Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

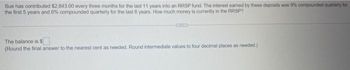

Transcribed Image Text:Sue has contributed $2,843.00 every three months for the last 11 years into an RRSP fund. The interest eamed by these deposits was 9% compounded quarterly for

the first 5 years and 6% compounded quarterly for the last 6 years. How much money is currently in the RRSP?

The balance is $

(Round the final answer to the nearest cent as needed. Round intermediate values to four decimal places as needed.).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Mr. Kinders has contributed $189.00 at the end of each month into an RRSP paying 3% per annum compounded annually GILE How much will Mr. Kinders have in the RRSP after 12 years? (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.). How much of the above amount is interest? (Round the final answer to the nearest cent as needed Round all intermediate values to six decimal places as needed)arrow_forwardK Mr. Deneau accumulated $94,000 in an RRSP. He converted the RRSP into a RRIF and started to withdraw $5100 at the end of every three months from the fund. If interest is 10.35% compounded monthly, for how long can Mr. Deneau make withdrawals? State your answer in years and months (from 0 to 11 months). He can make withdrawals for year(s) and month(s). Barrow_forward1. Emily and Jimmy each make deposits of 150 at the end of each year for 30 years. Starting at the end of the 31st year, Emily makes annual withdrawals of K for 10 years and Jimmy makes annual withdrawals of L for 10 years. Both funds have a balance of 0 after the last withdrawal. Emily's fund earns an annual effective interest rate of 8%. Jimmy's fund earns an annual effective interest rate of 6%. Calculate K-L Solution:arrow_forward

- $2,950 was deposited at the end of every six months for 8 years into a fund earning 4.5% compounded semi-annually. After this period, the accumulated money was left in the account for another 7 years at the same interest rate. a) Calculate the accumulated amount at the end of the 15-year term. $ b) Calculate the total amount of interest earned during the 15-year period.arrow_forwardCorrect answer pleasearrow_forwardCan anyone help me to answer this ?arrow_forward

- vith Solution Walkthrough Videos -/0.75 Question 2 of 7 View Policies Current Attempt in Progress Oriole, Inc., is considering investing in a new production line for eye drops. Other than investing in the equipment, the company needs to increase its cash and cash equivalents by $10,000, increase the level of inventory by $54,000, increase accounts receivable by $25,000, and increase accounts payable by $5,000 at the beginning of the project. Oriole will recover these changes in working capital at the end of the project 13 years later. Assume the appropriate discount rate is 15 percent. What are the present values of the relevant investment cash flows? (Do not round intermediate calculations. Round answer to 2 decimal places, e.g. 15.25.) Present value 24 eTextbook and Media Attempts: 0 of 3 used Submit Answer Save for Later IIarrow_forwardAlp Bilgin deposits $33.000 in asaving account that pays 9%interest compounded monthly.Four years later, he deposits $20.000. Three years after the20.000 deposit, he makesanother deposit in the amount of$16.500. Six years after the $16.500, half of the accumulatedfunds are transferred to a fundthat pays 12% interestcompounded quarterly. Howmuch money will be in accounteight years after the transfer?arrow_forwardMark Harris borrowed some money from his friend and promised to repay him $1,250, $1,340, $1,490, $1,560, and $1,560 over the next five years. If the friend normally discounts investment cash flows at 8.0 percent annually, how much did Mark borrow? (Round answer to 2 decimal places)arrow_forward

- Jeff deposits 10 into a fund today and 20 fifteen years later. Interest for the firstten years is credited at a nominal discount rate of d compounded quarterly, and thereafterat a nominal interest rate of 6% compounded semiannually. The accumulated balance in thefund at the end of 30 years is 100. Calculate d.arrow_forward$4,250 was deposited at the end of every six months for 5 years into a fund earning 2.2% compounded semi-annually. After this period, the accumulated money was left in the account for another 4 years at the same interest rate. a) Calculate the accumulated amount at the end of the 9-year term. $ b) Calculate the total amount of interest earned during the 9-year period.arrow_forwardFor 9 years, Janet saved $500 at the beginning of every month in a fund that earned 4.5% compounded annually. a. What was the balance in the fund at the end of the period? Round to the nearest cent b. What was the amount of interest earned over the period? Round to the nearest centarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education