Entrepreneurial Finance

6th Edition

ISBN: 9781337635653

Author: Leach

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Use this information to determine how much cash will increase (decrease) during April on these financial accounting question

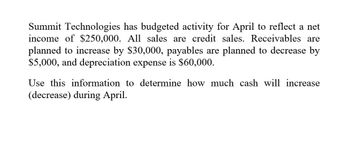

Transcribed Image Text:Summit Technologies has budgeted activity for April to reflect a net

income of $250,000. All sales are credit sales. Receivables are

planned to increase by $30,000, payables are planned to decrease by

$5,000, and depreciation expense is $60,000.

Use this information to determine how much cash will increase

(decrease) during April.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Review the completed master budget and answer the following questions: Is Ranger Industries expecting to earn a profit during the next quarter? If so, how much? Does the company need to borrow cash during the quarter? Can it make any repayments? Explain. (Carefully review rows 74 through 80.)arrow_forwardIn an attempt to better understand RR’s cash position, Johnson developed a cash budget for the first 2 months of the year. She has the figures for the other months, but they are not shown. After looking at the cash budget, answer the following questions: What does the cash budget show regarding the target cash level? Should depreciation expense be explicitly included in the cash budget? Why or why not? What are some other potential cash inflows besides collections? How can interest earned or paid on short-term securities or loans be incorporated in the cash budget? In her preliminary cash budget, Johnson has assumed that all sales are collected and thus that RR has no bad debts. Is this realistic? If not, how would bad debts be dealt with in a cash budgeting sense? (Hint: Bad debts will affect collections but not purchases.)arrow_forwardCASH BUDGETING Helen Bowers, owner of Helens Fashion Designs, is planning to request a line of credit from her bank. She has estimated the following sales forecasts for the firm for parts of 2019 and 2020: Estimates regarding payments obtained from the credit department are as follows: collected within the month of sale, 10%; collected the month following the sale, 75%; collected the second month following the sale, 15%. Payments for labor and raw materials are made the month after these services were provided. Here are the estimated costs of labor plus raw materials: General and administrative salaries are approximately 27,000 a month. Lease payments under long-term leases are 9,000 a month. Depreciation charges are 36,000 a month. Miscellaneous expenses are 2,700 a month. Income tax payments of 63,000 are due in September and December. A progress payment of 180,000 on a new design studio must be paid in October. Cash on hand on July 1 will be 132,000, and a minimum cash balance of 90,000 should be maintained throughout the cash budget period. a. Prepare a monthly cash budget for the last 6 months of 2019. b. Prepare monthly estimates of the required financing or excess fundsthat is, the amount of money Bowers will need to borrow or will have available to invest. c. Now suppose receipts from sales come in uniformly during the month (that is, cash receipts come in at the rate of 1/30 each day), but all outflows must be paid on the 5th. Will this affect the cash budget? That is, will the cash budget you prepared be valid under these assumptions? If not, what could be done to make a valid estimate of the peak financing requirements? No calculations are required, although if you prefer, you can use calculations to illustrate the effects. d. Bowers sales are seasonal, and her company produces on a seasonal basis, just ahead of sales. Without making any calculations, discuss how the companys current and debt ratios would vary during the year if all financial requirements were met with short-term bank loans. Could changes in these ratios affect the firms ability to obtain bank credit? Explain.arrow_forward

- What is the amount of budgeted cash payments if purchases are budgeted for $190,500 and the beginning and ending balances of accounts payable are $21,000 and $25,000, respectively?arrow_forwardThe data shown were obtained from the financial records of Italian Exports, Inc., for March: Sales are expected to increase each month by 10%. Prepare a budgeted income statement.arrow_forwardA companys sales for the coming months are as follows: About 20 percent of sales are cash sales, and the remainder are credit sales. The company finds that typically 10 percent of a months credit sales are paid in the month of sale, 70 percent are paid the next month, and 15 percent are paid in the second month after sale. Expected cash receipts in July are budgeted at what amount? a. 114,520 b. 143,150 c. 145,720 d. 156,000arrow_forward

- Get answer within informationarrow_forwardIn September, the capital expenditure budget of ABC Corp. Indicates a P140,000 purchase of equipment. The ending September cash balance from operations is budgeted at P20,000. The company wants to maintain a minimum cash balance of P10,000. What is the minimum cash loan that must be planned by ABC Corp borrowed from the bank in September?arrow_forwardPlease give me true answer this financial accounting questionarrow_forward

- Palmerin Corporation is preparing its cash budget for November. The budgeted beginning cash balance is $30,000. Budgeted cash receipts total $167,000 and budgeted cash disbursements total $171,000. The desired ending cash balance is $50,000. To attain its desired ending cash balance for November, the company should borrow: *arrow_forwardWhat is the total expected cash receipts during September on these financial accounting question?arrow_forwardFrom the following information, prepare a monthly cash budget for the three months ending 31st December 2023. Month June July August September October November December Materials Wages 1,800 650 2,000 750 2,400 750 2,250 750 2.300 800 2,500 2,600 900 1,000 The credit terms are as follows: 10% of sales are in cash. 3 months to debtors. 2 months from Creditors. Sales 3,000 3,250 3,500 3,750 4,000 4,250 4,500 The lag in payment for wages is 1/4 month and 1/2 month for overheads. The cash and bank balance on 1st October is expected to be RO 1,500. Other information is given as follows: Admin. Selling, etc 160 160 175 175 200 200 225 Production 225 225 250 300 300 350 350 Preference share dividends @ 5% on RO 50,000 are to be paid on 1st December. Calls on 250 equity shares @RO 2 per share are expected on 1st November. Dividends from investments amounting to RO 250 are expected on 31st December. Income tax (advance) is to be paid in December RO 1,500 Plant and machinery are to be installed…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College