Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:8%

1.08000

1.16640

1.25971

1.36049

1.46933

1.58687

1.71382

1.85093

1.99900

2.15892

2.33164

2.51817

2.71962

2.93719

3.17217

3.42594

3.70002

3.99602

4.31570

4.66096

5.03383

5.43654

5.87146

6.34118

6.84847

7.39635

7.98806

8.62711

9.31727

10.06266

10.86767

11.73708

12.67605

13.69013

14.78534

15.96817

17.24563

18.62528

20.11530

21.72452

9%

1.09000

1.18810

1.29503

1.41158

1.53862

1.67710

1.82804

1.99256

2.17189

2.36736

2.58043

2.81267

3.06581

3.34173

3.64248

3.97031

4.32763

4.71712

5.14166

5.60441

6.10881

6.65860

7.25787

7.91108

8.62308

9.39916

10.24508

11.16714

12.17218

13.26768

14.46177

15.76333

17.18203

18.72841

20.41397

22.25123

24.25384

26.43668

28.81598

31.40942

10%

1.10000

1.21000

1.33100

1.46410

1.61051

1.77156

1.94872

2.14359

2.35795

2.59374

2.85312

3.13843

3.45227

3.79750

4.17725

4.59497

5.05447

5.55992

6.11591

6.72750

7.40025

8.14028

8.95430

9.84973

10.83471

11.91818

13.10999

14.42099

15.86309

17.44940

19.19434

21.11378

23.22515

25.54767

28.10244

30.91268

34.00395

37.40434

41.14479

45.25926

11%

1.11000

1.23210

1.36763

1.51807

1.68506

1.87041

2.07616

2.30454

2.55803

2.83942

3.15176

3.49845

3.88328

4.31044

4.78459

5.31089

5.89509

6.54355

7.26334

8.06231

8.94917

9.93357

11.02627

12.23916

13.58546

15.07986

16.73865

18.57990

20.62369

22.89230

25.41045

28.20560

31.30821

34.75212

38.57485

42.81808

47.52807

52.75616

58.55934

65.00087

12%

1.12000

1.25440

1.40493

1.57352

1.76234

1.97382

2.21068

2.47596

2.77308

3.10585

3.47855

3.89598

4.36349

4.88711

5.47357

6.13039

6.86604

7.68997

8.61276

9.64629

10.80385

12.10031

13.55235

15.17863

17.00000

19.04007

21.32488

23.88387

26.74993

29.95992

33.55511

37.58173

42.09153

47.14252

52.79962

59.13557

66.23184

74.17966

83.08122

93.05097

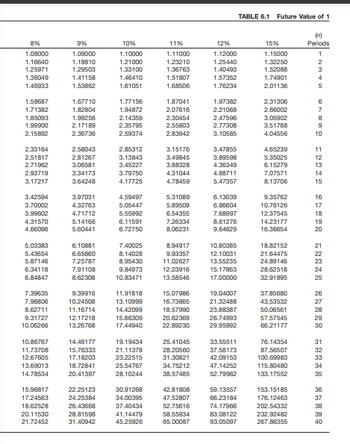

TABLE 6.1 Future Value of 1

15%

1.15000

1.32250

1.52088

1.74901

2.01136

2.31306

2.66002

3.05902

3.51788

4.04556

4.65239

5.35025

6.15279

7.07571

8.13706

9.35762

10.76126

12.37545

14.23177

16.36654

18.82152

21.64475

24.89146

28.62518

32.91895

37.85680

43.53532

50.06561

57.57545

66.21177

76.14354

87.56507

100.69983

115.80480

133.17552

153.15185

176.12463

202.54332

232.92482

267.86355

(n)

Periods

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

Transcribed Image Text:Steve Fillmore's lifelong dream is to own his own fishing boat to use in his retirement. Steve has recently come into an inheritance of

$421,000. He estimates that the boat he wants will cost $344,700 when he retires in 6 years.

Click here to view factor tables

How much of his inheritance must he invest at an annual rate of 15% (compounded annually) to buy the boat at retirement? (Round

factor values to 5 decimal places, e.g. 1.25124 and final answers to O decimal places, e.g. 458,581.)

Investment amount

$

149182

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Need help with the question pleasearrow_forwardMohammed is 65 years of age and has a life expectancy of 12 more years. He wishes to invest $40,000 in an annuity that will make a level payment at the end of each year until his death. If the interest rate is 10%, what income can Mr. Mohammed expect to receive each year? (Choose the correct answer from below options and attach all your explanations in the other link provided) Select one: a. 27256 b. 272 c. 2725 d. 272560arrow_forwardYou believe you will need to have saved $593,000 by the time you retire in 30 years in order to live comfortably. You also believe that you will inherit $113,000 in 5 years. (Do not round intermediate calculations. Leave no cells blank - be certain to enter "0" wherever required. Round your answers to 2 decimal places.) If the interest rate is 7% per year, what is the future value of your inheritance at retirement? How much additional money must you save to meet your retirement goal, assuming you save your entire inheritance?arrow_forward

- Suppose a husband wants to take his wife on a trip three years from now to Europe to celebrate their 40th anniversary. He has just received a $20,000 inheritance from an uncle and intends to invest it for the trip. The husband estimates the trip will cost $26,600. What interest rate, compounded annually, must be earned to accumulate enough to pay for the trip? Note: Use tables, Excel, or a financial calculatorarrow_forwardMarco is plans to retire in 16 years. He wants you to assume he will be retired for 19 years before he dies. You calculated that Marco needs $1,758,809 as a lump sum at the beginning of retirement. Use an investment return of 7 percent and an inflation assumption of 1.2 percent. How much money will he need to save monthly to have this amount when he begins retirement? (Round the final answer to 2 decimal places)arrow_forwardShane is about to have his twenty-fifth birthday. He has set a goal of retiring at age 55 with $700,000 in an RRSP. For planning purposes he is assuming that his RRSP will earn 8% compounded annually. (Do not round intermediate calculations and round your final answer to 2 decimal places.) a. What contribution on each birthday from age 25 to 54 inclusive will be required to accumulate the desired amount in his RRSP? PMT b. If he waits five years before starting his RRSP, what contribution on each birthday from age 30 to 54 inclusive will be required to accumulate the target amount? PMT $arrow_forward

- Suppose a husband wants to take his wife on a trip three years from now to Europe to celebrate their 40th anniversary. He has just received a $24,000 inheritance from an uncle and intends to invest it for the trip. The husband estimates the trip will cost $31,000 and he believes he can earn 8% interest, compounded annually, on his investment. Complete the following table to calculate the future value. Will he be able to pay for the trip with the accumulated investment amount? Note: Use tables, Excel, or a financial calculator. Round your final answers to the nearest whole dollar amount. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)arrow_forwardPaul Havlik promised his grandson Jamie that he would give him $7,300 5 years from today for graduating from high school. Assume money is worth 10% interest compounded semiannually. What is the present value of this $7,300? (Use the Table provided.) (Do not round intermediate calculations. Round your answer to the nearest cent.) Present valuearrow_forwardYour friend is celebrating her 35th birthday today and wants to start saving for her anticipated retirement at age 65. She wants to be able to withdraw $130,000 from her savings account on each birthday for 24 years following her retirement, the first withdrawal will be on her 66th birthday. Your friend intends to invest her money at 10.7% interest per year. How much money must she accumulate by the time she retires in order to make these withdrawals? (Round your answer to the nearest dollar)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education