Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

What is the after tax cost of debt for this financial accounting question?

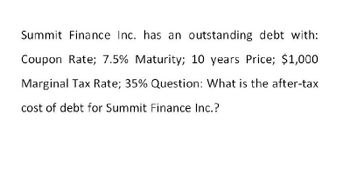

Transcribed Image Text:Summit Finance Inc. has an outstanding debt with:

Coupon Rate; 7.5% Maturity; 10 years Price; $1,000

Marginal Tax Rate; 35% Question: What is the after-tax

cost of debt for Summit Finance Inc.?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- ICU Window, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with 9 years to maturity that is quoted at 107 percent of face value. The issue makes semiannual payments and has an embedded cost of 6.6 percent annually. What is the company's pretax cost of debt? If the tax rate is 24 percent, what is the aftertax cost of debt? Pretax cost of debt: __________% Aftertax cost of debt: __________%arrow_forwardICU Window, inc, is trying to determine its cost of debt. The firm has a debt issue outstanding with 8 years to maturity that is quoted at 106.5 percent of face value. The issue makes semiannual payments and has an embedded cost of 6.4 percent annually. What is ICU's pretax cost of debt? If the tax rate is 23 percent, what is the aftertax cost of debt?arrow_forwardA company has outstanding long-term bonds with a face value of$1,000, a 10% coupon rate, 25 years remaining until maturity, anda current market value of $1,214.82. If it pays interest semiannually,then what is the nominal annual pre-tax required rate of return ondebt? (8%) If the company’s tax rate is 40%, what is the after-taxcost of debt? (4.8%)arrow_forward

- 1. ACT Inc. has a $1,000 (face value), 20 year bond issue selling for $1,229.40 that pays an annual coupon of 8.0 percent. Their marginal tax rate is 25%. a. What would be BAT's current before-tax component cost of debt? a. What would be BAT's current after-tax component cost of debt?arrow_forwardLadder Works has debt outstanding with a coupon rate of 6 percent and a yield to maturity of 6.8 percent. What is the aftertax cost of debt if the tax rate is 21 percent? Assume all interest is tax deductible. 5.62% 5.82% 5.37% 4.86%arrow_forwardSuppose that LilyMac Photography expects EBIT to be approximately $230,000 per year for the foreseeable future, and that it has 1,000 10-year, 9 percent annual coupon bonds outstanding. What would the appropriate tax rate be for use in the calculation of the debt component of LilyMac's WACC? Tax rate 37 %arrow_forward

- Waller, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with 20 years to maturity twith a current price of $854. The issue makes semiannual payments and has coupon rate of 5 percent. If the tax rate is 0.23, what is the aftertax cost of debt? Enter the answer with 4 decimals (e.g. 0.0123)arrow_forwardWaller, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with 8 years to maturity twith a current price of $1042. The issue makes semiannual payments and has coupon rate of 8 percent. If the tax rate is 0.21, what is the pretax cost of debt? Enter the answer with 4 decimals (e.g. 0.0123)arrow_forwardSuppose that LilyMac Photography expects EBIT to be approximately $210,000 per year for the foreseeable future, and that it has 1,000 10-year, 9 percent annual coupon bonds outstanding. What would the appropriate tax rate be for use in the calculation of the debt component of LilyMac's WACC?arrow_forward

- Calhoun Company's pre-tax cost of debt if the firm has outstanding bonds with par value of $1,000, a coupon rate of 8%, semi-annual coupon payments, 20 years remaining until maturity, and a market price of $1,058? Enter your answer as an annualized rate in decimal format, and show four decimal places. For example, if your answer is 5.1%, enter .0510.arrow_forwardHelparrow_forward2. An overview of a firm's cost of debt To calculate the after-tax cost of debt, multiply the before-tax cost of debt by (1-T). Western Gas & Electric Company (WGC) can borrow funds at an interest rate of 11.10% for a period of six years. Its marginal federal-plus-state tax rate is 25%. WGC's after-tax cost of debt is 8.32% (rounded to two decimal places). At the present time, Western Gas & Electric Company (WGC) has 10-year noncallable bonds with a face value of $1,000 that are outstanding. These bonds have a current market price of $1,495.56 per bond, carry a coupon rate of 10%, and distribute annual coupon payments. The company incurs a federal-plus-state tax rate of 25%. If WGC wants to issue new debt, what would be a reasonable estimate for its after-tax cost of debt (rounded to two decimal places)? (Note: Round your YTM rate to two decimal place.) 2.94% 2.35% 2.65% 3.38%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning