FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

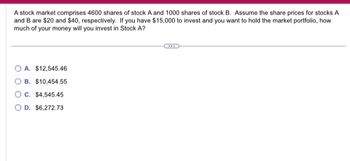

Transcribed Image Text:A stock market comprises 4600 shares of stock A and 1000 shares of stock B. Assume the share prices for stocks A

and B are $20 and $40, respectively. If you have $15,000 to invest and you want to hold the market portfolio, how

much of your money will you invest in Stock A?

A. $12,545.46

B. $10,454.55

C. $4,545.45

O D. $6,272.73

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- You purchased a stock at a price of $56.04. The stock paid a dividend of $2.31 per share and the stock price at the end of the year is $62.59. What is the capital gains yield? Multiple Choice 10.46% 15.81% 9.94% 4.12% 11.69%arrow_forwardYou have $150,000 invested in three stocks as follows: Stock Investment Stock's Beta SYK $50,000 1.9 ISRG $50,000 1.2 YUM $50,000 (a) What is the beta value of your portfolio? (b) You desire a portfolio of 1.15 and will achieve this by selling $25,000 of ISRG and an additional amount SYK, with the proceeds of both sales to purchase YUM. What dollar amount of SYK should you sell? What dollar amount of YUM will you purchase? 0.9arrow_forwardA stock is expected to paid a dividend of f $3.4 you just sold it for $173. If you bought it for $81 one year ago, what is the stock's Holding Period Return? Round to 2 decimal places. Answer:arrow_forward

- Assume you buy 200 shares of stock at $70 per share on margin (40 percent). a. If the price risesto $95 per share, what is your percentage gain on the initial equity? b. What would the percentageloss on the initial equity be if the price had decreased to $40 ?arrow_forwardYou have the following share price of XYZ. DATE Price 2-Mar-2021 $100 3-Mar-2021 $60 4-Mar-2021 $40 5-Mar-2021 $100 Investor B bought 100 shares of XYZ on 2-Mar-2021 and sold all the shares on 5-Mar-2021. Which answer is the closest value to the arithmetic average rate of return for the investor? A. 20% B. 15% C. 25% D. 0%arrow_forwardRequired: A common stock pays an annual dividend per share of $2.10. The risk-free rate is 7% and the risk premium for this stock is 4%. If the annual dividend is expected to remain at $2.10, what is the value of the stock? (Round your answer to 2 decimal places.) Stock valuearrow_forward

- Question A, B & C please. A study guide question. Suppose you sell short Tesla which is currently trading at $300 per share. You put $30,000 as cash into your brokerage account with an initial margin of 50%. The maintenance margin is 35%. a)How many shares of Tesla can you sell short? b)How far can the stock price increase before you get a margin call? c)Assume Tesla pays a dividend of $10 per share after you sell it short. At what price, will you get a margin call?arrow_forwardWhat is earning per share? What is price- earning patio? what is dividends per share ?What is dividend Yield? When Common stock $10 par value, preferred $5 stock, $25 par. The income was $1250000 and the declared dividends on common stock were$8000000 for the current year. the market price of common stock is $40 per Sharearrow_forward(Preferred stock valuation) Kendra Corporation's preferred shares are trading for $32 in the market and pay a $410 annual dividend. Assume that the market's required yield is 14 percent. a. What is the stock's value to you, the investor? b. Should you purchase the stock? a. The value of the stock to you, the investor, is $ per share. (Round to the nearest cent.) b. Should you acquire the stock? (Select from the drop-down menus.) You acquire the stock because it is currently in the market.arrow_forward

- Given $100,000 to invest, construct a value-weighted portfolio of the four stocks listed below. (Click on the following icon in order to copy its contents into a spreadsheet.) Stock Golden Seas Jacobs and Jacobs MAG PDJB Price/Share ($) 閘12 21 46 12 Number of Shares Outstanding (millions) 1.14 1.46 26.23 7.91arrow_forwardYou buy a share of Damanpour Corporation stock for $21.40. You expect it to pay dividends of $1.07, $1.1149, and $1.2250 in Years 1, 2, and 3 respectively. You also expect to sell the stock at a price of $26.22 at the end of three years. a. Calculate the growth rate in dividends. b. Calculate the expected dividend yield. c. Assuming that the calculated growth rate is expected to continue, you can add the dividend yield to the expected growth rate to determine the expected total rate of return. What is this stock's expected total rate of return?arrow_forwardPlease answer fast I give you upvote.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education