Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

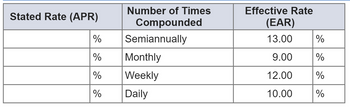

Find the APR, or stated rate, in each of the following cases.

Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Use 365 days in a year.

*From a previous question, i learned that I should use APR=[(1+EAR)1/m-1]*m, but im still not getting the correct answer. I dont think im following the correct steps to solve the equation properly.

Transcribed Image Text:Stated Rate (APR)

%

%

%

%

Number of Times

Compounded

Semiannually

Monthly

Weekly

Daily

Effective Rate

(EAR)

13.00

9.00

12.00

10.00

%

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please All option information and correct answer and don't use Ai solutionarrow_forwardThe number of properties newly listed with a real estate agency in each quarter over the last four years is given below. Assume the time series has seasonality without trend. Quarter 1 2 3 4 Year 1 73 89 123 92 Year 2 81 87 115 95 Year 3 76 91 108 87 Year 4 77 88 120 97 a. Develop the optimization model that finds the estimated regression equation that minimize the sum of squared error. b. Solve for the estimated regression equation. c. Forecast the four quarters of Year 5. *Please solve in excelarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all working!!!!!!arrow_forward

- Answer the given question with a proper explanation and step-by-step solution. Please provide the answer using the math tool otherwise I give the downvote. how long will it take $833.00 to accumulate to $1033.00 at 3% p.a. compounded quarterly? state your answer in years and months (from 0 to 11 ml tbs) the investment will take _____ years and ____ months to maturearrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardPV at 10% at the end of year 2. How do you get 0.82645? Do you use a calculator, if so, how do you work it out or written?arrow_forward

- Find the future value of the following annuities. The first payment in these annuities is made at the end of Year 1, so they are ordinary annuities. (Notes: If you are using a financial calculator, you can enter the known values and then press the appropriate key to find the unknown variable. Then, without clearing the TVM register, you can "override" the variable that changes by simply entering a new value for it and then pressing the key for the unknown variable to obtain the second answer. This procedure can be used in many situations, to see how changes in input variables affect the output variable. Also, note that you can leave values in the TVM register, switch to Begin Mode, press FV, and find the FV of the annuity due.) Do not round intermediate calculations. Round your answers to the nearest cent. $600 per year for 10 years at 10%. $ $300 per year for 5 years at 5%. $ $600 per year for 5 years at 0%. $ Now rework parts a, b, and c assuming that payments are made…arrow_forwarding annuities. The first payment in these annuities is made at the end of Year 1, so they are ordinary annuities. Do not round intermediate calculations. Round your answers to the nearest cent. (Notes: If you are using a financial calculator, you can enter the known values and then press the appropriate key to find the unknown variable. Then, without clearing the TVM register, you can "override" the variable that changes by simply entering new value for it and then pressing the key for the unknown variable to obtain the second answer. This procedure can be used in many situations, to see how changes in input variables affect the output variable. Also, note that you can leave values in the TVM register, switch to Begin Mode, press FV, and find the FV of the annuity due.) a. $600 per year for 10 years at 6%. $ b. $300 per year for 5 years at 3%. $ c. $600 per year for 5 years at 0%. $ d. Now rework parts a, b, and c assuming that payments are made at the beginning of each year; that is,…arrow_forwardPlease complete this practice problem by using the 2 images below. Please write cleary and everything in order. Thank youarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education