FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

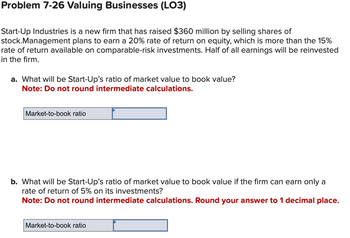

Transcribed Image Text:Problem 7-26 Valuing Businesses (LO3)

Start-Up Industries is a new firm that has raised $360 million by selling shares of

stock.Management plans to earn a 20% rate of return on equity, which is more than the 15%

rate of return available on comparable-risk investments. Half of all earnings will be reinvested

in the firm.

a. What will be Start-Up's ratio of market value to book value?

Note: Do not round intermediate calculations.

Market-to-book ratio

b. What will be Start-Up's ratio of market value to book value if the firm can earn only a

rate of return of 5% on its investments?

Note: Do not round intermediate calculations. Round your answer to 1 decimal place.

Market-to-book ratio

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The Farmer Co. has a payout ratio of 65% and a return on equity (ROE) of 16% (assume that this is expected ROE for the upcoming year). What will be the appropriate price-to-book value (PBV) based on return differential if the expected growth rate in dividends is 5.6% and the required rate of return is 13% ?arrow_forwardQ3. If EBIT in Year 1 is 6.5M (instead of 11.5M, in the attached screenshot), but all other assumptions are the same, what is the internal rate of return to: (i) Senior Debt Investors; (ii) Mezzanine Debt Investors; (iii) Equity Investors?arrow_forwardA company has current, trailing earnings of 3.2 per share. The company plans to plowback 0.41, a share of the earnings, at an ROE of 0.084. If the required rate of return is 0.095, what is the present value of the firm's growth opportunities? O -2.47 -2.60 -2.74 -2.37 -2.85arrow_forward

- S. Bouchard and Company hired you as a consultant to help estimate its cost of common equity. You have obtained the following data: DO $0.85; PO $22.00; and g 6.00% (constant). The CEO thinks, however, that the stock price is temporanly depressed, and that it will soon rise to $34.00. Based on the DCF approach, by how much would the cost of common from retained earnings change if the stock price changes as the CEO expects?.arrow_forwardHolt Enterprises recently paid a dividend, Do, of $4,00. It expects to have a nonconstant growth of 16% for 2 years followed by a consent rate of 8% thereafter. The firm's required return is 20%. I know this answer was $48.44. I need help with the last part below. What is the firm's intrinsic value today, P0? Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardAn insurance company’s projected loss ratio is 79.53 percent, and its loss adjustment expense ratio is 7.51 percent. It estimates that commission payments and dividends to policyholders will add another 13.96 percent. What is the minimum yield on investments required in order to maintain a positive operating ratio? (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16))arrow_forward

- Tinsley, Incorporated, wishes to maintain a growth rate of 16.25 percent per year and a debt-equity ratio of .95. The profit margin is 4.7 percent, and total asset turnover is constant at 1.07. a. What is the dividend payout ratio? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. What is the maximum sustainable growth rate for this company? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. a. Dividend payout ratio b. Sustainable growth rate % %arrow_forwardPlease solve complete in one hourarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education