FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

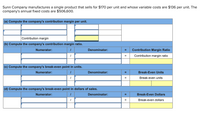

Transcribed Image Text:Sunn Company manufactures a single product that sells for $170 per unit and whose variable costs are $136 per unit. The

company's annual fixed costs are $506,600.

(a) Compute the company's contribution margin per unit.

Contribution margin

(b) Compute the company's contribution margin ratio.

Numerator:

Denominator:

Contribution Margin Ratio

Contribution margin ratio

=

(c) Compute the company's break-even point in units.

Numerator:

Denominator:

Break-Even Units

Break-even units

(d) Compute the company's break-even point in dollars of sales.

Numerator:

Denominator:

Break-Even Dollars

%3D

Break-even dollars

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company has total sales of $1,000,000, variable costs of $500,000, and fixed costs of $200,000. What is the contribution margin ratio?arrow_forwardThe company has a desired net income of $53,991 per service outlet. What is the dollar amount of each type of service that must be performed by each service outlet to meet its target net income per outlet? (Use Weighted-Average Contribution Margin Ratio rounded to 2 decimal places eg. 0.25 and round final answers to O decimal places, eg. 2,510.) Sales Dollars Needed Per Service Outlet Oil changes Brake repair $arrow_forwardDrake Company produces a single product. Last year's income statement is as follows: Sales (25,000 units) $1,532,500 Less: Variable costs 1,027,500 Contribution margin $505,000 Less: Fixed costs 273,600 Operating income $231,400 Required: 1. Compute the break-even point in units and sales revenue. In your computations, round the contribution margin per unit to the nearest cent and round the contribution margin ratio to four decimal places. Round your final answers to the nearest whole unit or dollar. Break-even units units Break-even dollars $ 2. What was the margin of safety in dollars for Drake Company last year? Round your final answer to the nearest whole dollar. 3. Suppose that Drake Company is considering an investment in new technology that will increase fixed costs by $216,600 per year, but will lower variable costs to 50 percent of sales. Units sold will remain unchanged. Prepare a budgeted income statement assuming Drake makes this…arrow_forward

- Manjiarrow_forwardCampbell Corporation sells products for $31 each that have variable costs of $18 per unit. Campbell's annual fixed cost is $295,100. Required Use the per-unit contribution margin approach to determine the break-even point in units and dollars.arrow_forwardSunn Company manufactures a single product that sells for $215 per unit and whose variable costs are $172 per unit. The company's annual fixed costs are $597,700. (a) Compute the company's contribution margin per unit. Contribution margin (b) Compute the company's contribution margin ratio. Numerator: (c) Compute the company's break-even point in units. 1 1 Numerator: 1 1 Numerator: Denominator: Denominator: (d) Compute the company's break-even point in dollars of sales. 1 1 Denominator: = = II II = Contribution Margin Ratio Contribution margin ratio Break-Even Units Break-even units Break-Even Dollars Break-even dollarsarrow_forward

- Zachia Ltd provides the following data regarding its four product lines: Product Sales mix Weighted average contribution margin per unit (WACMU) Fixed costs Desired profit after tax w Y 60 20 15 $13.7 $71,000 $33,950 The corporate tax rate is 30% Required Calculate the number of units of Product X that must be sold in order to achieve the desired after-tax profit?arrow_forwardXYZ Company's product has a contribution margin per unit of $12 and a variable cost ratio of 80%. What is the selling price of the product? Select one: O a. $37.5. O b. $28.125. O c. $22.5. O d. $120. O e. $60.arrow_forwardSohar Company has a product with a selling price per unit of OMR 200, the unit variable cost is OMR 110, and the total monthly fixed costs are OMR 300,000. How much is Sohar's contribution margin ratio? Select one: O a. 45% O b. None of the answers are correct O c. 150% O d. 55% O e. 182%arrow_forward

- Sunn Company manufactures a single product that sells for $210 per unit and whose variable costs are $168 per unit. The company's annual fixed costs are $575,400. (a) Compute the company's contribution margin per unit. Contribution margin (b) Compute the company's contribution margin ratio. 1 Numerator: (c) Compute the company's break-even point in units. 1 1 Numerator: Denominator: Numerator: Denominator: (d) Compute the company's break-even point in dollars of sales. 1 1 Denominator: II Contribution Margin Ratio Contribution margin ratio Break-Even Units Break-even units 0 Break-Even Dollars Break-even dollars 4arrow_forwardjagdisharrow_forwardCompany XYZ made total contribution margin of $200,000 and a net income of $150,000. The company also made a total gross margin of $210,000. Assume that the variable selling and administrative expenses were $40,000, how much is the fixed manufacturing cost ($)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education