FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:(b)

Acid-Test Ratio

Company

Choose Numerator:

Choose Denominator:

Acid-Test Ratio

Cash

Short-term investments

Current receivables

Current liabilities

Acid-test ratio

+

Barco

$

19,500

$

66,000

2$

46,500 /

61,340 =

2.2 to 1

+

Кyan

$

34,000

2$

98,600

$

64,600 /

$

93,300 =

2.1 to 1

+

+

1A Current Ratio

1A Acct Rec Turn

>

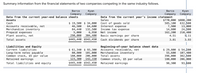

Transcribed Image Text:Summary information from the financial statements of two companies competing in the same industry follows.

Barco

Company

Data from the current year-end balance sheets

Кyan

Company

Barco

Company

Data from the current year's income statement

Кyan

Company

Assets

Cash

Accounts receivable, net

Merchandise inventory

$770,000 $880, 200

585,100

7,900

14,800

162,200

4.51

Sales

$ 19,500 $ 34,000

46,500

84,440

5,000

290,000

632,500

Cost

Interest expense

Income tax expense

Net income

goods sold

13,000

24,300

64,600

132,500

6,950

304,400

210,400

Prepaid expenses

Plant assets, net

Basic earnings per share

5.11

Total assets

$445,440 $542,450

Cash dividends per share

3.81

3.93

Liabilities and Equity

Current liabilities

Long-term notes payable

Common stock, $5 par value

Retained earnings

$ 61,340 $ 93,300

101,000

206.000

Beginning-of-year balance sheet data

Accounts receivable, net

Merchandise inventory

Total assets

Common stock, $5 par value

$ 29,800 $ 54,200

55,600

398,000

180,000

80,800

180,000

123,300

107,400

382,500

142,150

206, 000

Total liabilities and equity

$445,440 $542,450

Retained earnings

98,300

93,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Here are comparative financial statement data for Sandhill Company and Wildhorse Company, two competitors. All data are as of December 31, 2022, and December 31, 2021. Sandhill Company Wildhorse Company 2022 2021 2022 2021 Net sales $1,872,000 $559,000 Cost of goods sold 1,100,736 297,388 Operating expenses 263,952 79,378 Interest expense 9,360 4,472 Income tax expense 54,288 6,149 Current assets 326,000 $314,500 83,500 $78,600 Plant assets (net) 519,600 497,900 141,000 125,100 Current liabilities 66,000 75,800 36,600 29,800 Long-term liabilities 107,800 91,600 30,400 25,600 Common stock, $10 par 498,000 498,000 122,500 122,500 Retained earnings 173,800 147,000 35,000 25,800 (a) Prepare a vertical analysis of the 2022 income statement data for Sandhill Company and Wildhorse Company. (Round percentages…arrow_forwardSummary information from the financial statements of two companies competing in the same industry follows. Barco Company Kyan Company Barco Company Kyan Company Data from the current year-end balance sheets Data from the current year’s income statement Assets Sales $ 780,000 $ 883,200 Cash $ 19,000 $ 37,000 Cost of goods sold 589,100 644,500 Accounts receivable, net 37,400 54,400 Interest expense 8,000 12,000 Merchandise inventory 84,340 136,500 Income tax expense 14,992 24,383 Prepaid expenses 5,800 7,350 Net income 167,908 202,317 Plant assets, net 370,000 310,400 Basic earnings per share 4.66 4.68 Total assets $ 516,540 $ 545,650 Cash dividends per share 3.72 3.99 Liabilities and Equity Beginning-of-year balance sheet data Current liabilities $ 67,340 $ 97,300 Accounts receivable, net $ 28,800 $ 50,200 Long-term notes payable 86,800 111,000 Merchandise inventory 59,600 113,400 Common stock, $5 par value 180,000 216,000 Total assets…arrow_forwardHorizontal Analysis of the Income Statement Income statement data for Winthrop Company for two recent years ended December 31 are as follows: Current Year Previous Year Sales $2,240,000 $2,000,000 Cost of goods sold (1,925,000) (1,750,000) Gross profit $315,000 $250,000 Selling expenses $(152,500) $(125,000) Administrative expenses (118,000) (100,000) Total operating expenses $(270,500) $(225,000) Income before income tax expense $44,500 $25,000 Income tax expense (17,800) (10,000) Net income $26,700 $15,000 a. Prepare a comparative income statement with horizontal analysis, indicating the increase (decrease) for the current year when compared with the previous year. If required, round to one decimal place.arrow_forward

- Summary information from the financial statements of two companies competing in the same industry follows. Barco Company Data from the current year-end balance sheets Кyan Company Barco Кyan Company Company Data from the current year's income statement Sales Cost of goods sold Interest expense Income tax expense Net income $770,000 $880,200 632,500 13,000 24,300 210,400 5.11 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net $ 19,500 $ 34,000 46,500 84,440 5,000 290, 000 585,100 7,900 64,600 132,500 6,950 304,400 14,800 162,200 4.51 Basic earnings per share Total assets $445,440 $542,450 Cash dividends per share 3.81 3.93 Liabilities and Equity Current liabilities Long-term notes payable Common stock, $5 par value Retained earnings Beginning-of-year balance sheet data Accounts receivable, net Merchandise inventory Total assets $ 61,340 $ 93,300 55,600 398,000 180,000 $ 29,800 $ 54,200 107,400 382,500 206,000 93,600 80,800 180,000 123,300…arrow_forwardProvide answer pleasearrow_forwardSummary information from the financial statements of two companies competing in the same industry follows. Barco Company Kyan Company Barco Company Kyan Company Data from the current year-end balance sheets Data from the current year’s income statement Assets Sales $ 770,000 $ 895,200 Cash $ 18,500 $ 33,000 Cost of goods sold 593,100 642,500 Accounts receivable, net 40,400 51,400 Interest expense 8,300 16,000 Merchandise inventory 84,940 128,500 Income tax expense 14,800 24,714 Prepaid expenses 5,500 7,550 Net income 153,800 211,986 Plant assets, net 310,000 312,400 Basic earnings per share 4.52 4.91 Total assets $ 459,340 $ 532,850 Cash dividends per share 3.74 3.92 Liabilities and Equity Beginning-of-year balance sheet data Current liabilities $ 64,340 $ 98,300 Accounts receivable, net $ 30,800 $ 51,200 Long-term notes payable 79,800 109,000 Merchandise inventory 63,600 105,400 Common stock, $5 par value 170,000 216,000 Total assets…arrow_forward

- What is the current assets for each company? What are the short term investments for each company? What is the average account receivable for each company? What is the average inventory for each company?arrow_forwardBelow are Income Statement data for Baker Corporation: Operating expenses $124,000, Other expenses $12,000, Income taxes $29,000, Cost of goods sold $101,000, and the Net revenue $333,000. What is the company's return on sales? A. 69.67% B. 16.92% C. 32.43% D. 20.12%arrow_forwardCost of goods Soldarrow_forward

- Summary information from the financial statements of two companies competing in the same industry follows. BarcoCompany KyanCompany BarcoCompany KyanCompany Data from the current year-end balance sheets Data from the current year’s income statement Assets Sales $ 800,000 $ 926,200 Cash $ 18,500 $ 31,000 Cost of goods sold 595,100 638,500 Accounts receivable, net 37,400 55,400 Interest expense 9,200 10,000 Merchandise inventory 84,740 136,500 Income tax expense 15,377 25,570 Prepaid expenses 6,000 7,700 Net income 180,323 252,130 Plant assets, net 350,000 307,400 Basic earnings per share 4.75 5.84 Total assets $ 496,640 $ 538,000 Cash dividends per share 3.81 3.98 Liabilities and Equity Beginning-of-year balance sheet data Current liabilities $ 62,340 $ 94,300 Accounts receivable, net $ 31,800 $…arrow_forwardCommon-Size Income StatementsConsider the following income statement data from the Ross Company: Current Year Previous Year Sales revenue $529,000 $454,000 Cost of goods sold 336,000 279,000 Selling expenses 109,000 103,000 Administrative expenses 64,000 58,000 Income tax expense 7,800 5,400 Prepare common-size income statements for each year. Note: Round answers to one decimal place (ex: 0.2345 = 23.5%). Note: Compute percentages for each "Total" (do not add prior percentage amounts to arrive at Totals). ROSS COMPANYCommon-Size Income Statements(Percent of Sales Revenue) Current Year Previous Year Sales Revenue Answer Answer Cost of Goods Sold Answer Answer Answer Answer Answer Answer Selling Expenses Answer Answer Administrative Expenses Answer Answer Total Answer Answer Income before Income Taxes Answer Answer Answer Answer Answer Answer Answer Answer PreviousSave AnswersNextarrow_forwardUsing the income statement information for Einsworth Corporation that follows, prepare a vertical analysis of the income statement for Einsworth Corporation. Einsworth Corporation Income Statement 1 Amount Percentage 2 Sales $1,200,000.00 3 Cost of goods sold 780,000.00 4 Gross profit $420,000.00arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education