FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

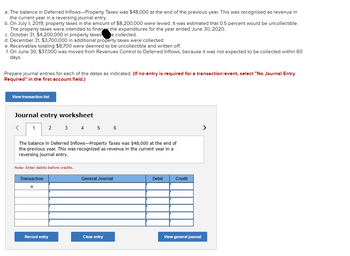

Transcribed Image Text:The image shows an exercise related to journal entries for property taxes on an educational website. Here's the transcription and explanation:

### Transaction Details

- **a.** The balance in Deferred Inflows—Property Taxes was $48,000 at the end of the previous year. This was recognized as revenue in the current year in a reversing journal entry.

- **b.** On July 1, 2019, property taxes amounting to $8,200,000 were levied. It was estimated that 0.5 percent would be uncollectible. These taxes were intended to finance expenditures for the year ended June 30, 2020.

- **c.** On October 31, $4,200,000 in property taxes were collected.

- **d.** On December 31, $3,700,000 in additional property taxes were collected.

- **e.** Receivables totaling $8,700 were deemed uncollectible and written off.

- **f.** On June 30, $37,000 was moved from Revenues Control to Deferred Inflows, as it was not expected to be collected within 60 days.

### Journal Entry Worksheet

This section includes a worksheet to prepare journal entries for each transaction. A note indicates that debits should be entered before credits. The worksheet has input fields for transactions labeled from "a" to "f". Options include:

- **Record entry**: To submit journal entries.

- **Clear entry**: To erase inputs.

- **View general journal**: To display the entries as recorded.

### Instruction Note

- If no entry is required for a transaction/event, the user should select "No Journal Entry Required" in the first account field.

This worksheet facilitates learning by requiring students to apply accounting principles to recognize property tax-related transactions properly.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Tesla State University is a public university. Assume deferred revenues as of July 1, 2022 are in the amount of $3,500,000. Record appropriate transactions for the year ended June 30, 2023. Properly classify the revenue transactions in your answers (operating revenues, nonoperating revenues, etc.): 1. Deferred revenues were earned prior to December 2022. 2. During the fiscal year ended June 30, 2023, student tuition and fees were assessed in the amount of $68,000,000. OF that amount, $52,000,000 was collected in cash. Also, of that amount, $2,400,000 pertained to that portion of the 2023 summer session that took place after June 30, 2023. 3. Student scholarships amounted to $2,500,000. No services were required of the students. 4. Student assistantships and work-study stipends amounted to $2,000,000. 5. Auxiliary enterprise revenues amounted to $10,500,000. 3. The state appropriation for operations was received in the amount of $43,000,000. Pell Grants in the amount of $ 18,000,000…arrow_forwardDawson City has a December 31 fiscal year end. The City levies property taxes of $5,000,000 on February 1, 2022 and expects 2% to be uncollectible. The City has two due dates for collection, 1/2 on October 31, 2022 and 1/2 on April 30, 2023. Record the requested journal entries: 1. Record the levy on February 1, 2022, assuming the City records the entire levy as unavailable revenue. 2. Record the collection of property taxes of $2,410,000 on October 31, 2022. 3. Record any necessary adjusting journal entry at December 31, 2022. 4. Record any necessary journal entry to recognize revenue associated with the 2/1/2022 levy in 2023. Repeat this process and record all four journal entries if the entire levy had been treated as revenue at the time of the levy.arrow_forwardShort-term borrowing and investing transactions A local government operates on a calendar-year basis. The following transactions and events occurred during calendar year 2021. 1. On February 1, 2021, borrowed $800,000 on tax anticipation notes (TANS). The TANS will be repaid with 0.8 percent interest on January 31, 2022. 2. Interest on the TANS was accrued through December 31, 2021. 3. Invested $200,000 in a certificate of deposit (CD) on April 1, 2021. The CD, which pays interest of 0.6 percent, will mature on September 30, 2021. 4. The CD matured on September 30, 2021. Prepare the appropriate journal entries. Round all amounts to the nearest dollar. Enter 0 or leave the field blank if no entry is required. If an entry affects more than one debit or credit account, enter the accounts in alphabetic order. Account Debit Credit To record amount borrowed. To record interest on TANS. To record investment in CD. To record redemption of CD. > > > > > >arrow_forward

- Expenditure accruals A state whose fiscal year ends June 30, 2022, had the following transactions and events. For each item, compute how much total expenditures the state will report in the General Fund Statement of revenues, expenditures, and changes in fund balance for the year ended June 30, 2022. 1. During the year, the state paid salaries of $3,780,000. Its employees also earned $157,500 during the period June 23 to June 30, but the payroll for that period will be paid on July 12. $0 2. The state permits its employees to accumulate up to 30 days of vacation leave. The employees are entitled to be paid on termination or retirement for any unused vacation days. At the beginning of the fiscal year, the state's liability for unused vacation pay was $756,000. By the end of the fiscal year, the vacation pay liability had increased to $850,500. The latter amount includes $16,800 owed to employees who retired as of June 30, 2022 with unused vacation pay. That amount will be paid on July…arrow_forwardDuring 2019, a county debt service fund receives $5,000,000 from the general fund for budgeted payment of principal and interest on general obligation bonds. The debt service fund makes $4,000,000 in interest and $1,000,000 in principal payments. How is this reported on the debt service fund’s 2019 operating statement? a. Expenditures, $4,000,000; revenues, $5,000,000 b. Expenditures, $4,000,000; other financing sources, $5,000,000 c. Expenditures, $5,000,000; other financing sources, $5,000,000 d. Expenditures, $5,000,000; revenues $5,000,000arrow_forwardat the end of the 2023 fiscal year the general fund had $500 in encumbrances that remained opened into fiscal year 2024. In 2024 the encumbered goods were received at an invoiced cost of $520. How much would be recorded as the 2024 expenditure?arrow_forward

- Godoarrow_forwardProperty Tax Revenue: A city that has a 12/31 fiscal year end has adopted a policy of recognizing property tax revenue consistent with the modified accrual accounting 60-day availability rule under GAAP. Assume every December 31st the government properly defers revenue amounts deemed unavailable. Important dates related to property tax revenue are listed below. 10/1/2019 Fiscal year 2020 property taxes of $800,000 (5% of which are estimated to be uncollectible) are levied (e.g. sent to taxpayers) and are legally enforceable on 10/1/2019 to finance the activities of fiscal year 2020. 1/1/2020 Tax and fiscal year 2020 begins. Cash collections related to property taxes are as follows: 2/15/2020 related to 2019 property taxes $40,000 5/30/2020 related to 2019 property taxes $10,000 11/10/2020 related to 2020 property taxes $590,000 1/30/2021 related to 2020 property taxes…arrow_forwardLl.133.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education