FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

provide cost account ans

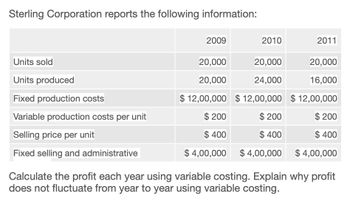

Transcribed Image Text:Sterling Corporation reports the following information:

Units sold

Units produced

2009

2010

2011

20,000

20,000

20,000

20,000

24,000

16,000

Fixed production costs

$12,00,000 $12,00,000 $12,00,000

Variable production costs per unit

$ 200

$ 200

$ 200

Selling price per unit

$ 400

$ 400

$ 400

Fixed selling and administrative

$ 4,00,000

$ 4,00,000 $ 4,00,000

Calculate the profit each year using variable costing. Explain why profit

does not fluctuate from year to year using variable costing.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A division sold 260000 calculators during 2020: Sales $2600000 Variable costs: Materials $494000 Order processing 195000 Billing labor 143000 Selling expenses 78000 Total variable costs 910000 Fixed costs 1000000 How much is the unit contribution margin? $1.00 $3.50 $7.35 $6.50arrow_forwardIdentify Breakeven in units for the scenario below: $170.000 $136.000 $102.000 $68.000 $34.000 GOOO 3000 2500 4000 Unit Sales Breakeven Analysis 1000 2000 3000 4000 5000 6000 7000 8000 9000 Units Sold O Fixed Costs Total Operating Costs Sales Revenuesarrow_forwardTotal Costs Variable Costs Fixed Costs Total Costs Costs per unit Variable cost per unit Fixed cost per unit 008 S Total cost per unit 0082 $ 60,000 101 150,000 Units produced and sold 80,000 001500 4.50 erinoM nsl 100,000 doa 19A Gigi's Gadgets manufactures and sells a single product. A partially completed schedule of the co total and per unit costs over a relevant range of 60,000 to 100,000 units produced and sold durir given year are listed above. 1. Complete the schedule for the company's total and unit costs above.matul ad quizU 2. Assume that the company sells 90,000 during a year. The selling price is $7.50 per unit. an income statement using the contribution margin format for that year.arrow_forward

- Check myt 750 900 Number of Canoes Produced and Sold Total costs Variable costs 550 $115,500 $157,500 $189,000 198,000 $387,000 198,000 198,000 $313,500 $355,500 Fixed costs Total costs Cost per unit Variable cost per unit Fixed cost per unit $ 210.00 360.00 $ 210.00 264.00 $ 210.00 220.00 $ 570.00 $ 474.00 $ 430.00 Total cost per unit Riverside sells its canoes for $650 each. Next year Riverside expects to sell 1,000 canoes. Required: Complete the Riverside's contribution margin income statement for each independent scenario. Assuming each scenario is a variation of Riverside's original data. (Round your unit contribution margin and contribution margin ratio to 2 decimal places (i.e. 1234 should be entered as 12.34%) and all other answers to the nearest dollar amount.) Scenario 2 Increase Scenario 3 Scenario 1 Raises Sales Price to $750 per Canoe Sales Price and Variable Cost per Unit by 10 Percent Decrease Fixed Cost by 20 Percent Unit Contribution Margin Contribution Margin Ratio…arrow_forward60.000 units $75,000 $120,000 $65,000 90,000 units $75,000 $180,000 $80,000 $335,000 Cost A Cost B Cost C $260,000 Total Costs cost Cost C is a О А. fixed О В. mixed O C. variable O D. sunkarrow_forwardCost Planning for Product Life Cycle... 229 RM800 Revenue Costs Research and development Prototypes Marketing Distribution Year 1 P 900,000 1,150,000 550,000 124,000 170,000 85,000 -0- P(1,179,000) Year 2 Year 3 P1,800,000 P2,000,000 -0- -0- 30,000 200,000 300,000 600,000 20,000 P 650,000 10,000 260,000 410,000 700,000 10,000 P 610,000 Manufacturing Customer service Income Required: 1. How would a product life-cycle income statement differ from this calendar- year income statement? 2. Prepare a three-year life-cycle income statement for both products. Which product appears to be more profitable? 3. Prepare a schedule showing each cost category as a percentage of total annual costs. Pay particular attention to the research and development and customer service categories. What do you think this indicates about the profitability of each product over the three-year life cycle?arrow_forward

- 50 voitabicaol brus eigaoto Cost Accounting Last year. Abner Company incurred the following costs P 50,000 20,000 130,000 40,000 36,000 bourbo Direct materials Direct labora Factory overhead Selling expense Administrative expense leto Units produced and sold 10,000 units at a price P31 each 13. Prime cost per unit is a. P 7.00 b.P15.00 c. P 5.00 d. P20.00 14. Con ersion cost per unit is a. ? 7. b. P 15.) c P20.00. d. P26.00 15. Cost of goods solt pe unit is stoq 31A a. P 7.0 b. P 15.09 0200 ba c. P 20.00 d. P26.00 16. Gross profit per unit is dshav a. P 11.00 c. P 16.00 d. P 24.00 b. P 15.00 17. Operating income is a. P 24,000 le bivism.ro b. P 110,000 c. P°74,000 d. P110,000arrow_forwardAssume the following information for a company that produced and sold 10,000 units during its first year of operations: Per Unit $ 200 $77 $ 50 $10 Selling price Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Using absorption costing, what is the company's unit product cost? Multiple Choice O $157 O $167 $127 $137 Per Year $ 300,000arrow_forwardData table Unit Selling Case Price a. b. C. d. GA Unit Variable Operating Costs 70 $ 280 140 20 66 Number of Units Sold 11,000 30,000 20,000 Total Contribution Margin 875,000 5,000,000 1,720,000 Total Fixed Costs 235,000 1,500,000 Operating Income $ 210,000 117,500 920,000arrow_forward

- Larner Corporation is a diversified manufacturer of industrial goods. The company's activity-based costing system contains the following six activity cost pools and activity rates: Activity Rates Activity Cost Pool Labor-related Machine-related Machine setups Production orders Shipments General factory ME $ 5.00 per direct labor-hour $ 4.00 per machine-hour $ 60.00 per setup $ 100.00 per order $ 120.00 per shipment $ 4.00 per direct labor-hour Cost and activity data have been supplied for the following products: 378 852 Direct materials cost per unit Direct labor cost per unit $ 3.50 $ 20.00 $ 3.75 Number of units produced per year $9.00 400 2,000 Direct labor-hours Machine-hours Machine setups Production orders Chinmante Total Expected Activity 378 852 1,200 40 2,800 20 4 4 A 7 7 4arrow_forwardSelling price $215 $230 Direct materials (pounds) 23,000 25,000 Direct materials costs per pound $30 $32 Manufacturing capacity for CM5 (units) 11,000 11,000 Conversion costs (fixed costs) $770,000 $803,000 Conversion costs per unit of capacity $70 $73 Manufacturing conversion costs in each year depend on production capacity defined in terms of CM5 units that can be produced. Required: What is the net effect on operating income as a result of the growth component? $51,000 $116,800 $112,000 $166,000arrow_forwardA8arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education