Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

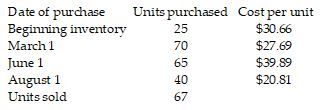

Solve the problem using the information given in the table and the weighted-average inventory method. Round the final answer to the nearest cent - do no round other calculation.

Calculate the cost of goods sold.

| Answer: | ($2,053.55) |

The answer is here but I need to know HOW to get the answer - the chart is attached.

Transcribed Image Text:Date of purchase

Beginning inventory

March 1

June 1

August 1

Units sold

Units purchased

25

70

65

40

67

Cost per unit

$30.66

$27.69

$39.89

$20.81

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please answer true or false. If false, please correct the statement. Numbers 1 to 5.arrow_forwardHi thank you so much for your response, the income statement goes a little more in depth, as part of cost of goods sold it also asks for begginning and ending inventory, goods available for sale, and purchases; all under the cost of goods sold section. Theres also a selling and administrative expenses section that asks for stuff like accounts payable and receivable, buildings and equipment, cash, common stock, notes payable, prepaid insurance, etc. I'll insert an image of what the question looks like. Each of the empty spaces has a dropdown list.arrow_forwardMake any adjustment necessary to inventory Please include all the calculations for my reference. Thanks!arrow_forward

- Please help to pick which optionarrow_forwardPina Furniture Ltd. uses a perpetual inventory system and has a beginning inventory, as at June 1, of 490 bookcases at a cost of $132 each. During June, the company had the following purchases and sales of bookcases: Date June (a) e here to search 6 10 14 16 26 Purchases Units 1,160 1,780 970 Unit cost $134 135 136 Units 950 1.660 Sales Unit price $201 206 hp $10 27°C Mostly cloudy f11 19 ENG insertarrow_forwardplease solve and explain the formula to get net sales and gross revenuearrow_forward

- Katelyn is the Purchasing Manager at Polo Industries, Inc. She asked you to help her determine what the Ending Balance for Inventory and the Cost of Goods Sold total would be using the three (3) valuation methods: (a) LIFO (last in first out), (b) FIFO (first in first out), and Weighted Average. The purchase information is below: Inventory Purchase Saturday, June 6, 2020 Sunday, June 14, 2020 Thursday, June 18, 2020 Tuesday, June 30, 2020 Items Cost per Item 85.10 107 24 87 158 79.50 %24 95.00 93 2. 92.40 445 Katelyn told you that 300 items were sold and 145 remained in inventory. (a) Calculate the valuations using LIFO (2 answers required). Round to the nearest 2 decimal places. HTML Editor B IUA - A I E E 3 E E X x, E E 田。 Vx A v / 回 M 12pt Paragrapharrow_forwardbarrow_forwardplease answer all without copy paste and with all work like explanation , computation, formula with steps need correct and complete answer for better understanding please answer in textarrow_forward

- Attached are the spreadsheet and numbers from problem for numbers to be placedarrow_forwardPlease do not give solution in image format ? And Fast Answering Please ? And please explain proper steps by Step.arrow_forwardTake me to the text a) Fill in the missing numbers in the inventory schedule using the weighted-average cost inventory valuation method. This company uses the perpetual inventory system. Do not enter dollar signs or commas in the input boxes.Round all answers to 2 decimal places. When calculating the unit cost, round to 2 decimal places as well. Inventory Schedule Purchases Sales Balance Transaction Description Quantity Amount Quantity Amount Quantity Amount Opening Balance 0 $ 0 #1 Purchase from AAA Co. 600 $6,600.00 Answer $Answer Answer $Answer #2 Sale to SSS Co. Answer $Answer Answer $Answer 300 $3,300.00 #3 Sale to TTT Co. Answer $Answer 150 $Answer Answer $Answer #4 Purchase from BBB Co. 70 $1,400.00 Answer $Answer Answer $Answer #5 Sale to UUU Co. Answer $Answer 30 $Answer Answer $Answer b) If the FIFO method had been used, what would the value of COGS been for the sale to UUU Co.? COGS = $Answer c) If the specific identification method had…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education