accumulated depreciation 576, 000 S744, 000 Depreciation is calculated at $96, 000 per year on a straight - line basis. A set of independent situations follows. For each situation, prepare the journal entry for Tamarisk to record the transaction. Ensure that depreciation entries are recorded to update the machine's carrying amount before its disposal. Assume that Tamarisk uses IFRS for financial statement purposes. (a) A fire completely destroyed the machine on August 31, 2023. An Insurance settlement of $428,000 was received for this casualty. Assume the settlement was received immediately. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.…arrow_forwardOn January 1, 2019, Ginger Company purchased land and a building for a total cash price of $6,900,000. Individually, the land was appraised at $2,250,000 and the building at $5,250,000. The buildings estimated useful life is 25 years and its estimated salvage value is $300,000. a. Prepare the journal entry to record the purchase of land and building on January 1, 2019. b. What is the 2019 depreciation expense on the building, assuming that double declining-balance depreciation is used?arrow_forwardCullumber Company owns equipment that cost $61,500 when purchased on January 1, 2019. It has been depreciated using the straight-line method based on estimated salvage value of $4,800 and an estimated useful life of 5 years.Prepare Cullumber Company’s journal entries to record the sale of the equipment in these four independent situations. (a) Sold for $29,020 on January 1, 2022. (b) Sold for $29,020 on May 1, 2022. (c) Sold for $10,300 on January 1, 2022. (d) Sold for $10,300 on October 1, 2022.arrow_forward

- Lucky Lure Co. purchased a machine on October 1, 2018 for $125,000. It has a $15,000 residual value and a 10- year useful life. On July 1, 2020 the machine sold for $79,500. The company uses the double-declining-balance method of depreciation. The company fiscal year end is December 31. Instructions Prepare the journal entries for 2018 through 2020. Š A▾ B Iarrow_forwardCoronado Company is in the process of preparing its financial statements for 2022. Assume that no entries for depreciation have been recorded in 2022. The following information related to depreciation of fixed assets is provided to you. Coronado purchased equipment on January 2, 2019, for $86,300. At that time, the equipment had an estimated useful life of 10 years with a $5,300 residual value. The equipment is depreciated on a straight-line basis. On January 2, 2022, as a result of additional information, the company determined that the equipment has a remaining useful life of 4 years with a $2,800 1. residual value. 2. During 2022, Coronado changed from the double-declining-balance method for its building to the straight-line method. The building originally cost $300,000. It had a useful life of 10 years and a residual value of $30,000. The following computations present depreciation on both bases for 2020 and 2021. 2021 2020 Straight-line $27,000 $27,000 Declining-balance 48,000…arrow_forwardCheadle Company purchased a fleet of 20 delivery trucks for $8,000 each on January 2, 2019. It decided to use composite depreciation on a straight-line basis and calculated the depreciation from the following schedule: 1. Prepare the journal entries necessary to record the preceding events. 2. Assume that the company expected all the trucks to last 4 years and be retired for $1,600 each. Using group depreciation, prepare journal entries for all 6 years, assuming the company retired the trucks as shown by the latter schedule.arrow_forward

- Sarasota Company sells equipment on September 30, 2022, for $20,600 cash. The equipment originally cost $73,300 and as of January 1, 2022, had accumulated depreciation of $42,100. Depreciation for the first 9 months of 2022 is $4,750. Prepare the journal entries to (a) update depreciation to September 30, 2022, and (b) record the sale of the equipment. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No. Account Titles and Explanation (a) (b) Debit 11 Creditarrow_forwardSandhill Company owns equipment that cost $61,200 when purchased on January 1. 2019. It has been depreciated using the straight-line method based on estimated salvage value of $4,200 and an estimated useful life of 5 years. Prepare Sandhill Company's journal entries to record the sale of the equipment in these four independent situations. Sold for $29,200 on January 1.2022. Sold for $29,200 on May 1, 2022. Sold for $10,200 on January 1, 2022. Sold for $ 10,200 on October 1, 2022arrow_forwardWhispering Company owns equipment that cost $100,000 when purchased on January 1, 2019. It has been depreciated using the straight-line method based on an estimated salvage value of $10,000 and an estimated useful life of 5 years. Depreciation expense adjustments are recognized annually. Instructions: Prepare Whispering Company's journal entries to record the sale of the equipment in these four independent situations. Update depreciation on assets disposed of at time of sale. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) (a) (b) (c) (d) (e) (f) (a) Sold for $59,000 on January 1, 2022. Sold for $59,000 on April 1, 2022. SR. Account Titles and Explanation (b) Sold for $21,000 on January 1, 2022. Sold for $21,000 on September 1, 2022. Repeat (a), assuming Whispering uses double-declining…arrow_forward

- Pharoah Company sells office equipment on July 31, 2022, for $23,270 cash. The office equipment originally cost $83,600 and as of January 1, 2022, had accumulated depreciation of $35,030. Depreciation for the first 7 months of 2022 is $3,920. Prepare the journal entries to (a) update depreciation to July 31, 2022, and (b) record the sale of the equipment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No. Account Titles and Explanation Debit Credit (a) (b)arrow_forwardOriole Company owns equipment that cost $120,000 when purchased on January 2, 2024. It has been depreciated using the straight- line method based on estimated residual value of $6,000 and an estimated useful life of five years. Following are the four independent situations. Assume depreciation has been recorded to the date of sale. (a) Prepare Oriole Company's journal entry to record the sale of the equipment for $55,100 on January 2, 2027. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Date Account Titles Jan. 2 Debit Creditarrow_forwardSheridan Company owns equipment that cost $68,520 when purchased on January 1, 2019. It has been depreciated using the straight-line method based on estimated salvage value of $6,000 and an estimated useful life of 5 years.Prepare Sheridan Company’s journal entries to record the sale of the equipment in these four independent situations. (a) Sold for $32,512 on January 1, 2022. (b) Sold for $32,512 on May 1, 2022. (c) Sold for $10,100 on January 1, 2022. (d) Sold for $10,100 on October 1, 2022.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education