FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

How can I calculate using a financial indicator, which of the companies has the greatest possibility of obtaining more money borrowed from a bank?

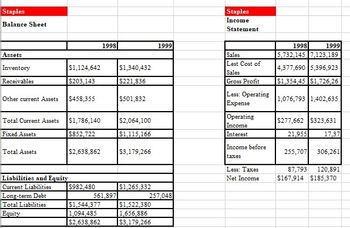

Transcribed Image Text:Staples

Balance Sheet

Assets

Inventory

Receivables

Other current Assets $458,355

$1,124,642

$203,143

Total Current Assets $1,786,140

Fixed Assets

$852,722

Total Assets

Liabilities and Equity

Current Liabilities

Long-term Debt

Total Liabilities

Equity

$2,638,862

$982,480

1998

561,897

$1,544,377

1,094,485

$2,638,862

$1,340,432

$221,836

$501,832

$2,064,100

|$1,115,166

$3,179,266

$1,265,332

$1,522,380

1,656,886

$3,179,266

1999

257,048

Staples

Income

Statement

Sales

Lest Cost of

Sales

Gross Profit

Less: Operating

Expense

Operating

Income

Interest

Income before

taxes

Less: Taxes

Net Income

1998

1999

|5,732,145 | 7,123,189

4,377,690 5,396,923

||$1,354,45|$1,726,26

1,076,793 1,402,635

$277,662 $323,631

21,955 17,37

255,707 306,261

87,793

120,891

$167,914 $185,370

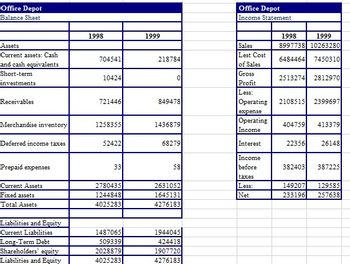

Transcribed Image Text:Office Depot

Balance Sheet

Assets

Current assets: Cash

and cash equivalents

Short-term

investments

Receivables

Merchandise inventory

Deferred income taxes

Prepaid expenses

Current Assets

Fixed assets

Total Assets

Liabilities and Equity

Current Liabilities

Long-Term Debt

Shareholders' equity

Liabilities and Equity

1998

704541

10424

721446

1258355

52422

33

2780435

1244848

4025283

1487065

509339

2028879

4025283

1999

218784

0

849478

1436879

68279

58

2631052

1645131

4276183

1944045

424418

1907720

4276183

Office Depot

Income Statement

Sales

Lest Cost

of Sales

Gross

Profit

Less:

Operating

expense

Operating

Income

Interest

Income

before

taxes

Less:

Net

1998

1999

8997738 10263280

6484464 7450310

2513274 2812970

2108515 2399697

404759

22356

413379

26148

382403 387225

149207

129585

233196 257638

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

I don´t undertand why Office Depot has the greatest possibility if the Debt ratio is higher which means that the company has a higher indebtedness?? Sorry is my first course =(

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

I don´t undertand why Office Depot has the greatest possibility if the Debt ratio is higher which means that the company has a higher indebtedness?? Sorry is my first course =(

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In managing credit risk for banks what are the two main concerns that banks have when lending money? Name them, and explain what these are, then give an overview of the tools banks use to mitigate credit risk.arrow_forwardExplain commercial banks’ brokerage and intermediation functions. Clearly detail how these functions help overcome the information costs, liquidity risk and price risk arising from financial investments.arrow_forwardwhat are some of the businesses that used credit card/s as their financial leverage?arrow_forward

- Describe how a bank makes a profit with its securities trading account. What are the risks?arrow_forwardis a financial product that allows an individual to lend their money to a bank A and be paid an interest rate for doing so.arrow_forward5. How will you treat Bank Overdraft in a Cash Flow Statement? (A) Cash Flow from Operating Activities' (B) Cash Flow from Investing Activities {C) Cash Equivalent (D) Cash Flow from Financing Activities.arrow_forward

- b) Why is the risk-adjusted return on capital (RAROC) an important tool in credit risk management for commercial banks?arrow_forwardWhich of the following would not represent a financing activity? a. Borrowing money from a bank to finance the purchase of new equipment. b. An investment of financial capital by the owners. c. Paying dividends to shareholders. d. Collecting cash from customers. Xarrow_forwardWhich statement best describes the role of a credit agency? OIt tracks the use of credit for lenders. It predicts future earning potential for lenders. OIt teaches how to make smart financial decisions. OIt shows how saving money makes financial sense.arrow_forward

- If a company is worried about having enough cash to pay interest to their bondholders, rent to their landlords and wages to their employees. they are having:a. Solvency issuesb. Liquidity issuesc. Duration matching issuesarrow_forwardA bank that grants loans to firms in a many different lines of business: will increase its information cost and decrease its credit risk will increase both its information cost and its credit risk will decrease its information cost and decerase its credit risk will decrease its information costs and increase its credit riskarrow_forwardwhat are the methods to maximize the use of credit card/s as financial leverage in your business?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education