FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

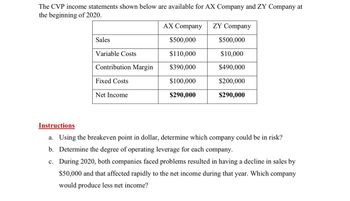

Transcribed Image Text:The CVP income statements shown below are available for AX Company and ZY Company at

the beginning of 2020.

AX Company

ZY Company

Sales

$500,000

$500,000

Variable Costs

$110,000

$10,000

Contribution Margin

$390,000

$490,000

Fixed Costs

$100,000

$200,000

Net Income

$290,000

$290,000

Instructions

a. Using the breakeven point in dollar, determine which company could be in risk?

b. Determine the degree of operating leverage for each company.

c. During 2020, both companies faced problems resulted in having a decline in sales by

$50,000 and that affected rapidly to the net income during that year. Which company

would produce less net income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- f net profit of the firm is OMR 280,000 and capital employed is OMR 1,400, 000 the return on capital employed will be 20%. During inflation with net profit calculated with replacement cost is OMR 180,000 and capital employed is OMR 22,00,000 the return on capital employed will be 8.2%. This situation expresses the following problem. a. Under historical cost accounting, the profits are overstated, and fixed assets are understated specially when there is increase in the price of the old fixed assets. b. Under historical cost accounting, return on capital employed which is very useful for the valuation of the business by its owners, creditors and management will not be correct and may lead to misleading decision c. Both the given statements are true in the given situation d. Both the given statements are false in the given situationarrow_forwardcompany's margin of safety in pesos is P30,000; fixed costs, P90,000; sales, P200,000; and CM ratio, 60%. The 7. The following are taken from Lily Company's income statement: net income. 's а. Р30,000 b. P50,000 с. PI50,000 d. None of these. 8 Refer to no. 7. The margin of safety in percentage form is a. 75% b. 40% c. 25% d. 60% e. None of these.arrow_forward> Question 3: Sohar Company's financial information is given in the table below. Sales (OMR) Fixed Costs 90000 120000 Year Variable Costs 405000 2019 2020 225000 450000 240000 Calculate: c) Sales required to earn a profit of OMR 40000. d) Margin of safety at a profit of OMR 50000 e) Profit when sales are OMR. 200000. 面arrow_forward

- If net operating income is $83.000. average operating assets are $415,000, and the minimum required rate of return is 14%, what is the residual income? Multiple Choice $107,900 $33.200 $24,900 $58100arrow_forwardUse the following information about Rat Race Home Security, Inc. to answer the questions: Average selling price per unit $324. Variable cost per unit $187 Units sold 449 Fixed costs $8,589 Interest expense 17,204 Based on the data above, what will be the resulting percentage change in earnings per share of Rat Race Home Security, Inc. if they expect operating profit to change 4.2 percent? (You should calculate the degree of financial leverage first). (Write the percentage sign in the "units" box).arrow_forwardThe following data are available for X Corp in Year 2020:arrow_forward

- Assume the following data for Eim Alex Company for the years 2019, 2020, and 2021. Year Lifting.(Production) Costs (excluding DD&A) DD&A Production bbl 2019 750,000 855,000 325,000 2020 685,000 787,000 297,000 2021 578,000 729,000 362,000 Compute the DD&A per BOE for 2019. O 2.6308 2.6380 2.3680arrow_forwardQ1. Below is the projected financial information provided by Altaf Hussain Manufacturing LLC. The company wants to introduce two new products into the market, Zandu and Eundu. The company provides the following forecasted information of sales and costs. Sales in units Product/Year Year 1 Year 2 Year 3 Year 4 Zandu 60,000 110,000 100,000 30,000 Eundu 75,000 137,000 125,000 37,500 Product Zandu Eundu Direct material costs 14 11 Selling price 31 23 Selling price inflation (per year). 3% Direct material cost inflation (per year) 3% Advertisement cost (First Year) 500,000 Advertisement cost (2nd and 3rd Year) 200,000 Investment 1,000,000 Machinery 1,000,000 Fixed costs 1,000,000 Таx 25% Residual value 1.2million Required: Calculate NPV and IRR of this proposal project using MS Excel. Hint: Calculate expected revenue 2. Expected costs 3. Expected cashflows 1. to calculate NPV and IRR MTEESarrow_forwardCompany H wants to calculate degree of operating, financial and combined leverage for the company using 2018 financial data. The financial data are as follows: Sales (80,000 units) S800,000 Variable costs S250,000 $550,000 $150,000 Contribution Fixed costs $400,000 $50,000 Operating income Interest Earnings before taxes $350,000 What is the Degree of Operating Leverage (DOL), Degree of Financial Leverage (DFL) and Degree of Combined Leverage (DCL)? a. DOL is 1.143; DFL is 1.132 and DCL is 1.571. b. DOL is 1.571; DFL is 1.143 and DCL is 1.143. c. DOL is 1.143; DFL is 1.143 and DCL is 1.137. d. DOL is 1.375; DFL is 1.143 and DCL is 1.571.arrow_forward

- Assuming that the fixed costs are expected to remain at P200,000 for the coming year and the sales price per unit and variable costs per unit are also expected to remain constant, how much profit after taxes will be produced if the company anticipates sales for the coming year rising to 125 percent of the current year’s level?arrow_forwardConsider the following simplified financial statements for the Wims Corporation (assuming no income taxes): Income Statement Sales Costs $ 29,000 Assets 13,500 Net income $15,500 Total $9,800 The company has predicted a sales increase of 12 percent. It has predicted that every item on the balance sheet will increase by 12 percent as well. Create the pro forma statements and reconcile them. What is the plug variable here? Multiple Choice O O O $24,384 $16,655 $16,642 Balance Sheet $9,800 Debt $16,649 $ 4,100 5,700 $9,800 Equity Totalarrow_forwardProblem 1: The following information has been taken from the accounting records of Ahmed and Company in first and second period. Period 2019 2020 Calculate: Sales $ 100,000 150,000 Profit $15,000 25,000 1) Profit volume ratio 2) Fixed cost for two periods 3) Variable cost of two periods.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education