FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

conduct horizontal and vertical analyses for the

- Use basic financial analysis to examine any horizontal changes in Starbucks’ accounts receivable balances over time.

- Use basic financial analysis to examine any vertical changes in Starbucks’ accounts receivable balances over time.

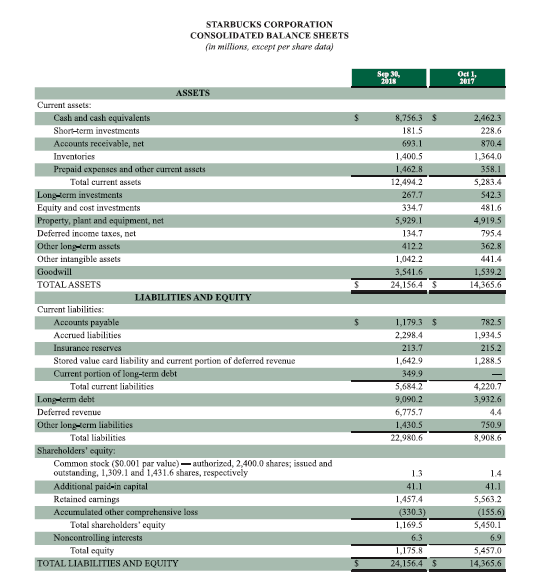

Transcribed Image Text:STARBUCKS CORPORATION

CONSOLIDATED BALANCE SHEETS

(in millions, except per share data)

Sep 30,

2018

Oct 1,

2017

ASSETS

Current assets

Cash and cash equivalents

8,756.3 $

2,462.3

181.5

Short-term investments

228.6

Accounts receivable, net

693.1

870.4

Inventories

1,400.5

1,364.0

Prepaid expenses and other current assets

1,462.8

358.1

Total current assets

12,494.2

5,283.4

Longterm investments

Equity and cost investments

Property, plant and equipment, net

Deferred income taxes, net

267.7

542.3

334.7

481.6

5,929.1

4,919.5

795.4

134.7

412.2

362.8

Other longerm asscts

Other intangible assets

Goodwill

TOTAL ASSETS

1,042.2

441.4

1.539.2

3,541.6

24.156.4

14,365.6

LIABILITIES AND EQUITY

Current liabilities

1,179.3 S

Accounts payable

Accrued liabilities

782.5

2,298.4

1,934.5

Insurance reserves

213.7

215.2

Stored value card liability and current portion of deferred revenue

Current portion of long-term debt

Total current liabilitics

1,642.9

1,288.5

349.9

4,220.7

5,684.2

Long-term debt

Deferred revenue

9,090.2

3,932.6

6,775.7

4.4

Other longtem liabilities

1,430.5

750.9

Total liabilities

22,980.6

8,908.6

Shareholders' equity:

Common stock (S0.001 par value)-authorized, 2,400.0 shares; issued and

outstanding, 1,309.1 and 1,431.6 shares, respectively

13

14

Additional paid-in capital

Retained carmings

41.1

41.1

5,563.2

1,457.4

Accumulated other comprehensive loss

Total shareholders' equity

(330.3)

1,69.5

(155.6)

S,450.1

Noncontrolling interests

Total equity

6.3

6.9

1,175.8

5,457.0

24,156.4

TOTAL LIABILITIES AND EQUITY

14,365.6

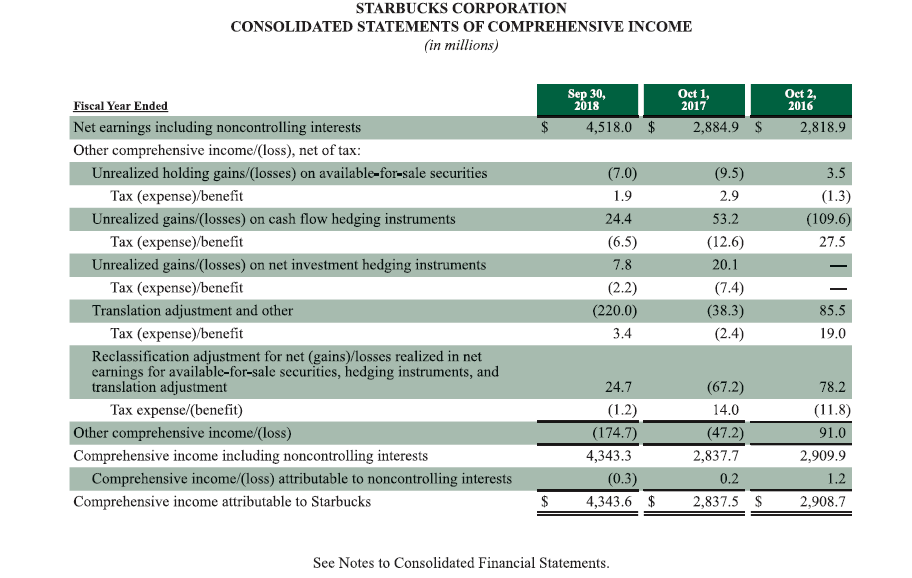

Transcribed Image Text:STARBUCKS CORPORATION

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

in millions

Sep 30,

2018

Oct 1,

2017

Oct 2,

2016

Fiscal Year Ended

Net earnings including noncontrolling interests

$

2,884.9 $

2,818.9

4,518.0

Other comprehensive income/(loss), net of tax:

Unrealized holding gains/(losses) on available-for-sale securities

(7.0)

(9.5)

3.5

Tax (expense)/benefit

1.9

2.9

(1.3)

(109.6)

Unrealized gains/(losses) on cash flow hedging instruments

24.4

53.2

Таx (еxpense)benefit

(6.5)

(12.6)

27.5

Unrealized gains/(losses) on net investment hedging instruments

7.8

20.1

Таx (еxpense)benefit

(2.2)

(7.4)

Translation adjustment and other

(220.0)

(38.3)

85.5

Таx (еxpense) benefit

Reclassification adjustment for net (gains)/losses realized in net

earnings for available-for-sale securities, hedging instruments, and

translation adjustment

(2.4)

3.4

19.0

24.7

(67.2)

78.2

Tax expense/(benefit)

(1.2)

14,0

(11.8)

91.0

Other comprehensive income/(loss)

(174.7)

(47.2)

Comprehensive income including noncontrolling interests

4,343.3

2,837.7

2,909.9

(0.3)

Comprehensive income/(loss) attributable to noncontrolling interests

0.2

1.2

Comprehensive income attributable to Starbucks

4,343.6 $

2,837.5 $

2,908.7

See Notes to Consolidated Financial Statements

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The accounting records and bank statement of Orison Supply Store provide the following information at the end of April. The closing 'Cash' account balance was $28,560, and the bank statement shows a closing balance of $32,000. On reviewing the bank statement it is found an account customer has deposited $2,000 into the bank account for a March sale and the monthly insurance premium of $4,500 was automatically charged to the account. Interest of $5,10 was paid by the bank and a bank fee of $50 was charged to the account. A payment of $1,500 to a supplier has been recorded twice in the accounts. After the ,calculation of the "ending reconciled cash balance", what is the balance of the 'cash' account?arrow_forwardSimplifying the ABC System: TDABC Golding Bank provided the following data about its resources and activities for its checking account process: Time per Unit Traditional Interest-Bearing Resources Activities Driver of Activity Account Account Supervision $70,000 Processing accounts No. of accounts 0.20 hr. 2,000 1,000 Phone and supplies 90,000 Issuing statements No. of statements 0.10 hr. 60,000 10,000 Salaries 275,000 Processing transactions No. of transactions 0.05 hr 160,000 120,000 Computer 25,000 Answering customer inquiries No. of inquiries 0.15 hr. 1,500 1,500 Total $460,000 At practical capacity, Golding uses 25,000 check processing hours. Required: 1. Calculate the capacity cost rate for the checking account process. Round your answers to the nearest cent. 18.4 V per hour Calculate the activity rates for the four activities. Round your answers to the nearest cent. Processing accounts 3.68 V per account Issuing statements 1.84 V per statement Processing transactions 0.92 V per…arrow_forwardA paragraph stating your evaluation of the company’s performance and financial status for the quarter ending March 30, 2022. In your evaluation, state whether: o the business is profitable?o it is able to pay its current obligations/liabilities?o its assets are financed more by debts or equity?o its retained earnings increased or decreased during the quarter and why? You may state any other insights you have on the company’s financial statements. Justify your evaluation and support your discussion with relevant calculations or ratios.arrow_forward

- Best Exports has noticed their current year net income is only $60,000. In order to get a loan from their bank to assist the business they will need to provide a statement of cash flows. In reviewing the statement of cash flows, you notice a large increase ($80,000) in accounts receivable due to two of your largest customers being behind in payments. Since the bank looks at the operating activities, this increase will create concern. You make a suggestion to reclassify the accounts receivables to long-term, thus removing them from current assets will increase the net cash from operations. Under what circumstances would this reclassification be considered ethical or unethical? Support your selection by finding an article which explains your choice.arrow_forwardBelow are several amounts reported at the end of the year. Currency located at the company Supplies Short-term investments that mature within three months Accounts receivable Balance in savings account Checks received from customers but not yet deposited Prepaid rent Coins located at the company Equipment Balance in checking account Required: Calculate the amount of cash to report in the balance sheet. $ 925 2,700 1,825 3,000 8,000 525 1,325 120 8,900 5,700arrow_forwardBelow is a scrambled list of accounts of Jubli Berhad, a technology company (in RM mil). Construct the firm's income statement and balance sheet for year ended 31st December 2022. RM (in mil) Accounts payable Accounts receivable Accumulated depreciation Cash Cost of goods sold Common stock Depreciation expense Gross fixed assets income taxes Interest expense Long-term debt Marketable securities Prepaid expenses inventories Retained earnings Sales Selling, marketing & administrative expenses Short-term notes 4,400 2,500 4,200 3,300 17,000 13,800 1,500 24,500 15 1,000 10,000 12,400 3,200 1,500 8,000 30,000 10,000 7,000arrow_forward

- Please help me with all answers I will give upvotearrow_forwardPrepare the journal entries, with appropriate journal entry descriptions, for 2020, including any required year-end adjusting entries.The company prepares annual adjusting entries.arrow_forward"Marquis Smith started IT Consulting Services Incorporated on January 1, Year 1. The company experienced the following events during its first year of operation 1 On June 1 Year 1, the company borrowed $21.600 cash from the bank. The note had a one-year term and 6% annual interest rate 2. On December 31. Year 1, the company adjusted the accounting records to recognize accrued interest expense on the bank note Required: Use a horizontal financial statements model to show how each event affects the balance sheet, income statement, and statement of cash flows More specifically, record the amounts of the events into the model. Also, in the Statement of Cash Flows column, classify the cash flows as operating activities (OA), investing activities (IA), or financing activities (FA) Note: Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed. Event Number Assets Cash 21 600 2 Total CNet change in cash 01 21.600 Notes Payable 21,600…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education