Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

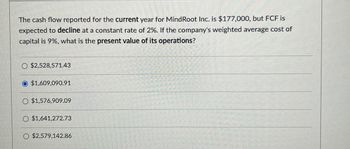

Transcribed Image Text:The cash flow reported for the current year for MindRoot Inc. is $177,000, but FCF is

expected to decline at a constant rate of 2%. If the company's weighted average cost of

capital is 9%, what is the present value of its operations?

$2,528,571.43

$1,609,090.91

O $1,576,909.09

$1,641,272.73

O $2,579,142.86

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Last year Rocco Corporation's sales were $650 million. If sales grow at 6.0% per year, how large (in millions) will they be 8 years later? O a. $977.36 million Ob. $689.00 million O c. $1,066.33 million Od. $962.00 million O e. $1,036.00 millionarrow_forwardNonearrow_forwardKosm Inc. forecasts a positive Free Cash Flow for the coming year, with FCF1 = $10,000,000, and it expects a growth rate of 30% for the next two years. After Year 3, FCF is expected to grow at a constant rate of 4% forever. The Weighted Average Cost of Capital (WACC) is 11%, and the company has $65,000,000 of long-term debt (the remainder is comprised of common equity) and 10.0 million shares of common stock outstanding. What is the firm's estimated intrinsic value per share of common stock?arrow_forward

- Young & Liu Inc.'s free cash flow during the just-ended year (t = o) was $100 million, and FCF is expected to grow at a constant rate of 5% in the future. If the weighted average cost of capital is 15%, what is the firm's value of operations, in millions? a. $998 O b. $1,050 Oc$1,158 Od. $948 Oe. $1,103arrow_forward) Suppose a company’s current free cash flow (i.e. FCF0) is $100 million and is expected to grow at a constant rate of 5 percent. If the company’s overall cost of capital is 15 percent, what is the current value of operations? $ 913 million $1,000 million $1,050 million $1,500 million $2,000 millionarrow_forwardNonearrow_forward

- HCB, Inc.free cash flows for next year (FCF1) are expected to be $5 million. Free cash flows are expected to grow at a rate of 6% forever. It also has the following financial information: Market value of HCB Debt = $70 million Short-term investments = $15 million Book value of equity = $60 million Total Assets = $80 million Shares outstanding = 2.5 million Required return on stock = 11% WACC = 9% Calculate HCB's intrinsic value per share. $30.51 $33.56 $36.91 $40.61 $44.67 - the correct answer Do not use Excel!arrow_forwardKale Inc. forecasts the free cash flows (in millions) shown below. Assume the firm has zero non-operating assets. If the weighted average cost of capital is 11.0% and FCF is expected to grow at a rate of 5.0% after Year 2, then what is the firm’s total corporate value (in millions)? Do not round intermediate calculations. Year 1 2 Free Cash flow -$30 $195 a. $3,413 million b. $2,901 million c. $3,044 million d. $2,743 million e. $2,643 millionarrow_forwardA company is projected to generate revenues of $336 million and $406 million over the next two years. After that, the company is assumed to enter its terminal phase with steady growth. Given the following information, how much is each share worth today? Answer in dollars rounded to one decimal place. Forecasted operating margin: 35.4%. Forecasted tax rate: 22.2%. Forecasted reinvestment rate: 30%. Forecasted steady growth rate of free cash flow: 1.3% per year. Cost of capital: 13.2%. Debt: $40 million. Cash: $35 million. Shares outstanding: 12 million.arrow_forward

- 1. (10 Percent) Ryan Enterprises forecasts the free cash flows (in millions) shown below. Assume the firm has zero non-operating assets. The weighted average cost of capital is 13.0%, and the FCFs are expected to continue growing at a 6.5% rate after Year 3. What is the firm's total corporate value (in millions)? Do not round intermediate calculations. Year FCF 1 -$18 2 $10 3 $35arrow_forwardACME, Inc. forecasts that it will have the free cash flows shown below. The free cash flows are expected to grow by 4% per year after year 3. Year 1 23 FCF (S million) 20 48 54 The weighted average cost of capital is 11%. The firm has $40 million of debt and 10 million shares outstanding. What is a good estimate of ACME's share price? O $55.25 $27.30 $60.70 $38.55arrow_forward55arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education