FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

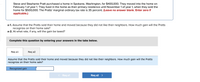

Transcribed Image Text:Steve and Stephanie Pratt purchased a home in Spokane, Washington, for $400,000. They moved into the home on

February 1 of year 1. They lived in the home as their primary residence until November 1 of year 1, when they sold the

home for $500,000. The Pratts' marginal ordinary tax rate is 35 percent. (Leave no answer blank. Enter zero if

applicable.)

a-1. Assume that the Pratts sold their home and moved because they did not like their neighbors. How much gain will the Pratts

recognize on their home sale?

a-2. At what rate, if any, will the gain be taxed?

Complete this question by entering your answers in the tabs below.

Req a1

Req a2

Assume that the Pratts sold their home and moved because they did not like their neighbors. How much gain will the Pratts

recognize on their home sale?

Recognized gain

< Req a1

Req a2 >

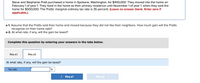

Transcribed Image Text:Steve and Stephanie Pratt purchased a home in Spokane, Washington, for $400,000. They moved into the home on

February 1 of year 1. They lived in the home as their primary residence until November 1 of year 1, when they sold the

home for $500,000. The Pratts' marginal ordinary tax rate is 35 percent. (Leave no answer blank. Enter zero if

applicable.)

a-1. Assume that the Pratts sold their home and moved because they did not like their neighbors. How much gain will the Pratts

recognize on their home sale?

a-2. At what rate, if any, will the gain be taxed?

Complete this question by entering your answers in the tabs below.

Req a1

Req a2

At what rate, if any, will the gain be taxed?

Tax rate

%

Req a1

Req a2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hana is in the 24% tax bracket and owns depreciable business equip-ment that she purchased several years ago for $135,000. She has taken $100,000 of depreciation on the equipment, and it is worth $55,000. Hana’s niece, Michelle, is starting a new business and is short of cash. Michelle has asked Hana to gift the equipment to her so that Michelle can use it in her business. Hana no longer needs the equipment. Identify the alternatives available to Hana if she wants to help Michelle and the tax effects of those alternatives. (Assume that all alternatives involve the business equipment in one way or another, and ignore the gift tax.)arrow_forwardThis year, Leron and Sheena sold their home for $750,000 after all selling costs. Under the following scenarios, how much taxable gain does the home sale generate for Leron and Sheena? Assume that the couple is married filing jointly. Leron and Sheena bought the home one year ago for $600,000 and lived in the home until it sold. What's the taxable gain?arrow_forwardTimothy (40) and Tina (42) are California residents. Todd (age 10) and Ted (age 7) are their two dependent children (age 17). Tim and Tina also help Tim's brother, Bob. For tax reasons, Bob is Tim and Tina's dependant (qualifying relative). What is Tim and Tina's child tax credit (including additional dependent tax credit) for 2020? Assume Tim and Tina's AGI in 2020 is less than the phaseout level for the child tax credit. I gave two different answers of $4000 and $4500, but both were erroneous.arrow_forward

- Alan inherited $100,000 with the stipulation that he"invest it to financially benefit his family." Alan and his wife Alice decided they would invest the inheritance to help them accomplish two financial goals: purchasing a Park City vacation home and saving for their son Cooper's education. INVESTMENT: Initial Investment; Investment horizon VACATION HOME: $50,000; 5 years COOPER'S EDUCATION: $50,000; 18 years. Alan and Alice have a marginal income tax rate of 32 percent (capital gains rate of 15 percent) and have decided to investigate the following investment opportunities. Growth Stock: 5 years, Future Value = $$65,000: What is the Annual After-Tax Rate of Return: _____________% : 18 years, Future Value = $140,000: What is the Annual After-Tax Rate of Return: _____________%arrow_forwardHarold and Maude were married and lived in a common-law state. Maude died in 2018 with a taxable estate of $26.00 million and left it all to Harold. Maude's executor filed a timely estate tax return claiming the marital deduction for the property left to Harold including a valid portability election. Harold died this year, leaving the entire $26.00 million to their three children. (Refer to Exhibit 25- 1 and Exhibit 25-2.) Calculate how much estate tax is due from Harold's estate under the following two alternatives. a. Assume that neither Harold nor Maude had made any taxable gifts prior to this year. b. Assume that Harold and Maude each made a $1 million taxable gift in 2011 and offset the gift tax at that time with the applicable credit. Estate tax if no taxable gifts were made Estate tax if taxable gifts were made $ 5,928,000 $ 0arrow_forwardJason and Alicia Johnston purchased a home in Austin, Texas, for $655,000. They moved into the home on September 1, year 0. They lived in the home as their primary residence until July 1 of year 5, when they sold the home for $982,500. What amount of the $327,500 gain are they allowed to exclude? (Assume married filing jointly.) (Enter only numbers with no dollar signs or other punctuation.)arrow_forward

- Amanda (who is single) just sold her house and moved from Phoenix to L.A. to start a new job one year ago. At that time, she excluded $250,000 of gain on the sale of her home under Section 121. Now, her employer has decided to relocate her again from L.A. to Cincinnati. Her employer has given her the option of either relocating now or waiting until the end of next year. She would like to use Section 121 to exclude part of the gain on the sale of her new home in L.A. The home in L.A. has an adjusted basis of $230,000 (includes $10,000 of depreciation due to the home office deduction) and a FMV of $430,000. Amanda is excited because she believes she will be able to fully exclude her entire gain from her taxable income regardless of when she moves. Is she correct? Please explain your reasoning and what amount of gain Amanda will be required to recognize in this transaction. What would you recommend to Amanda if she wishes to optimize her Section 121 deduction?arrow_forwardJason, 39 and single, helps support his mother Maria and his girlfriend Layla, both of whom are U.S. citizens with SSNs and none of whom file a joint tax return with anyone else. Neither Maria or Layla are disabled. Maria, single, did not live with Jason at all in 2020. She lived in her own home across the street from Jason. Jason provided 80% of Maria’s support in 2020 and paid all costs of maintaining a home for Maria. Maria's only income was municipal bond interest of $5,000. Layla, 40, single, lived with Jason for all of 2020, and Jason paid all costs of maintaining the home. Layla had no income in 2020, and Jason provided all of her support. Which of the following is most accurate?arrow_forwardPaul, age 40 and single, has an 8-year-old son, Larry. Larry resides with his mother, Susan, in her home. Pursuant to the terms of their divorce, Paul properly claims Larry as a dependent on his income tax return. Paul pays child support payments to his ex-wife for the support of his child. Susan does not claim Larry as her dependent, but she does bear the economic burden of supporting the household in which they reside. What is the maximum amount of the 2020 standard deduction that Susan qualifies for? Oa. $12,400 Оb. S18,650 Oc. $20,300 а. Od. $24,800 Oe. Susan does not qualify for claiming a standard deduction. е.arrow_forward

- Matt and Meg Comer are married and file a joint tax return. They do not have any children. Matt works as a history professor at a local university and earns a salary of $69,900. Meg works part time at the same university. She earns $33,200 a year. The couple does not itemize deductions. Other than salary, the Comers' only other source of income is from the disposition of various capital assets (mostly stocks). (Use the tax rate schedules. Dividends and Capital Gains Tax Rates.) Note: Round your final answers to the nearest whole dollar amount. Problem 7-45 Part-b (Algo) b. What is the Comers' tax liability for 2022 if they report the following capital gains and losses for the year? $ 1,500 0 Short-term capital gains Short-term capital losses Long-term capital gains Long-term capital losses Total tax liability 13,100 (10,100)arrow_forwardJoyce is a widowed taxpayer whose husband Willard passed away on March 31, 2020. Joyce and Willard had purchased a home for $215,000 on September 12, 2004, lived in the home as their main home until Willard's death. Joyce moved in with her daughter after Willard's death, and sold the home on November 30, 2020 , for $595,000. How much of the gain on the sale can Joyce exclude from taxable income? Select one: O a. $500,000, the maximum exclusion for an unmarried surviving spouse O b. $380,000, the amount of gain on the sale of the home O C. $250,000, the maximum exclusion amount for a single taxpayer O d. $0, because she moved out before she sold the homearrow_forwardTom Brown is 36 years old and has never been married. Frank, age 13, is Tom1s nephew who lived with hin all year. Tom provided all of his support and provifded over half the cost of keeping up the home. Tom earned 44,000 in wages Tom is legally blind and cannot be claiment as a dependent by another taxpayer. Tom and Frank are U.S citizens, have valid social securities numbers, and lived in the U.S. the entire year. Do the individual income tax return? If need to use a state use mississippiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education