Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

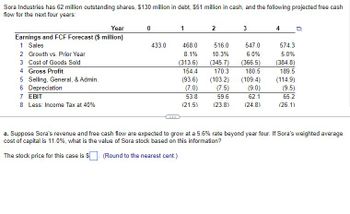

Transcribed Image Text:Sora Industries has 62 million outstanding shares, $130 million in debt, $51 million in cash, and the following projected free cash

flow for the next four years:

Year

Earnings and FCF Forecast ($ million)

1 Sales

2 Growth vs. Prior Year

3 Cost of Goods Sold

4 Gross Profit

5 Selling, General, & Admin.

6 Depreciation

7 EBIT

8 Less: Income Tax at 40%

0

433.0

1

468.0

8.1%

(313.6)

154.4

(93.6)

(7.0)

53.8

(21.5)

2

516.0

10.3%

(345.7)

170.3

(103.2)

(7.5)

59.6

(23.8)

3

547.0

6.0%

(366.5)

180.5

(109.4)

(9.0)

62.1

(24.8)

4

574.3

5.0%

(384.8)

189.5

(114.9)

(9.5)

65.2

(26.1)

a. Suppose Sora's revenue and free cash flow are expected to grow at a 5.6% rate beyond year four. If Sora's weighted average

cost of capital is 11.0%, what is the value of Sora stock based on this information?

The stock price for this case is $. (Round to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Last year Dania Corporation's sales were $525 million. If sales grow at 11.3% per year, how large (in millions) will they be 6 years later? O a. $880.95 million Ob. $998.00 million Oc. $584.33 million Od. $896.68 million Oe. $1,078.00 millionarrow_forwardThe price earnings ratios for 4 public companies are: 5.2, 4.6, 3.4, 4.86. The after-tax capitalization rate is: a. 16.00% b. 18.08% c. 20.19% d. 22.15%arrow_forwardA company reports the following for the prior year: $1.6 million in sales $1 million in total assets $160,000 in net income $800,000 in equity (at the beginning of this prior year) $ 520,000 in current assets $480,000 in fixed assets $48,000 in accounts payable $32,000 in accrued liabilities The company projects that the sales will grow at 30%. Calculate the AFN for this company assuming 80% retention ratio.arrow_forward

- The Indy Company experiences the following annual incomes over the last five years: $60,000, $70,000, $110,000, $150,000, $160,000. A firm like Indy Company commands a 13% discount rate and has a long term growth rate of 3% considering the capitalization of earnings method. Using a non-weighted earnings model, what is the approximate value of the firm (rounded)?arrow_forwardUse the table for the question(s) below. FCF Forecast (S million) Year Sales 1 270 12.5% 27.00 (5.40) Less Increase in NWC (12% of Change in Sales) 3.60 Free Cash Flow 18.00 Growth versus Prior Year EBIT (10% of Sales) Less: Income Tax (20%) 0 240 OA. $46.15 B. $25.64 OC. $12.82 D. $23.07 2 290 7.4% 29.00 5.80 2.40 20.80 • 3 310 6.9% 31.00 6.20 2.40 22.40 4 325.5 5.0% 32.55 6.51 1.86 2418 Banco Industries expect sales to grow at a rapid rate over the next three years, but settle to an industry growth rate of 7% in year 4. The spreadsheet above shows a simplified pro forma for Banco Industries. If Banco industries has a weighted average cost of capital of 11%, $30 million in cash, $60 million in debt, and 18 million shares outstanding, which of the following is the best estimate of Banco's stock price at the start of year 1?arrow_forwardPuckett Products is planning for $3 million in capital expenditures next year. Puckett's target capital structure consists of 60% debt and 40% equity. If net income next year is $2 million and Puckett follows a residual distribution policy with all distributions as dividends, what will be its dividend payout ratio? Round your answer to two decimal places.arrow_forward

- A company reports the following for the prior year: $1.6 million in sales $1 million in total assets $160, 000 in net income $800, 000 in equity (at the beginning of this prior year) $520, 000 in current assets $480, 000 in fixed assets $48, 000 ir accounts payable $32,000 in accrued liabilities The company projects that the sales will grow at 30 % . Calculate the AFN or this company assuming 80% retention ratio. a. $134,425 b. $127,650 c. $109,600 d. $76,950arrow_forwardLast year Rocco Corporation's sales were $700 million. If sales grow at 6.0% per year, how large (in millions) will they be 8 years later? a. $1,148.35 million b. $1,036.00 million c. $1,115.69 million d. $742.00 million e. $1,052.54 millionarrow_forwardEdwards Construction currently has debt outstanding with a market value of $75,000. The company has a WACC of 10 percent. Tax rate is 20%. The company just released its EBIT of $8,750 for the preceding financial year (t = 0). What is the debt-to-value ratio if the company’s growth rate is 7 percent? Group of answer choices 0.23 0.3 0.21 0.7arrow_forward

- Last year Rocco Corporation's sales were $650 million. If sales grow at 6.0% per year, how large (in millions) will they be 8 years later? O a. $977.36 million Ob. $689.00 million O c. $1,066.33 million Od. $962.00 million O e. $1,036.00 millionarrow_forwardces NoNuns Companies has a 21 percent tax rate and has $350 million in assets, currently financed entirely with equity. Equity is worth $37 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below: State Probability of state Expected EBIT in state Recession 0.25 $ 5 million EBIT Average 0.55 $ 10 million Boom 0.20 $ 17 million The firm is considering switching to a 20-percent-debt capital structure, and has determined that it would have to pay an 8 percent yield on perpetual debt in either event. What will be the break-even level of EBIT? Note: Round intermediate calculations. Enter your answer in dollars not millions and round your final answer to the nearest whole dollar amount.arrow_forwardH3. Please show proper step by step calculationarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education