FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

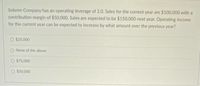

Transcribed Image Text:Solemn Company has an operating leverage of 2.O. Sales for the current year are $100,000 with a

contribution margin of $50,000. Sales are expected to be $150,000 next year. Operating income

for the current year can be expected to increase by what amount over the previous year?

O $25,000

O None of the above

O $75,000

O $50,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Mountville's results for the year and the potential new investment are shown below. The new investment is approved and expected to create sales of $100,000, a contribution margin of 70% of sales and added fixed costs of $40,000. If the manager gets a bonus of 10% of Residual income, what is the change in bonus expected for next year expected to be (assume rest of firm operates same as last year)? Express as a whole number. Sales Variable expenses Fixed expenses $1,000,000 $300,000 $500,000 Average operating assets $800,000 Minimum rate of return 9% New investment $268,000arrow_forwardNoah’s ark video game expects sales to grow by 25% next year. Assume that it pays out 95% of its net income. Using the following statements and the percent of sales method, forecast the amount of net new financing needed.arrow_forwardCompany H wants to calculate degree of operating, financial and combined leverage for the company using 2018 financial data. The financial data are as follows: Sales (80,000 units) S800,000 Variable costs S250,000 $550,000 $150,000 Contribution Fixed costs $400,000 $50,000 Operating income Interest Earnings before taxes $350,000 What is the Degree of Operating Leverage (DOL), Degree of Financial Leverage (DFL) and Degree of Combined Leverage (DCL)? a. DOL is 1.143; DFL is 1.132 and DCL is 1.571. b. DOL is 1.571; DFL is 1.143 and DCL is 1.143. c. DOL is 1.143; DFL is 1.143 and DCL is 1.137. d. DOL is 1.375; DFL is 1.143 and DCL is 1.571.arrow_forward

- Tennill Inc. has a $1,400,000 investment opportunity with the following characteristics: Sales $ 4,480,000 40 % of sales Contribution margin ratio Fixed expenses S 1,657,600 The ROI for this year's investment opportunity is closest to: A) 8.1% B) 128.0 % C) 3.0% D) 9.6% 33)arrow_forwardPhoenix TV is forecasting the following income statement: Sales Operating costs excluding depr.& amort. EBITDA Depreciation & amortization EBIT Interest EBT Taxes (40%) Net income $8,000,000 4,400,000 $3,600,000 800,000 $2,800,000 600,000 $2,200,000 800,000 $1,320,000 The CEO would like to see higher sales and a forecasted net income of $2,500,000. Assume that operating costs (excluding depreciation and amortization) are 55% of sales and that depreciation and amortization and interest expenses will increase by 10%. The tax rate, which is 40%, will remain the same. What level of sales would generate $2,500,000 in net income?arrow_forwardGodoarrow_forward

- The Carioco Company has two divisions that operate independently of one another. The financial data for the year 2022 reported the following results: Alpha Beta Sales $3,000,000 $2,500,000 Operating income 750,000 550,000 Taxable income 650,000 375,000 Investment 6,000,000 5,000,000 The company's desired rate of return is 10%. Income is defined as operating income. Required: What are the respective return-on-investment ratios for the Alpha and Beta Divisions? a. 0.110 and 0.125 b. 0.125 and 0.110 c. 0.050 and 0.150 d. 0.108 and 0.075arrow_forwardRequired information [The following information applies to the questions displayed below.] Henna Co. produces and sells two products, T and O. It manufactures these products in separate factories and markets them through different channels. They have no shared costs. This year, the company sold 46,000 units of each product. Sales and costs for each product follow. Product 0 $ 800,400 160,080 640,320 512,320 128,000 44,800 Product T $ 800,400 640,320 Sales Variable costs Contribution margin 160,080 32,080 128,000 44,800 $ 83,200 Fixed costs Income before taxes Income taxes (35% rate) Net income $ 83, 200arrow_forwardAssume the Hiking Shoes division of the All About Shoes Corporation had the following results last year (in thousands). Management's target rate of return is 5% and the weighted average cost of capital is 25%. Its effective tax rate is 30%. $13,000,000 1,300,000 1,500,000 Sales Operating income Total assets Current liabilities 810,000 What is the division's sales margin? O A. 10.00% O B. 54.00% O C. 866.67% O D. 86.67%arrow_forward

- Aa 93.arrow_forwardAssume that a company plans to introduce a new product to the market at a target selling price of $20 per unit. It is investing $4,000,000 to purchase the equipment needed to produce and sell 250,000 units per year. Assuming the company’s required rate of return on all investments is 16.50%, what is the new product’s target cost per unit? Multiple Choice $21.84 $22.84 $18.36 $17.36arrow_forwardVijayarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education