Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Quick answer of this accounting questions

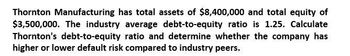

Transcribed Image Text:Thornton Manufacturing has total assets of $8,400,000 and total equity of

$3,500,000. The industry average debt-to-equity ratio is 1.25. Calculate

Thornton's debt-to-equity ratio and determine whether the company has

higher or lower default risk compared to industry peers.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is the firm's debt equity ratio on these financial accounting question?arrow_forwardWhat is the firm's debt equity ratio??arrow_forwardCompute the debt-to-equity ratio for each of the following companies. Which company appears to have a riskier financing structure? Atlanta Company Spokane Company Total liabilities $429,000 $ 549,000 Total equity 572,000 1,830,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT