FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

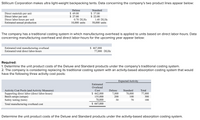

Transcribed Image Text:Stillicum Corporation makes ultra light-weight backpacking tents. Data concerning the company's two product lines appear below:

Deluxe

Standard

$ 57.00

$ 22.00

Direct materials per unit

Direct labor per unit

Direct labor-hours per unit

Estimated annual production

$ 69.00

$ 27.00

0.70 DLHS

1.40 DLHS

10,000 units

50,000 units

The company has a traditional costing system in which manufacturing overhead is applied to units based on direct labor-hours. Data

concerning manufacturing overhead and direct labor-hours for the upcoming year appear below:

Estimated total manufacturing overhead

Estimated total direct labor-hours

$ 667,000

77,000 DLHS

Required:

1. Determine the unit product costs of the Deluxe and Standard products under the company's traditional costing system.

2. The company is considering replacing its traditional costing system with an activity-based absorption costing system that would

have the following three activity cost pools:

Expected Activity

Estimated

Overhead

Activity Cost Pools (and Activity Measures)

Supporting direct labor (direct labor-hours)

Batch setups (setups)

Safety testing (tests)

Cost

Deluxe

Standard

Total

$ 462,000

135,000

70,000

7,000

200

70,000

100

77,000

300

30

70

100

Total manufacturing overhead cost

$ 667,000

Determine the unit product costs of the Deluxe and Standard products under the activity-based absorption costing system.

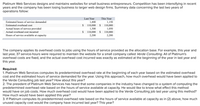

Transcribed Image Text:Platinum Web Services designs and maintains websites for small business entrepreneurs. Competition has been intensifying in recent

years and the company has been losing business to larger web design firms. Summary data concerning the last two years of

operations follow:

Last Year

This Year

1,400

$

Estimated hours of service demanded

1,150

110,000

1,050

110,000

2,200

$

110,000

1,300

$

Estimated overhead cost

Actual hours of service provided

Actual overhead cost incurred

$

110,000

2,200

Hours of service available at capacity

The company applies its overhead costs to jobs using the hours of service provided as the allocation base. For example, this year and

last year, 37 service-hours were required to maintain the website for a small company called Verde Consulting. All of Platinum's

overhead costs are fixed, and the actual overhead cost incurred was exactly as estimated at the beginning of the year in last year and

this year.

Required:

1. Platinum Web Services computes its predetermined overhead rate at the beginning of each year based on the estimated overhead

cost and the estimated hours of service demanded for the year. Using this approach, how much overhead would have been applied to

the Verde Consulting job last year? How about this year?

2. The president of Platinum Web Services has heard that some companies in the industry have changed to a system of computing the

predetermined overhead rate based on the hours of service available at capacity. He would like to know what effect this method

would have on job costs. How much overhead cost would have been applied to the Verde Consulting job last year using this method?

How much would have been applied this year?

3. If Platinum computes its predetermined overhead rate based on the hours of service available at capacity as in (2) above, how much

unused capacity cost would the company have incurred last year? This year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Glover Company makes three products in a single facility. These products have the following unit product costs: Product A B C Direct materials $ 32.80 $ 49.30 $ 55.70 Direct labor 20.20 22.80 13.60 Variable manufacturing overhead 1.20 0.60 0.90 Fixed manufacturing overhead 13.50 9.10 9.70 Unit product cost $ 67.70 $ 81.80 $ 79.90 Additional data concerning these products are listed below. Product A B C Mixing minutes per unit 1.20 1.20 0.20 Selling price per unit $ 58.00 $ 80.40 $ 73.90 Variable selling cost per unit $ 0.60 $ 1.10 $ 2.30 Monthly demand in units 2,000 3,300 1,300 The mixing machines are potentially the constraint in the production facility. A total of 6,520 minutes are available per month on these machines. Direct labor is a variable cost in this company. Required: a. How many minutes of mixing machine time would be required to satisfy demand for all three products? b. How much of…arrow_forwardGodoarrow_forwardPreble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct material: 5 pounds at $8.00 per pound Direct labor: 2 hours at $14 per hour Variable overhead: 2 hours at $5 per hour Total standard variable cost per unit $ 40.00 28.00 10.00 $ 78.00 The company also established the following cost formulas for its selling expenses: Advertising Sales salaries and commissions Shipping expenses Variable Cost per Unit Sold Fixed Cost per Month $ 200,000 $ 100,000 $ 12.00 $ 3.00 S The planning budget for March was based on producing and selling 25,000 units. However, during March the company actually produced and sòld 30,000 units and incurred the following costs: a. Purchased 160,000 pounds of raw materials at a cost of $7.50 per pound. All of this material was used in production. b. Direct-laborers worked 55,000 hours at a rate of $15.00 per hour. c. Total variable…arrow_forward

- Rahularrow_forwardPuvo, Incorporated, manufactures a single product in which variable manufacturing overhead is assigned on the basis of standard direct labor-hours. The company uses a standard cost system and has established the following standards for one unit of product: Standard Quantity Standard Price or Rate Standard Cost Direct materials 5.8 pounds $ 0.60 per pound $ 3.48 Direct labor 0.5 hours $ 33.50 per hour $ 16.75 Variable manufacturing overhead 0.5 hours $ 8.50 per hour $ 4.25 During March, the following activity was recorded by the company: The company produced 2,400 units during the month. A total of 19,400 pounds of material were purchased at a cost of $13,580. There was no beginning inventory of materials on hand to start the month; at the end of the month, 3,620 pounds of material remained in the warehouse. During March, 1,090 direct labor-hours were worked at a rate of $30.50 per hour. Variable manufacturing overhead costs during March totaled $14,061. The…arrow_forwardLockTite Company produces two products, Pretty Safe (PS) and Virtually Impenetrable (VI). The following two tables give pertinent information about these products. Solve, a. What is the cost per unit of Pretty Safe if LockTite uses traditional overhead allocation based on number of units produced? b. What is the cost per unit of Pretty Safe if LockTite uses activity-based costing to allocate overhead?arrow_forward

- Munabhaiarrow_forwardHanshabenarrow_forwardMaxey & Sons manufactures two types of storage cabinets—Type A and Type B—and applies manufacturing overhead to all units at the rate of $120 per machine hour. Production information follows. Type A Type BAnticipated volume (units) 24,000 45,000 Direct-material cost per unit $ 28 $ 42 Direct-labor cost per unit 33 33 The controller, who is studying the use of activity-based costing, has determined that the firm’s overhead can be identified with three activities: manufacturing setups, machine processing, and product shipping. Data on the number of setups, machine hours, and outgoing shipments, which are the activities’ three respective cost drivers, follow. Type A Type B TotalSetups 140 100 240 Machine hours 48,000 67,500 115,500 Outgoing shipments 200 150 350 The firm’s total…arrow_forward

- Petrillo Company produces engine parts for large motors. The company usesa standard cost system for production costing and control. The standard costsheet for one of its higher volume products (a valve) is as follows: Direct materials (7 lbs @$5,4) $37,80 Direct labor (1,75 lbs @$18) $31,50 Variable overhead (1,75 lbs @$4) $7 Fixed overhead (1,75 lbs @$3) $5,25 Standard unit cost $81,55 During the year, Petrillo had the following activity related to valve production:a. Production of valves totaled 20,600 units.b. A total of 135,400 pounds of direct materials was purchased at $5.36per pound.c. There were 10,000 pounds of direct materials in beginning inventory(carried at $5.40 per pound). There was no ending inventory. d. The company used 36,500 direct labor hours at a total cost of $656,270.e. Actual fixed overhead totaled $110,000.f. Actual variable overhead totaled $168,000.Petrillo produces all of its valves in a single plant. Normal activity is 20,000units per year. Standard…arrow_forwardGiven the following information, determine the product cost of one unit: Direct Materials = $60; Direct labor = $10; Apply Overhead based on $2 per Direct Labor hour; Direct labor hours is 4 hours per unit. a. $70 per unit b. $80 per unit c. $78 per unit d. $85 per unit Contribution margin is sales less: a. Fixed overhead and fixed selling and administrative expenses b. Variable Cost of goods sold and variable selling & administrative expenses c. Variable selling and administrative expemses and Fixed selling and administrative expenses d. variable cost of goods sold An investment generates an operating income of $100,000, and the average operating assets are $400,000. What is the return on the investment? a. 100% b. 75% c. 25% d. 20%arrow_forwardStillicum Corporation makes ultra light-weight backpacking tents. Data concerning the company's two product lines appear below: Standard Direct materials per unit Direct labor per unit Direct labor-hours per unit Estimated annual production Estimated total manufacturing overhead Estimated total direct labor-hours Deluxe $ 57.00 $15.00 The company has a traditional costing system in which manufacturing overhead is applied to units based on direct labor-hours. Data concerning manufacturing overhead and direct labor-hours for the upcoming year appear below: 0.70 DLHS 10,000 units Unit product cost Deluxe $ 45.00 $ 12.40 Required: 1. Determine the unit product costs of the Deluxe and Standard products under the company's traditional costing system. 2. The company is considering replacing its traditional costing system with an activity-based absorption costing system that would have the following three activity cost pools: Complete this question by entering your answers in the tabs below.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education