FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

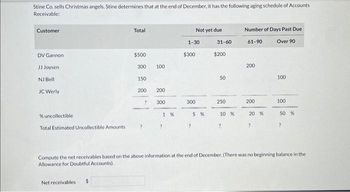

Transcribed Image Text:Stine Co. sells Christmas angels. Stine determines that at the end of December, it has the following aging schedule of Accounts

Receivable:

Customer

DV Gannon

JJ Joysen

NJ Bell

JC Werly

% uncollectible

Total Estimated Uncollectible Amounts i

Total

Net receivables

$500

300

150

200

?

100

200

300

1 %

1-30

$300

Not yet due

300

5 %

31-60

$200

50

250

10 %

?

Number of Days Past Due

Over 90

61-90

200

200

20 %

?

100

100

50 %

Compute the net receivables based on the above information at the end of December. (There was no beginning balance in the

Allowance for Doubtful Accounts).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Indiana Bones, Inc., has the following account balances at the end of the year before adjustments: Accounts Receivable $60,000 Allowance for Doubtful Accounts $800 credit balance Sales $900,000 Doubtful Accounts Expense 0 Management estimates that 11% of accounts receivable will be uncollectible. After the correct adjusting entry has been made, Doubtful Accounts Expense on the income statement for the year equals:arrow_forwardDo not give solution in imagearrow_forwardDo not give image formatarrow_forward

- The beginning balance in the Allowance for Uncollectible Accounts account is a $3,500 credit. After conducting an aging analysis, management has determined that $11,700 of accounts receivable will be uncollectible. What is the ending balance in the Allowance for Uncollectible Accounts account? $11,700 $3,500 $15,200 $8,200arrow_forwardDaley Company prepared the following aging of receivables analysis at December 31. Total 0 Accounts receivable Percent uncollectible $ 625,000 $ 407,000 1 to 30 $ 101,000 Days Past Due 31 to 60 $ 47,000 61 to 90 $ 29,000 Over 90 $ 41,000 3% 4% 7% 9% 12% a. Estimate the balance of the Allowance for Doubtful Accounts assuming the company uses 5% of total accounts receivable to estimate uncollectibles, instead of the aging of receivables method. b. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $13,100 credit. c. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $2,100 debit. Answer is not complete. Complete this question by entering your answers in the tabs below. Req A Req B and C Estimate the balance of the Allowance for Doubtful Accounts assuming the company…arrow_forwardRequired information Use the following information for the Exercises below. Skip to question [The following information applies to the questions displayed below.]Daley Company prepared the following aging of receivables analysis at December 31. Days Past Due Total 0 1 to 30 31 to 60 61 to 90 Over 90 Accounts receivable $ 625,000 $ 407,000 $ 101,000 $ 47,000 $ 29,000 $ 41,000 Percent uncollectible 3 % 4 % 7 % 9 % 12 % Exercise 9-9 Percent of receivables method LO P3 a. Estimate the balance of the Allowance for Doubtful Accounts assuming the company uses 5% of total accounts receivable to estimate uncollectibles, instead of the aging of receivables method.b. Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $13,100 credit.c. Prepare the adjusting entry to record bad debts expense…arrow_forward

- AB Co made a credit sale to DE Co for $200,000 on July 19x9. It is known that at the end of 19x9 there was an outstanding receivable of $47,000. Managementestimates that $25,000 will be uncollectible.In July 19x9 the collections department stated that a receivable of $5,000 was written off frombookkeeping because it is impossible to receive payment from DE Co. Unexpectedly monthOctober 19x9 DE Co pays its outstanding debt. Requested:Prepare the adjusting entries and the journals needed to record the above transactions properlythe backup method as well as the direct deletion method!arrow_forward11. The following aging of Accounts Receivable is for Cook Company at the end of its first year of business: Leticia James Sarah Green Jay Krishnan Luis Hernandez Preeti Shroff Yu Gao Total Overall $ 30,000 Age of Account Less than 30 days 31 to 60 days 61 to 90 days Over 90 days 120,000 36,000 180,000 48,000 75,000 Aging of Accounts Receivable December 31, 20X1 31 days to 60 days 2 Less than 30 days $24,000 93,000 9,000 12 35 80 150,000 30,000 60,000 Percent Ultimately Uncollectible $366,000 12,000 12,000 $489.000 $24,000 Cook Company has collected the following bad debt information from a consultant familiar with Cook's industry: 30,000 18,000 61 days to 90 days $3,000 6,000 $72,000 15,000 Over 90 days $3,000 15,000 9,000 $27,000 Required a. Compute the appropriate allowance for bad debts as of December 31, 20X1. b. What is Cook's NET Accounts Receivable balance as of December 31, 20X1? c. Assume the balance in the Allowance for Doubtful Accounts before any adjusting entries was a…arrow_forwardPrepare an aging schedule to determine the total estimated uncollectibles at March 31,2018arrow_forward

- Aging of Receivables; Estimating Allowance for Doubtful Accounts Wig Creations Company supplies wigs and hair care products to beauty salons throughout Texas and the Southwest. The accounts receivable clerk for Wig Creations prepared the following partially completed aging of receivables schedule as of the end of business on December 31, 20Y7: Not Days Past Due Past Customer Balance Due 1-30 31-60 61-90 91-120 Over 120 ABC Beauty 21,000 21,000 Angel Wigs 7,600 7,600 Zodiac Beauty 3,500 3,500 Subtotals 1,305,100 746,400 294,000 125,900 43,800 16,400 78,600 The following accounts were unintentionally omitted from the aging schedule. Assume all due dates are for the current year except for Visions Hair & Nail, which is due in the next year. Customer Due Date Balance Arcade Beauty Aug. 17 $4,500 Creative Images Oct. 30 4,900 Excel Hair Products…arrow_forwardRoute Canal Shipping Company has the following schedule for aging of accounts receivable: Age of Receivables April 30, 20X1 (1) (2) (3) (4) Month of Sales Age of Account Amounts Percent of Amount Due April 0–30 $ 283,500 _______ March 31–60 63,000 _______ February 61–90 252,000 _______ January 91–120 31,500 _______ Total receivables $ 630,000 100% Calculate the percentage of amount due for each month. If the firm had $1,680,000 in credit sales over the four-month period, compute the average collection period. Average daily credit sales should be based on a 120-day period.arrow_forwardAging of Receivables; Estimating Allowance for Doubtful Accounts Wig Creations Company supplies wigs and hair care products to beauty salons throughout Texas and the Southwest. The accounts receivable clerk for Wig Creations prepared the following partially completed aging of receivables schedule as of the end of business on December 31, 20Y1: Days Past Due Customer Balance Not Past Due 1-30 31-60 61-90 91-120 over 120 Subtotals 646,600 358,900 155,200 71,100 23,900 21,300 16,200 The following accounts were unintentionally omitted from the aging schedule: Customer Due Date Balance Arcade Beauty May 28, 20Y1 $3,000 Creative Images Sept. 7, 20Y1 6,200 Excel Hair Products Oct. 17, 20Y1 800 First Class Hair Care Oct. 24, 20Y1 2,100 Golden Images Nov. 23, 20Y1 700 Oh The Hair Nov. 29, 20Y1 3,600 One Stop Hair Designs Dec. 2, 20Y1 2,300 Visions Hair and Nail Jan. 5, 20Y2 7,600 Wig Creations has a past history of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education