Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

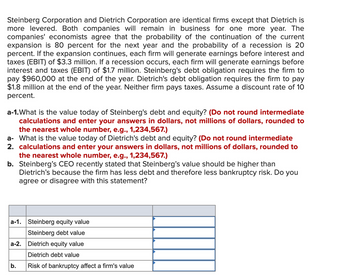

Transcribed Image Text:Steinberg Corporation and Dietrich Corporation are identical firms except that Dietrich is

more levered. Both companies will remain in business for one more year. The

companies' economists agree that the probability of the continuation of the current

expansion is 80 percent for the next year and the probability of a recession is 20

percent. If the expansion continues, each firm will generate earnings before interest and

taxes (EBIT) of $3.3 million. If a recession occurs, each firm will generate earnings before

interest and taxes (EBIT) of $1.7 million. Steinberg's debt obligation requires the firm to

pay $960,000 at the end of the year. Dietrich's debt obligation requires the firm to pay

$1.8 million at the end of the year. Neither firm pays taxes. Assume a discount rate of 10

percent.

a-1. What is the value today of Steinberg's debt and equity? (Do not round intermediate

calculations and enter your answers in dollars, not millions of dollars, rounded to

the nearest whole number, e.g., 1,234,567.)

a- What is the value today of Dietrich's debt and equity? (Do not round intermediate

2. calculations and enter your answers in dollars, not millions of dollars, rounded to

the nearest whole number, e.g., 1,234,567.)

b. Steinberg's CEO recently stated that Steinberg's value should be higher than

Dietrich's because the firm has less debt and therefore less bankruptcy risk. Do you

agree or disagree with this statement?

a-1. Steinberg equity value

Steinberg debt value

Dietrich equity value

Dietrich debt value

Risk of bankruptcy affect a firm's value

a-2.

b.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose Goodyear Tire and Rubber Company is considering divesting one of its manufacturing plants. The plant is expected to generate free cash flows of $1.50 million per year, growing at a rate of 2.5% per year. Goodyear has an equity cost of capital of 8.5%, a debt cost of capital of 7.0%, a marginal corporate tax rate of 35%, and a debt-equity ratio of 2.6. If the plant has average risk and Goodyear plans to maintain a constant debt-equity ratio, what after-tax amount must it receive for the plant for the divestiture to be profitable? A divestiture would be profitable if Goodyear received more than $ million after tax. (Round to one decimal place.)arrow_forwardSuppose Goodyear Tire and Rubber Company is considering divesting one of its manufacturing plants. The plant is expected to generate free cash flows of $1.41 million per year, growing at a rate of 2.3% per year. Goodyear has an equity cost of capital of 8.4%, a debt cost of capital of 7.2%, a marginal corporate tax rate of 32%, and a debt-equity ratio of 2.6. If the plant has average risk and Goodyear plans to maintain a constant debt-equity ratio, what after-tax amount must it receive for the plant for the divestiture to be profitable? A divestiture would be profitable if Goodyear received more than $enter your response here million after tax. (Round to one decimal place.)arrow_forwardFountain Corporation’s economists estimate that a good business environment and a bad business environment are equally likely for the coming year. The managers of the company must choose between two mutually exclusive projects. Assume that the project the company chooses will be the firm’s only activity and that the firm will close one year from today. The company is obligated to make a $5,300 payment to bondholders at the end of the year. The projects have the same systematic risk but different volatilities. Consider the following information pertaining to the two projects: Economy Probability Low-Volatility Project Payoff High-Volatility Project Payoff Bad .50 $ 5,300 $ 4,700 Good .50 6,400 7,000 a. What is the expected value of the company if the low-volatility project is undertaken? The high-volatility project? (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) b. What is the expected value of the…arrow_forward

- Halliford Corporation expects to have earnings this coming year of $2.879 per share. Halliford plans to retain all of its earnings for the next two years. Then, for the subsequent two years, the firm will retain 48% of its earnings. It will retain 18% of its earnings from that point onward. Each year, retained earnings will be invested in new projects with an expected return of 22.9% per year. Any earnings that are not retained will be paid out as dividends. Assume Halliford's share count remains constant and all earnings growth comes from the investment of retained earnings. If Halliford's equity cost of capital is 9.7%, what price would you estimate for Halliford stock? The stock price will be $. (Round to the nearest cent.)arrow_forwardAlfa Inc company is targeted for merger. In the present, the revenues of the company are $10 mil and it is forecast that in the next years it will increase by 10% each year. The operating expenses are $8 mil, which are expected to grow with the same growth rate as the revenues. Depreciation is $500,000 and is estimated to increase by $50,000/year. The investment needs (CAPEX) are $200,000 each year, and the short term financing needs (NWC) are estimated at 2% of turnover. The company has $1 mil in net debts, at an interest rate of 4.5%. The risk-free rate for government bonds is 4.5%, the market risk premium is 6% and beta coefficient is 1.5. The D/E ratio is 0.5After the merger, the D/E ratio will be 0.35 taking into account the repayment of loans forecasted by the acquirer. Net debt = 700,000 after the deal b) Will the company record a financial synergy. Compute the value of the synergy. c) $10 mil will be a good price for the deal?arrow_forwardGood Time Company is a regional chain department store. It will remain in business for one more year. The probability of a boom year is 50 percent and the probability of a recession is 50 percent. It is projected that the company will generate a total cash flow of $126 million in a boom year and $78 million in a recession. The company's required debt payment at the end of the year is $75 million. The market value of the company's outstanding debt is $58 million. The company pays no taxes. What is the expected rate of return on the company's debt? O 34.5% O O 29.3% O 100%arrow_forward

- Steber Packaging Inc. expects sales next year of $42 million. Of this total, 30 percent is expected to be for cash and the balance will be on credit, payable in 30 days. Operating expenses are expected to total $27 million. Accelerated depreciation is expected to total $8 million, although the company will only report $4 million of depreciation on its public financial reports. The marginal tax rate for Steber is 34 percent. Current assets now total $28 million and current liabilities total $15 million. Current assets are expected to increase to $33 million over the coming year. Current liabilities are expected to increase to $17 million. Compute the projected after-tax operating cash flow for Steber during the coming year. Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Round your answer to two decimal places. $ millionarrow_forwardPhil plc and Costas plc are identical firms except that Costas is more levered. Both companies will remain in business for one more year. The economy is has recently been expanding. According to consensus forecasts, the probability of the continuation of the current expansion is 60% for the next year, and the probability of a recession is 40%. If the expansion continues, each firm will generate profit before interest and taxes of £2 million. If a recession occurs, each firm will generate profit before interest and taxes of £800,000. Phil’s debt obligation requires the firm to pay £750,000 at the end of the year. Costas’s debt obligation requires the firm to pay £1 million at the end of the year. Neither firm pays taxes. Assume a discount rate of 15 per cent. What is the market value of (i) Phil plc and (ii) Costas plc? a None of the above b (i) £1,321,739 and (ii) £1,153,435 c (i) £1,530,435 and (ii) £1,530,435 d (i) £1,321,739 and (ii) £1,321,739 e (i)…arrow_forwardSuppose Goodyear Tire and Rubber Company is considering divesting one of its manufacturing plants. The plant is expected to generate free cash flows of $1.49 million per year, growing at a rate of 2.3% per year. Goodyear has an equity cost of capital of 8.6%, a debt cost of capital of 6.7%, a marginal corporate tax rate of 34%, and a debt-equity ratio of 2.4. If the plant has average risk and Goodyear plans to maintain a constant debt-equity ratio, what after-tax amount must it receive for the plant for the divestiture to be profitable? A divestiture would be profitable if Goodyear received more than $ million after tax. (Round to one decimal place.)arrow_forward

- Good Time Company is a regional chain department store. It will remain in business for one more year. The probability of a boom year is 70 percent and the probability of a recession is 30 percent. It is projected that the company will generate a total cash flow of $186 million in a boom year and $77 million in a recession. The company's required debt payment at the end of the year is $111 million. The market value of the company's outstanding debt is $84 million. The company pays no taxes. a. What payoff do bondholders expect to receive in the event of a recession? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) b. What is the promised return on the company's debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What is the expected return on the company's debt? (Do not round intermediate calculations and…arrow_forwardDyrdek Enterprises has equity with a market value of $12.6 million and the market value of debt is $4.45 million. The company is evaluating a new project that has more risk than the firm. As a result, the company will apply a risk adjustment factor of 1.9 percent. The new project will cost $2.56 million today and provide annual cash flows of $666,000 for the next 6 years. The company's cost of equity is 11.79 percent and the pretax cost of debt is 5.06 percent. The tax rate is 24 percent. What is the project's NPV? Multiple Choice $208,195 $194,561 $536,049 $183,363 $364,858arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education