FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Stancil Dry Cleaners has determined the following about its costs: Total variable expenses are$42,000,total fixed expenses are $24,000, and the sales revenue needed to break even is $48,000. Determine the company's current 1) sales revenue and 2) operating income.

(Hint: First, find the contribution margin ratio; then prepare the contribution margin income statement.)

Use the contribution margin income statement and the shortcut contribution margin approaches to determine Stancil's current (1) sales revenue and (2) operating income.

Begin by computing the contribution margin ratio. (Enter the result as a5 whole number.)

|

The contribution margin ratio is

|

50

|

%.

|

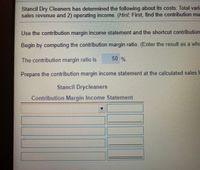

Prepare the contribution margin income statement at the calculated sales level.

NOTE: the other picture is to show the options.

Transcribed Image Text:Stancil Dry Cleaners has determined the following about its costs: Total variable expenses are

sales revenue and 2) operating income. (Hint: First, find the contribution margin ratio; then pre

Use the contribution margin income statement and the shortcut contribution margin approach

Begin by computing the contribution margin ratio. (Enter the result as a whole number.)

50 %.

The contribution margin ratio is

Prepare the contribution margin income statement at the calculated sales level.

Stancil Drycleaners

Contribution Margin Income Statement

Contribution margin

Less: Fixed expenses

Less: Variable expenses

Operating income (loss)

Sales revenue

Choose from any list or enter any number in the input fields and then click Check An:

Transcribed Image Text:Stancil Dry Cleaners has determined the following about its costs: Total varia

sales revenue and 2) operating income. (Hint: First, find the contribution ma

Use the contribution margin income statement and the shortcut contribution

Begin by computing the contribution margin ratio. (Enter the result as a whc

50 %.

The contribution margin ratio is

Prepare the contribution margin income statement at the calculated sales I

Stancil Drycleaners

Contribution Margin Income Statement

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help me with all I will give upvotearrow_forwardFill in the missing amounts in each of the eight case situations below. Each case is independent of the others. (Hint: One way to find the missing amounts would be to prepare a contribution format income statement for each case, enter the known data, and then compute the missing items.)arrow_forwardPlease help fill in the rest of the table on based on Cost-Volume-Profit relationshiparrow_forward

- Fill in the missing amounts in each of the eight case situations below. Each case Is Independent of the others. (Hint: One way to find the missing amounts would be to prepare a contribution format Income statement for each case, enter the known data, and then compute the missing items.) Required: a. Assume that only one product is being sold in each of the following four case situations: Unit sold Sales Variable expenses Fixed expenses Operating income (loss) Contribution margin per unit Sales Variable expenses Fixed expenses $ Operating income (loss) Average contribution margin (percentage) Case #1 20,400 244,800 163,200 68,000 $ $ 136,000 $ 10 Case #2 $ Case #1 536,000 43,520 10.880 $ 8,800 20% 10 $ 69 Case #3 Case #2 13,600 b. Assume that more than one product is being sold in each of the following four case situations: (Enter "Contribution margin ratio" in percent. Round your final answers to the nearest whole dollar amount.) 436.000 283.400 109.000 95,200 16,320 13 $ S CA Case #4…arrow_forwardFill in the missing amounts in each of the eight case situations below. Each case is independent of the others. (Hint: One way to find the missing amounts would be to prepare a contribution format income statement for each case, enter the known data, and then compute the missing items.) Required: a. Assume that only one product is being sold in each of the following four case situations: Unit sold Sales Variable expenses Fixed expenses Operating income (loss) Contribution margin per unit Sales Variable expenses Fixed expenses $ Operating income (loss) Average contribution margin (percentage) Case #1 20,100 241,200 $ 160,800 67,000 $ Case #2 S $ $ Case #1 134,000 42,880 10,720 S 10 S 8,700 20% b. Assume that more than one product is being sold in each of the following four case situations. (Enter "Contribution margin ratio" in percent. Round your final answers to the nearest whole dollar amount.) 534,000 $ Case #3 Case #2 13,400 434,000 282,100 108,500 93,800 Case #4 8,040 S 402,000…arrow_forwardFill in the missing amounts in each of the eight case situations below. Each case is independent of the others. (Hint: One way to find the missing amounts would be to prepare a contribution format income statement for each case, enter the known data, and then compute the missing items.) Required: a. Assume that only one product is being sold in each of the following four case situations: Unit sold Sales Variable expenses Fixed expenses Operating income (loss) Contribution margin per unit Sales Variable expenses Fixed expenses $ Operating income (loss) Average contribution margin (percentage) Case #1 15,600 187,200 124,800 52,000 $ $ $ 104,000 $ $ Case #2 Case #1 33,280 8,320 $ 10 $ 7,200 20% Case #3 Case #2 504,000 $ 404,000 262,600 101,000 b. Assume that more than one product is being sold in each of the following four case situations: (Enter "Contribution margin ratio" in percent. Round your final answers to the nearest whole dollar amount.) 10,400 72,800 $ $ Case #4 104,000 12,480 $…arrow_forward

- How to calculate profitability analysis?arrow_forwardAPPLY THE CONCEPTS: Target income (sales revenue) Another useful method for figuring out the type of performance your company will need to reach a target income is by using sales revenue. Rather than using the number of units, this method uses total sales revenue. In companies for which the total set of goods produced and sold is more varied, this would be the preferred method, as opposed to a business in which only one product is sold. Assume a company has pricing and cost information as follows: Price and Cost Information Amount Selling Price per Unit $30 Variable Cost per Unit $15 Total Fixed Cost $15,000 For the upcoming period, the company wishes to generate operating income of $40,000. Given the cost and pricing structure for the company's product, how much sales revenue must it generate to attain its target income? Step 1: Calculate the contribution margin ratio: The contribution margin ratio is the contribution margin in proportion to the selling price on a per-unit basis.…arrow_forwardContribution income statement Top Disc manufactures flying disks. The following information is available for the year, the company's first year in business when it produced 325,000 units. Revenue of $812,500 was generated by the sale of 325,000 flying disks. Production Direct material Direct labor Manufacturing overhead Selling and administrative Variable Cost Fixed Cost $150,000 100,000 75,000 $112,500 90,000 100,000arrow_forward

- What is a good response to this classmates post? For this week's discussion, I will answer: What are the purposes of each margin, and what information do they convey? Contribution margin uses the CPV calculation with C=unit margin, P =unit revenue, and V=unit variable cost. The formula is C=P-V. The contribution margin shows the money each product/unit sold makes after removing the unit variable cost. This can be displayed grossly or per unit (Team, 2024). This margin shows what kind of profit and revenue a particular product can generate after covering the fixed costs. Gross margin is calculated by gross margin = revenue-product cost. Subtracting the direct costs (labor and materials) from the company's revenue will allow the company to see what its gross profit is compared to its revenues as a percentage. The main difference is how the costs are classified by function (product vs. period).arrow_forwardProblem 3-17A (Algo) Determining the break-even point and preparing a contribution margin income statement LO 3-1 Ritchie Manufacturing Company makes a product that it sells for $150 per unit. The company incurs variable manufacturing costs of $76 per unit. Variable selling expenses are $14 per unit, annual fixed manufacturing costs are $352.000, and fixed selling and administrative costs are $266,000 per year. Required Determine the break-even point in units and dollars using each of the following approaches: a. Use the equation method. b. Use the contribution margin per unit approach. c. Use the contribution margin ratio approach. d. Prepare a contribution margin income statement for the break-even sales volume.arrow_forwardTo find the number of units that need to be sold in order to breakeven or generate a target profit, the formula used is A. (fixed expenses + operating income) contribution margin per unit. B. (fixed expenses operating income) + contribution margin ratio. C. (fixed expenses operating income) + contribution margin per unit. D. (fixed expenses + operating income) + contribution margin ratio.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education