FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Require both answer

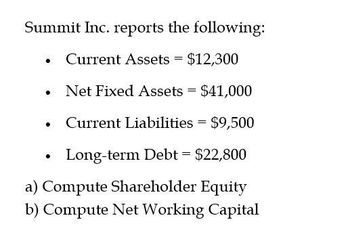

Transcribed Image Text:Summit Inc. reports the following:

•

Current Assets = $12,300

•

Net Fixed Assets = $41,000

•

•

Current Liabilities = $9,500

Long-term Debt = $22,800

a) Compute Shareholder Equity

b) Compute Net Working Capital

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- General accountingarrow_forwardAshworth Enterprises has: • Current assets = $6,500 • Net fixed assets = $30,700 • Current liabilities = $5,200 • Long-term debt = $12,300 a) The value of the shareholders' equity account. b) The net working capital.arrow_forwardYou find the following financial information about a company: net working capital = $7, 809; total assets $11,942; and long-term debt Multiple Choice $9, 115 $4, 507 $10, 339 $6, 129 $4, 133 = = = $1, 287; fixed assets $4,589. What is the company's total equity?arrow_forward

- Need answer pleasearrow_forwardThe balance sheet for the Capella Corporation is as follows: Assets Liabilities and Shareholders' Equity Current assets $ 300 Current liabilities $ 110 Net fixed assets 1, 200 Long-term debt 500 Shareholders' equity 890 Total assets $ 1,500 Total liabilities and shareholders' equity $ 1, 500 What is the Net Working Capital for Capella Corporation?arrow_forwardSolve the problemarrow_forward

- how do i determine the working capital from the following information Sunland CompanyBalance SheetDecember 31, 2022 Assets Current assets Cash $ 61,800 Debt investments 87,000 Accounts receivable (net) 169,800 Inventory 155,150 Total current assets 473,750 Plant assets (net) 570,000 Total assets $ 1,043,750 Liabilities and Stockholders’ Equity Current liabilities Accounts payable $ 153,500 Income taxes payable 36,000 Total current liabilities 189,500 Bonds payable 186,250 Total liabilities 375,750 Stockholders’ equity Common stock 351,000 Retained earnings 317,000 Total stockholders’ equity 668,000 Total liabilities and stockholders’ equity $1,043,750arrow_forwardThe balance sheet for Fanning Corporation follows: Current assets $ 247,000 Long-term assets (net) 752,000 Total assets $ 999,000 Current liabilities $ 144,000 Long-term liabilities 452,000 Total liabilities 596,000 Common stock and retained earnings 403,000 Total liabilities and stockholders’ equity $ 999,000 RequiredCompute the following. (Round "Ratios" to 1 decimal place.) Working capital Current ratio Debt-to-assets ratio Debt-to-equity ratioarrow_forwardThe balance sheet for Munoz Corporation follows: Current assets Long-term assets (net) Total assets Current liabilities Long-term liabilities Total liabilities Common stock and retained earnings Total liabilities and stockholders' equity $ 235,000 762,000 $997,000 $160,000 457,000 617,000 380,000 $997,000 Required Compute the following. (Round "Ratios" to 1 decimal place.) ace Working capital Current ratio Debt to assets ratioarrow_forward

- Financial Accountingarrow_forwardThe balance sheet for Baird Corporation follows: Current assets Long-term assets (net) Total assets Current liabilities Long-term liabilities Total liabilities Common stock and retained earnings Total liabilities and stockholders' equity Required Compute the following. Note: Round "Ratios" to 1 decimal place. Working capital Current ratio Debt-to-assets ratio Debt-to-equity ratio % $ 248,000 751,000 $ 999,000 $ 142,000 456,000 598,000 401,000 $ 999,000arrow_forwardPractice Helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education