Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:1

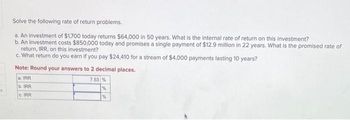

Solve the following rate of return problems.

a. An investment of $1,700 today returns $64,000 in 50 years. What is the internal rate of return on this investment?

b. An investment costs $850,000 today and promises a single payment of $12.9 million in 22 years. What is the promised rate of

return, IRR, on this investment?

c. What return do you earn if you pay $24,410 for a stream of $4,000 payments lasting 10 years?

Note: Round your answers to 2 decimal places.

a. IRR

b. IRR

c. IRR

7.53 %

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are considering investing in a security that will pay you $2,000 in 35 years. a. If the appropriate discount rate is 10 percent, what is the present value of this investment? b. Assume these investments sell for $275 in return for which you receive $2,000 in 35 years. What is the rate of return investors earn on this investment if they buy it for $275?arrow_forward. Evaluate the following statement:Consider two riskless perpetuities: (i) pays $120 every year; (ii) pays $10 every month. If the rates of returns of the two perpetuities are the same, investors must buy perpetuity (ii) because it makes more interest payments.arrow_forwardYour firm is considering an investment that will cost $750,000 today. The investment will produce cash flows of $250,000 in year 1, $300,000 in years 2 through 4, and $100,000 in year 5. What is the investment's discounted payback period if the required rate of return is 10%? Answer 3.33 years 3.16 years 2.67 years 2.33 yearsarrow_forward

- An investment costs $4,000 today. This investment is expected to produce annual cash flows of $1,200, $1,400, $ 1,300 and $1,100, respectively, over the next four years. What is the internal rate of return (IRR) ( or geometric average) on this investment? Question 23 options: 2.43 % 6.25 % 9.72% 31.25%arrow_forwardYou are considering an investment in a clothes distributer. The company needs $106,000 today and expects to repay you $124,000 in a year from now. What is the IRR of this investment opportunity? Given the riskiness of the investment opportunity, your cost of capital is 15%. What does the IRR rule say about whether you should invest? What is the IRR of this investment opportunity? The IRR of this investment opportunity is %. (Round to two decimal places.)arrow_forwardComputing the Present Value of a Single Amount Depp is reviewing an investment that will provide a payout of $108,000 in five years. If Depp considers a 5% interest rate (compounded annually) acceptable, what amount is Depp willing to pay for the investment today? Round your answer to the nearest whole number. Do not use a negative sign with your answer.arrow_forward

- Future Value You invest $1,000 today and exect to sell the investment for $2,000 in 10 years. a. Is this a good deal if the investment rate is 6%? b. What if the interest rate is 10%? Why ? Show the calculations in Excel.arrow_forwardYou are considering in investing one of the two options: Investment A requires a $175,000 upfront payment and generates $12,000 annually, Investment B requires a $250,000 upfront payment. How much should Investment B generate annually so that the total returns from Investment A and B become equal after 25 years? O None of the others O $15,000 O $9,000 O $75,000 O $3,000arrow_forwardAssume you invest $5,100 today in an investment that promises to return $6,928 in exactly 10 years. a. Use the present-value technique to estimate the IRR on this investment. b. If a minimum annual return of 9% is required, would you recommend this investment? #69 Part 1 a. The IRR of the investment is enter your response here%. (Round to the nearest whole percent.) Part 2 b. If a minimum return of 9% is required, would you recommend this investment? (Select the best choice below.) A. No, because this investment yields less than the minimum required return of 9%. B. Yes, because a minimum required return of 9% does not compensate for an investment that lasts longer than one year. C. No, because a minimum required return of 9% is an arbitrary choice for an investment of this risk level. D. Yes, because this investment yields more than the minimum required return of 9%arrow_forward

- You are considering a safe investment opportunity that requires a $1,410 investment today, and will p $780 two years from now and another $830 five years from now. a. What is the IRR of this investment? b. If you are choosing between this investment and putting your money in a safe bank account that pa an EAR of 5% per year for any horizon, can you make the decision by simply comparing this EAR wit the IRR of the investment? Explain. a. What is the IRR of this investment? The IRR of this investment is %. (Round to two decimal places.)arrow_forwardWhat is the no arbitrage price of a risk-free investment that promises to pay $1,000 in one year? The risk-free interest rate is 3.5%. If you can purchase the investment for $950, do you have an arbitrage opportunity?arrow_forwardYou have an opportunity to invest $50,600 now in return for $60,800 in one year. If your cost of capital is 7.9%, what is the NPV of this investment?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education