FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

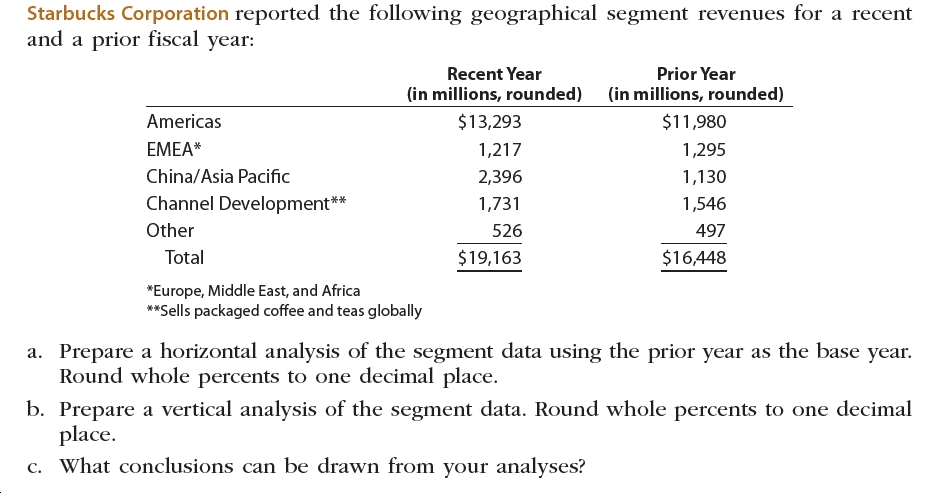

Transcribed Image Text:Starbucks Corporation reported the following geographical segment revenues for a recent

and a prior fiscal year:

Recent Year

Prior Year

(in millions, rounded)

(in millions, rounded)

Americas

$13,293

$11,980

EMEA*

1,217

1,295

China/Asia Pacific

2,396

1,130

Channel Development**

1,731

1,546

Other

526

497

$19,163

$16448

Total

*Europe, Middle East, and Africa

**Sells packaged coffee and teas globally

a. Prepare a horizontal analysis of the segment data using the prior year as the base year.

Round whole percents to one decimal place.

b. Prepare a vertical analysis of the segment data. Round whole percents to one decimal

place.

c. What conclusions can be drawn from your analyses?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Similar questions

- The following revenue data were taken from the December 31, 2017, Coca-Cola annual report (10-K): 2017 (in millions) Europe,Middle East,Africa LatinAmerica NorthAmerica AsiaPacific BottleInvestments Outside sales $7,332 $3,956 $8,651 $4,767 $10,524 Intersegment sales 42 73 1,986 409 81 Total sales $7,374 $4,029 $10,637 $5,176 $10,605 2016 (in millions) Europe,Middle East,Africa LatinAmerica NorthAmerica AsiaPacific BottleInvestments Outside sales $7,014 $3,746 $6,437 $4,788 $19,751 Intersegment sales 264 73 3,773 506 134 Total sales $7,278 $3,819 $10,210 $5,294 $19,885 For each segment and each year, calculate intersegment sales (another name for transfer sales) as a percentage of total sales. Round your answers to one decimal place. Intersegment Sales as a % of Total Sales Europe,Middle East,Africa LatinAmerica NorthAmerica AsiaPacific BottleInvestments 2017 ? ? ? ? ?…arrow_forwardKey figures for Samsung follow (in $ millions). Cash and equivalents Accounts receivable, net Inventories Retained earnings $ 23,069 Cost of sales 30,144 Revenues 22,966 Total assets 218,440 $ 126,336 197, 691 302,511 Required: 1. Compute common-size percents for Samsung using the data given. 2. What is Samsung's gross margin ratio on sales? 3. Does Samsung's gross margin ratio outperform or underperform the industry average of 25%?arrow_forwardVertical Analysis Income statement information for Einsworth Corporation follows: Sales Cost of goods sold Gross profit $298,000 104,300 193,700 Prepare a vertical analysis of the income statement for Einsworth Corporation. If required, round percentage answers to the nearest whole number. Einsworth Corporation Vertical Analysis of the Income Statement Amount Percentage Sales $298,000 Cost of goods sold 104,300 Gross profit $193,700 % %arrow_forward

- Times-interest-earned (TIE) ratio The times-interest-earned (TIE) ratio shows how well a firm can cover its interest payments with operating income. Compare the income statements of Black Sheep Broadcasting Company and Purple Panda Importers and calculate the TIE ratio for each firm. Black Sheep Broadcasting Company Income Statement For the Year Ended on December 31 (Millions of dollars) Net Sales 1400 Variable costs 560 Fixed costs 490 Total Operating Costs $1,050.00 Operating Income (or EBIT) 350 Less interest 60 Earnings before Taxes (EBT) 290 Less taxes (40%) 116 Net Income 174 Times Interest Earned (TIE) _________? Purple Panda Importers Income Statement For the Year Ended on December 31 (Millions of dollars) Net Sales $1,700.00 Variable costs 425 Fixed costs 765 Total Operating Costs $1,190.00 Operating Income (or EBIT) 510 Less interest 100 Earnings before Taxes (EBT) 410 Less taxes (40%) 164 Net…arrow_forwardForecast Income Statement and Balance Sheet Following are the income statement and balance sheet for Medtronic PLC. Note: Complete the entire question using the following Excel template: Excel Template. Then enter the answers into the provided spaces below with two decimal places. Medtronic PLC Consolidated Statement of Income $ millions, For Fiscal Year Ended April 26, 2019 Net sales $30,557 Costs and expenses Cost of products sold 9,155 Research and development expense 979 Selling, general, and administrative expense 10,418 Amortization of intangible assets 1,764 Restructuring charges, net 83 Certain litigation charges, net 166 Other operating expense, net 258 Operating profit 7,734 Other nonoperating income, net (157) Interest expense 1,444 Income before income taxes 6,447 Income tax provision 547 Net income 5,900 Net income loss attributable to noncontrolling interests (19) Net income attributable to Medtronic $5,881…arrow_forwardCochran corporation, Inc. has the following income statement: Cochran corporation, Inc. Income statement For the year ended December 31, 2021 net sales $240 Cost of goods sold $150 gross profit $90 Operating expenses $65 Net income $25 Using vertical analysis, what percentage is assigned to operating expenses? a. 27,1% b. 43.3% c. 72.2% d. 260.0%arrow_forward

- Payton Company has the following segment revenues for the two most recent fiscal years. Segment China Canada Other countries Total revenues Segment Prepare a vertical analysis of the segment data. Calculate the percentage to four decimal places, then round your answer to one decimal place. China Canada Other countries Current Year (in millions) $745 339 211 $1,295 Total revenues Payton Company Vertical Analysis Current Year Amount (in millions) $745 339 211 $1,295 Current Year Percent % Prior Year (in millions) $660 244 166 $1,070 % Prior Year Amount (in millions) $660 244 166 $1,070 Prior Year Percent % %arrow_forwardVertical Analysis Income statement information for Ivanoff Corporation follows: Sales $472,000 Cost of goods sold 146,320 Gross profit 325,680 Prepare a vertical analysis of the income statement for Ivanoff Corporation. If required, round percentage answers to the nearest whole number. Ivanoff CorporationVertical Analysis of the Income Statement Amount Percentage Sales $472,000 fill in the blank 1% Cost of goods sold 146,320 fill in the blank 2% Gross profit $325,680 fill in the blank 3%arrow_forwardPlease help mearrow_forward

- Segment Contribution Margin Analysis The operating revenues of the three largest business segments for Time Warner, Inc., for a recent year follow. Each segment includes a number of businesses, examples of which are indicated in parentheses.arrow_forward(Question 3) Finder Health Corp is one of the biggest companies in the United States with the market capital $69.2 billion. It also operated in Singapore and United Kingdom. Below are the details of the transactions for Finder Health Corp throughout the year: i. The total sales produced for each countries is 900,000 units. United States produce 500 000 units with USD25 per unit, 200000 units is from Singapore at SGD18 and the remaining balance is from United Kingdom at GBP30 per unit. ii. In order to reduce the cost of production, Finder Health Corp import the cost of material which imported from United Kingdom is 400000 unit at GBP15 per unit. The balance was incurred in Singapore where the cost of material is SGD15 per unit. iii. Fixed costs is USD 950000 and variable operating expenses represent approximately 10 percent of each from United States and only United Kingdom which out of their sales. iv. Interest expense is estimated at SGD 75000 on Singapore loans only. v. The exchange…arrow_forwardPayton Company has the following segment revenues for the two most recent fiscal years. Segment Current Year (in millions) Prior Year (in millions) China $770 $650 Canada 326 240 Other countries 212 168 Total revenues $1,308 $1,058 Prepare a vertical analysis of the segment data. Calculate the percentage to four decimal places, then round your answer to one decimal place. Payton Company Vertical Analysis Current Year Prior Year Current Year Percent Prior Year Segment Amount Amount Percent (in millions) (in millions) China $770 $650 % Canada 326 240 Other countries 212 168 Total revenues $1,308 $1,058 Previous Nextarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education