FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

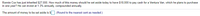

Transcribed Image Text:Ronnie Cox has just inherited S27,000. How much of this money should he set aside today to have $18,000 to pay cash for a Ventura Van, which he plans to purchase

in one year? He can invest at 1.3% annually, compounded annually.

The amount of money to be set aside is S. (Round to the nearest cent as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Brianca plans to save $5,000, $1,000, and $42,000 a year over the next three years, respectively. How much would you need to deposit in one lump sum today to have the same amount as Brianca three years from now if you both earn 10.9 percent, compounded annually?arrow_forward← A newborn child receives a $8,000 gift toward a college education from her grandparents. How much will the $8,000 be worth in 19 years if it is invested at 5.9% compounded quarterly? It will be worth $ (Round to the nearest cent.)arrow_forwardJoe Pierce has been offered the opportunity of investing $178,556.90 now. The investment will earn 8% per year and at the end of its life will return $500,000 to Joe. How many years must Joe wait to receive the $500,000?arrow_forward

- Debra Moore needs $20,000 3 years from now. How much should she invest today in order to reach her goal if she can earn an annual rate of 6% compounded semiannually? Round answers to the nearest dollar.arrow_forwardSuppose a husband wants to take his wife on a trip three years from now to Europe to celebrate their 40th anniversary. He has just received a $24,000 inheritance from an uncle and intends to invest it for the trip. The husband estimates the trip will cost $31,000 and he believes he can earn 8% interest, compounded annually, on his investment. Complete the following table to calculate the future value. Will he be able to pay for the trip with the accumulated investment amount? Note: Use tables, Excel, or a financial calculator. Round your final answers to the nearest whole dollar amount. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)arrow_forwardBrian would like to accumulate $130,000 for his retirement in 9 years. If he is promised a rate of 4.32% compounded semi-annually by his local bank, how much should he invest today? Round to the nearest centarrow_forward

- AI Derover wants to buy a used jeep in five years. He estimates the cost will be $13,000 If he invests $8,500 now at a rate of 10% compounded semiannually, will he have enough money to buy the jeep at the end of five years? Show your work (Round your answer to the nearest cent.) Yes he will have 13,845 60arrow_forwardMickey & Minnie have $47 million in cash. Before they retire, they want the $47 million to grow to $112 million. How many years before Mickey & Minnie can retire if they earn 11.0% per annum on their stash of cash? Assume annual compounding. (Enter your answer in years to 2 decimal places, e.g., 12.34)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education