Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

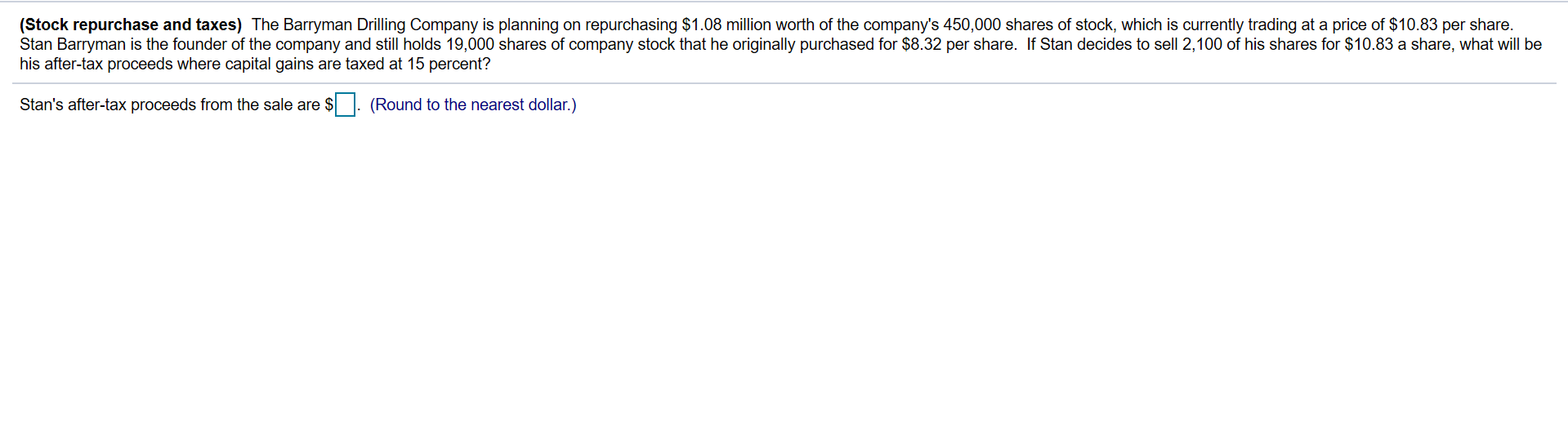

Transcribed Image Text:(Stock repurchase and taxes) The Barryman Drilling Company is planning on repurchasing $1.08 million worth of the company's 450,000 shares of stock, which is currently trading at a price of $10.83 per share.

Stan Barryman is the founder of the company and still holds 19,000 shares of company stock that he originally purchased for $8.32 per share. If Stan decides to sell 2,100 of his shares for $10.83 a share, what will be

his after-tax proceeds where capital gains are taxed at 15 percent?

Stan's after-tax proceeds from the sale are $. (Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Similar questions

- Cullumber Company is considering these two alternatives for financing the purchase of a fleet of airplanes. Issue 63,000 shares of common stock at $48 per share. (Cash dividends have not been paid nor is the payment of any contemplated.) Issue 13%, 15-year bonds at face value for $3,024,000. 1. 2 It is estimated that the company will earn $834,000 before interest and taxes as a result of this purchase. The company has an estimated tax rate of 30% and has 94,100 shares of common stock outstanding prior to the new financing. Determine the effect on net income and earnings per share for issuing stock and issuing bonds. Assume the new shares or new bonds will be outstanding for the entire year. Start with Income Before Interest and Taxes. (Round earnings per share to 2 decimal places, e.g. $2.66. Start with Income Before Interest and Taxes.)arrow_forwardAn investment bank agrees to underwrite an issue of 15 million shares of stock for Looney Landscaping Corporation. a. The investment bank underwrites the stock on a firm commitment basis, and agrees to pay $10.00 per share to Looney Landscaping Corporation for the 15 million shares of stock. The investment bank then sells those shares to the public for $11.50 per share. How much money does Looney Landscaping Corporation receive? What is the profit to the investment bank? If the investment bank can sell the shares for only $8.50, how much money does Looney Landscaping Corporation receive? What is the profit to the investment bank? b. Suppose, instead, that the investment bank agrees to underwrite the 15 million shares on a best efforts basis. The investment bank is able to sell 13.5 million shares for $10.00 per share, and it charges Looney Landscaping Corporation $0.325 per share sold. How much money does Looney Landscaping Corporation receive? What is the profit to the investment…arrow_forwardEuropCar Rental is considering two alternatives for the financing of a purchase of a fleet of cars. These two alternatives are: Issue 60,000 shares of common stock at $45 per share. Issue 12%, 10-year bonds at face value for $2,500,000. It is estimated that the company will earn $750,000 before interest and taxes as a result of this purchase. The company has an estimated tax rate of 30% and has 90,000 shares of common stock outstanding prior to the new financing. Instructions Determine the effect on net income and earnings per share for these two methods of financing.arrow_forward

- Please help me. Thankyou.arrow_forwardJohn Tye has just been hired as the new corporate finance analyst at I-Ell Enterprises and has received his first assignment. John is to take the $25 million in cash received from a recent divestiture and use part of these proceeds to retire an outstanding $10 million bond issue and the remainder to repurchase common stock. However, the bond issue cannot be retired for another two years. If John can place the funds necessary to retire this $10 million debt into an account earning 6 percent compounded monthly,how much of the $25 million remains to repurchase stock?arrow_forward) Your firm has the following structure: you own all the shares of the Dixit paper cup company. Dixit has $2,000,000 of outstanding perpetual debt with a 10% coupon selling at par. Dixit is currently selling paper cups which produce earnings before interest of $210,000 per year. You receive the following offer from your engineer friend. He would help you liquidate Dixit’s assets and with the proceeds you could build solar powered scooters. Your financing would remain the same. You believe that there is a 75% chance that solar powered scooters would not be particularly successful. In this case they would generate only $100/year. However, there is a 25% chance that solar powered scooters would be very successful. In this case they would generate $500,000 per year. Assume your equity discount rate is 15%. Assume the firm pays no taxes. b) What is the value of the solar powered scooters investment assuming a 15% discount rate? c) What is the value of your equity under each of these…arrow_forward

- Ivanhoe Company is considering these two alternatives for financing the purchase of a fleet of airplanes: 1. 2. Issue 52,500 shares of common stock at $44 per share. (Cash dividends have not been paid nor is the payment of any contemplated.) Issue 10%, 10-year bonds at face value for $2,310,000. It is estimated that the company will earn $809,200 before interest and taxes as a result of this purchase. The company has an estimated tax rate of 30% and has 92,000 shares of common stock outstanding prior to the new financing. Determine the effect on net income and earnings per share for (a) issuing stock and (b) issuing bonds. Assume the new shares or new bonds will be outstanding for the entire year. (Round earnings per share to 2 decimal places, e.g. 2.66.) O î (a) Plan One Issue Stock $ (b) Plan Two Issue Bondsarrow_forwardCullumber Company is considering these two alternatives for financing the purchase of a fleet of airplanes. 1. Issue 63,000 shares of common stock at $48 per share. (Cash dividends have not been paid nor is the payment of any contemplated.) 2. Issue 13%, 15-year bonds at face value for $3,024,000. It is estimated that the company will earn $825,000 before interest and taxes as a result of this purchase. The company has an estimated tax rate of 40% and has 94,100 shares of common stock outstanding prior to the new financing.Determine the effect on net income and earnings per share for issuing stock and issuing bonds. Assume the new shares or new bonds will be outstanding for the entire year. (Round earnings per share to 2 decimal places, e.g. $2.66.)arrow_forwardThe Tax Museum Corporation purchases 5 percent of the common stock of Florida Oranges Corporation (recognizing that the consumption of tax history and the consumption of oranges are, for whatever strange reason, substitutes, so this appears to be a useful hedge). Florida Oranges Corporation pays $100,000 of dividends on its common stock (so $5,000 goes to The Tax Museum). The Tax Museum has $600,000 of taxable income before taking into account any dividend income it receives. Assume a 21 percent corporate tax rate, and a 50 percent dividends received deduction when a corporation owns less than 20 percent of the stock of the paying corporation. How much tax will The Tax Museum Corporation pay on the dividends from Florida Oranges? Group of answer choices $525 ($5000 x (1-.5)(.21)) $1,050 $21,000 $10,500arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education