FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

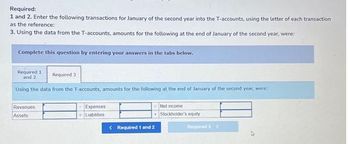

Transcribed Image Text:Required:

1 and 2. Enter the following transactions for January of the second year into the T-accounts, using the letter of each transaction

as the reference:

3. Using the data from the T-accounts, amounts for the following at the end of January of the second year, were:

Complete this question by entering your answers in the tabs below.

Required 1

and 2

Required 3

Using the data from the T-accounts, amounts for the following at the end of January of the second year, were:

Revenues

Assets

Expenses

Liabilities

< Required 1 and 2

Net income

Stockholder's equity

Required 3>

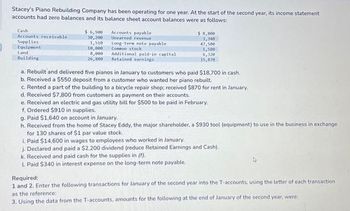

Transcribed Image Text:Stacey's Piano Rebuilding Company has been operating for one year. At the start of the second year, its income statement

accounts had zero balances and its balance sheet account balances were as follows:

Cash

Accounts receivable

Supplies

Equipment

Land

Building

$ 6,900

30,200

1,510

10,000

8,000

26,800

Accounts payable

Unearned revenue

Long-term note payable

Common stock

Additional paid-in capital

Retained earnings

$8,800

3,340

47,500

1,500

6,320

15,870

a. Rebuilt and delivered five pianos in January to customers who paid $18,700 in cash.

b. Received a $550 deposit from a customer who wanted her piano rebuilt.

c. Rented a part of the building to a bicycle repair shop; received $870 for rent in January.

d. Received $7,800 from customers as payment on their accounts.

e. Received an electric and gas utility bill for $500 to be paid in February.

f. Ordered $910 in supplies.

g. Paid $1,640 on account in January.

h. Received from the home of Stacey Eddy, the major shareholder, a $930 tool (equipment) to use in the business in exchange

for 130 shares of $1 par value stock.

i. Paid $14,600 in wages to employees who worked in January.

j. Declared and paid a $2,200 dividend (reduce Retained Earnings and Cash).

k. Received and paid cash for the supplies in (f).

L. Paid $340 in interest expense on the long-term note payable,

Required:

1 and 2. Enter the following transactions for January of the second year into the T-accounts, using the letter of each transaction

as the reference:

3. Using the data from the T-accounts, amounts for the following at the end of January of the second year, were:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On the basis of the following data related to assets due within one year for Simons Co. prepare partial balance sheet in good form at December 31. Show total current assets. Cash $96,000 Notes Receivable 50,000 Accounts Receivable 275,000 Allowance for Doubtful Accounts 40,000 Interest Receivable 1,000arrow_forwardRequired information [The following information applies to the questions displayed below.] Ricky's Piano Rebuilding Company has been operating for one year. On January 1, at the start of its second year, its income statement accounts had zero balances and its balance sheet account balances were as follows: Cash Accounts Receivable Supplies Equipment Land Buildings $ 8,100 Accounts Payable. 38,000 Deferred Revenue (deposits): 2,800 Notes Payable (long-term) 13,000 Common Stock 7,300 Retained Earnings 22,300 $ 11,350 5,000 49,500 16,500 9,150 Following are the January transactions: a. Received a $695 deposit from a customer who wanted her piano rebuilt in February. b. Rented a part of the building to a bicycle repair shop: $325 rent received for January. c. Delivered five rebuilt pianos to customers who paid $15,600 in cash. d. Delivered two rebuilt pianos to customers for $8,000 charged on account. e. Received $5,400 from customers as payment on their accounts. f. Received an electric…arrow_forwardAssume that Dennis Savard Inc. has the following accounts at the end of the current year. 1. Common Stock 2. Discount on Bonds Payable 3. Treasury Stock (at cost) 4. Notes Payable (short-term) 5. Raw Materials 6. Equity Investments (long-term) 7. Unearned Rent Revenue 8. Work in Progress 9. Copyrights 10. Buildings 11. Notes Receivable (short-term) 12. Cash 13. Salaries and Wages Payable 14. Accumulated Depreciation-Buildings 15. Restricted Cash for Plant Expansion 16. Land Held for Future Plant Site 17. Allowance for Doubtful Accounts 18. Retained Earnings 19. Paid-in Capital in Excess of Par-Common Stock 20. Unearned Subscriptions Revenue 21. Receivables-Officers (due in on year) 22. Inventory (finished goods) 23. Accounts Receivable 24. Bonds Payab;e (due in 4 years) Prepare a classified balance sheet in good form. (No monetary amounts are necessary). (For Land, Treasury Stock, Notes Payable, Preferred Stock Investments, Notes Receivable, Receivables-Officers, Inventory, Bonds…arrow_forward

- Renue Spa had the following balances at December 31, Year 2: Cash of $12,000, Accounts Receivable of $81,000, Allowance for Doubtful Accounts of $2,000, and Retained Earnings of $91,000. During Year 3, the following events occurred: 1. $1,900 of accounts receivable were written off as uncollectible. 2. The company unexpectedly collected $130 of receivables that had been written off in a previous accounting period. 3. Services provided on account during Year 3 were $222,000. 4. Cash collections from receivables were $224,037. 5. Uncollectible accounts expense was estimated to be 1 percent of the sales on account for the period. Required: 1. Organize the transaction data in accounts under an accounting equation. 2. Based on the preceding information, compute (after year-end adjustment): (1) Balance of Allowance for Doubtful Accounts at December 31, Year 3. (2) Balance of Accounts Receivable at December 31, Year 3 (3) Net realizable value of Accounts Receivable at December 31, Year 3. 3.…arrow_forwardValero’s energy’s balance sheet showed total current assets of $3000 all of which were required in operations. It’s current liabilities consists of $905 of accounts payable $600 of 6% short term notes payable to the bank and $250 of acute wages and taxes. What was its net operating working capital?arrow_forwardook ht rint rences In its first year of operations, Cloudbox has credit sales of $230,000. Its year-end balance in accounts receivable is $13,000, and the company estimates that $3,000 of its accounts receivable is uncollectible. a. Prepare the year-end adjusting entry to estimate bad debts expense. b. Prepare the current assets section of Cloudbox's classified balance sheet assuming Inventory is $29,500, Cash is $21,500, and Prepaid Rent is $3,750. Note: The company reports Accounts receivable, net on the balance sheet. Complete this question by entering your answers in the tabs below. Required A Required B Prepare the year-end adjusting entry to estimate bad debts expense. View transaction list Journal entry worksheet 1 Record the year-end adjusting entry to estimate bad debts expense. Note: Enter debits before credits. Date December 31 General Journal Bad debts expense 8 Allowance for doubtful accounts Debit Creditarrow_forward

- DO not give answer in imagearrow_forwardAmerican Laser, Inc., reported the following account balances on January 1. Debit Credit Accounts Receivable $ 5,000 Accumulated Depreciation $ 30,000 Additional Paid-in Capital 90,000 Allowance for Doubtful Accounts 2,000 Bonds Payable 0 Buildings 247,000 Cash 10,000 Common Stock, 10,000 shares of $1 par 10,000 Notes Payable (long-term) 10,000 Retained Earnings 120,000 Treasury Stock 0 TOTALS $ 262,000 $ 262,000 The company entered into the following transactions during the year. Jan. 15 Issued 5,000 shares of $1 par common stock for $50,000 cash. Jan. 31 Collected $3,000 from customers on account. Feb. 15 Reacquired 3,000 shares of $1 par common stock into treasury for $33,000 cash. Mar. 15 Reissued 2,000 shares of treasury stock for $24,000 cash. Aug. 15 Reissued 600 shares of treasury stock for $4,600…arrow_forwardThe Miller Company recognized $129,000 of service revenue earned on account during Year 2. There was no beginning balance in the accounts receivable and allowance accounts. During Year 2, Miller collected $85,000 of cash from accounts receivable. The company estimates that it will be unable to collect 3% of its sales on account. The net realizable value of Miller's receivables at the end of Year 2 was: Multiple Choice $47,870. $44.000, $40,130. $41,450.arrow_forward

- Angel Valdez is an owner and manager of Angel V's Inc., which began operations a few years prior. On December 31, AV's shows the following selected accounts and amounts for the fiscal year ended December 31. Account Debit Credit Account Debit Credit Cash $ 25,394 Common stock $ 79,500 Accounts receivable 24,010 Paid-in capital in excess of par-C.S. 485,475 Allowance for doubtful accounts 807 Retained earnings 229,941 Interest receivable 100 Cash Dividends 10,004 Inventory 48,004 Sales 2,297,999 Supplies 10,410 Sales discounts 13,276 Prepaid insurance 3,272 Sales returns & allowances 62,900 Prepaid rent 5,398 Interest revenue 2,203 Notes receivable 39,004 Gain on sale of plant asset 4,226 Investment in stock 25,994 Cost of goods sold 1,266,441 Land 144,994 Depreciation expense 44,720 Buildings 1,394,986 Amortization expense 4,175 Equipment 215,400 Salaries expense 569,992…arrow_forwardGadubhaiarrow_forwardAt the beginning of Year 3 Omega Company had a $75,000 balance in its accounts receivable account and a $10,400 balance in allowance for doubtful accounts. During Year 3 Omega experienced the following events. (1) Earned $256,000 of revenue on account. (2) Collected $248,000 cash from accounts receivable. (3) Wrote off $8,500 of accounts receivable as uncollectible. Omega estimates uncollectible accounts to be 4% of receivables. The December 31, Year 3 ending balance in the allowance for doubtful accounts account (balance after expense recognition) is: Multiple Choice $2,980. $8,500. $2,660. $3,300.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education