FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

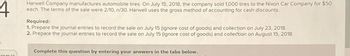

Transcribed Image Text:4

Harwell Company manufactures automobile tires. On July 15, 2018, the company sold 1,000 tires to the Nixon Car Company for $50

each. The terms of the sale were 2/10, n/30. Harwell uses the gross method of accounting for cash discounts.

Required:

1. Prepare the journal entries to record the sale on July 15 (ignore cost of goods) and collection on July 23, 2018.

2. Prepare the journal entries to record the sale on July 15 (ignore cost of goods) and collection on August 15, 2018.

01-19-27

Complete this question by entering your answers in the tabs below.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required: Record the following transactions of Fashion Park in a general journal. Fashion Park must charge 8 percent sales tax on all sales. The company uses the perpetual inventory system. DATE TRANSACTIONS 20X1 April 2 Sold merchandise for cash, $2,500 plus sales tax. The cost of merchandise sold was $1,500. 3 The customer purchasing merchandise for cash on April 2 returned $250 of the merchandise; provided a cash refund to the customer. The cost of returned merchandise was $150. 4 Sold merchandise on credit to Jordan Clark; issued Sales Sslip 908 for $1,050 plus tax, terms n/30. The cost of the merchandise sold was $630. 6 Accepted return of merchandise from Jordan Clark; issued Credit Memorandum 302 for $150 plus tax. The original sale was made on Sales Slip 908 of April 4. The cost of returned merchandise was $90. 30 Received payment on account from Jordan Clark in payment of her purchase of April 4, less the return on April 6. View transaction listarrow_forwardThey sold $50,000 worth of goods on credit, with terms 3/10, n/20, on 2/1/2021. Record this journal entry using both the net and gross methods. Record the journal entry if the customer pays off this account on 2/5/2021. Record the journal entry if the customer pays off this account on 3/1/2021.arrow_forwardEC Ltd. is a merchandising company. The company uses the perpetual method in recording its merchandise. Meanwhile, the treatment of uncollectible receivables is by using the allowance method. Below are transactions that occurred during 2019. Date Transactions Made credit sales of $100,000 to Brian Co. COGS for the product is $40,000. Jan-15 Received a note from Brian Co of S100,000, 3 months, 6% as a replacement of last month's debt that was due. Mar-15 Received notice that the note from Brian Co. cannot be fulfilled in time. EC Ltd estimates that the probability of uncollectible is 100%. Due to this condition, EC Ltd write-off Brian Co.'s note. Jun-15 Receivables from Brian Co. are reinstated, but only an amount of $75,000 is received and the remainder is written-off as uncollectible. Sep-30 Instruction: Journalize the transactions above!arrow_forward

- HOW DO I PREPARE A TRANSACTION CHART? On June 10, Wildhorse Company purchased $9,500 of merchandise on account from Novak Company, FOB shipping point, terms 2/10, n/30. Wildhorse pays the freight costs of $590 on June 11. Damaged goods totaling $350 are returned to Novak for credit on June 12. The fair value of these goods is $75. On June 19, Wildhorse pays Novak Company in full, less the purchase discount. Both companies use a perpetual inventory system.arrow_forwardStickUps Company uses a Sales Journal, a Purchases Journal, a Cash Receipts Journal, a Cash Disbursements Journal, and a General Journal. The following transactions occurred during the month of September 2020: Sept. 3 Purchased merchandise on credit for $6,200 from Pacer Co. 7 Sold merchandise on credit to J. Namal for $1,800, subject to a 2% sales discount if paid by the end of the month. Cost, $1,000. 9 Borrowed $5,500 by giving a note to the bank. 13 The owner, Dale Trent, invested an additional $7,000 cash into the business. 18 Sold merchandise to B. Baird for $460 cash. Cost, $280. 22 Paid Pacer Co. $6,200 for the merchandise purchased on September 3. 27 Received $1,764 from J. Namal in payment of the September 7 purchase. 30 Paid salaries of $3,200. Journalize the September transactions that should be recorded in the Cash Receipts Journal, assuming the perpetual inventory system. (Enter transactions in order) Image attached…arrow_forwardTracy Company, a manufacturer of air conditioners, sold 120 units to Thomas Company on November 17, 2024. The units have a list price of $750 each, but Thomas was given a 20% trade discount. The terms of the sale were 2/10, n/30. Required: Prepare the journal entries to record the sale on November 17 (ignore cost of goods) and collection on November 26, 2024, assuming that the gross method of accounting for cash discounts is used. Prepare the journal entries to record the sale on November 17 (ignore cost of goods) and collection on December 15, 2024, assuming that the gross method of accounting for cash discounts is used.arrow_forward

- Carla Vista Company uses special journals and a general journal. The following transactions occurred during September 2022. Sept. 2 (a) 10 12 21 25 Purchased merchandise on account from D. Downs $820, terms n/30. 27 Sold merchandise to S. Miller for $730 cash. The cost of the merchandise sold was $415. Sold merchandise on account to H. Drew, invoice no. 101, $695, terms n/30. The cost of the merchandise sold was $375. Date Purchased merchandise on account from A. Pagan $555, terms 2/10, n/30. Purchased office equipment on account from R. Cairo $6,400. Sold merchandise on account to G. Holliday, invoice no. 102 for $765, terms 2/10, n/30. The cost of the merchandise sold was $465. Prepare a sales journal and record the transactions for September that should be journalized. (Record entries in the order presented in the problem statement.) 2022 Account Debited CARLA VISTA COMPANY Sales Journal Invoice No. Ref. Accounts Receivable Dr. Sales Revenue Cr. S1 Cost of Goods Sold Dr. Inventory…arrow_forwardPlease do not give image formatarrow_forward! Required information [The following information applies to the questions displayed below.] On July 15, 2024, the Niche Car Company purchased 3,000 tires from the Treadwell Company for $30 each. The terms of the sale were 2/10, n/30. Niche uses a perpetual inventory system and the net method of accounting for purchase discounts. Required: 1. Prepare the journal entries to record the purchase on July 15 and payment on July 23, 2024. 2. Prepare the journal entry for the payment, assuming instead that it was made on August 15, 2024. Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entries to record the purchase on July 15 and payment on July 23, 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. No Date 1 July 15, 2024 Inventory Accounts payable 2 July 23, 2024 Accounts payable Interest expense Cash General Journal Debit 88,200 1,800…arrow_forward

- Hahaarrow_forwardTravis Company purchased merchandise on account from a supplier for $12,300, terms 2/10, net 30. Travis Company paid for the merchandise within the discount period. Under a perpetual inventory system, record the journal entries required for the above transactions. If an amount box does not require an entry, leave it blank. a. b.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education