Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

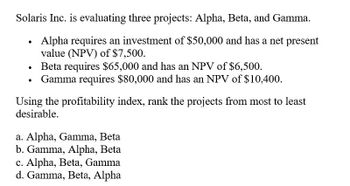

Transcribed Image Text:Solaris Inc. is evaluating three projects: Alpha, Beta, and Gamma.

•

Alpha requires an investment of $50,000 and has a net present

value (NPV) of $7,500.

Beta requires $65,000 and has an NPV of $6,500.

Gamma requires $80,000 and has an NPV of $10,400.

Using the profitability index, rank the projects from most to least

desirable.

a. Alpha, Gamma, Beta

b. Gamma, Alpha, Beta

c. Alpha, Beta, Gamma

d. Gamma, Beta, Alpha

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- how would i solve this problemarrow_forwardIvanhoe Manufacturing is evaluating two capital projects. The company's choice will be based on the profitability index. Project #1 has a present value of cash flows of $216,000 and a net initial investment of $194,400 while Project #2 has a present value of future cash flows of $885,600 and a net initial investment of $864,000. Click here to view the factor table. Using the present value tables, which project will Ivanhoe choose? (Round answers to 3 decimal places, e.g. 2.575.) Project #1 Project #2 Profitability Index Ivanhoe should choose since its profitability index is * than the profitability index ofarrow_forwardYokam Company is considering two alternative projects. Project 1 requires an initial investment of $470,000 and has a present value of all its cash flows of $2,350,000. Project 2 requires an initial investment of $5,000,000 and has a present value of all its cash flows of $6,000,000. (a) Compute the profitability index for each project. (b) Based on the profitability index, which project should the company select? Complete this question by entering your answers in the tabs below. Required A Required B Compute the profitability index for each project. Profitability Index Numerator: Denominator: Profitability Index = Profitability index Project 1 Project 2arrow_forward

- The senior management of Netherworld Ltd is evaluating four project proposals and will select one project to invest in. The following summary information is available: Project Code Initial Investment Required Net Present Value Project life (years) A 172,000 48,000 7 B 155,000 48,000 12 C 115,000 39,100 7 D 141,000 38,500 3 Required: Calculate the profitability index for each project. In order of preference, rank the four projects in terms of net present value and the profitability index. Which project do you think should be chosen?arrow_forwardConsider the following projects, X and Y where the firm can only choose one. Project X costs $1500 and has cash flows of $678, $652, $347, $111, $54, $16 in each of the next 6 years. Project Y also costs $1500, and generates cash flows of $738, $693, $405 for the next 3 years, respectively. WACC=11%.Plot NPV profiles for the two projects. Identify the projects’ IRRs on the graph.arrow_forwardim struggling with this problemarrow_forward

- You are a financial analyst for the Hittle Company. The director of capital budgeting has asked you to analyze six proposed capital investments. Each project has a cost of $1,000, and the required rate of return for each is 12%, determine for each project (a) the payback period, (b) the net present value, (c) the profitability index, and (d) the internal rate of return. Assume under MACRS the asset falls in the three-year property class and that the corporate tax rate is 25 percent. You are limited to a maximum expenditure of $3000 only for this capital budgeting period. Which projects you will accept and why? Justify your suggestions Project A Project B Project C Project D Project E Project F Investment -1000 -1000 -1000 -1000 -1000 -1000 1 150 200 250 800 900 1000 2 350 300 250 350 300 200 3 400 500 600 200 150 100 4 700 650 600 200 150 50 12 Capital Budgeting and Estimating Cash Flows Table 12.2 PROPERTY CLASS RECOVERY YEAR MACRS depreciation percentages 3-YEAR 5-YEAR 7-YEAR 10-YEAR…arrow_forwardYou have been assigned to perform a project selection based on profitability index. You have collected data on the three project alternatives A1, A2, and A3 and your team has calculated the following (table) present worth equivalent for the benefits, costs, and investments at a social discount rate of 10%. The service life of each alternative is identical. (a) Find the PI(i) for each project alternative (b) Find the best alternative based on incremental PI(i) analysis (c) Why is the profitability index referred to as a measure of capital efficiency?arrow_forwardDo the following problems. You must show your work.c) Find the IRR and MIRR of the following project and make your decision. Assume that the project's cost of capital (or WACC) is 4%. Project X that costs $30 million is expected to generate $13m per year for 3 years. Is this project acceptable?arrow_forward

- Connor Corporation is considering two projects (see below). For your analysis, assume these projects are mutually exclusive with a required rate of return of 12%. project 1 project 2 initial investment $(510,000) $(685,000) cash flow year 1 485,000 610,000 Compute the following for each project: NPV (net present value) PI (profitability index) IRR (internal rate of return) Based on your analysis, answer the following questions : Which is the best choice? Why? Which project should be selected and why? If the projects had the same IRR amounts but different NPV totals, then how would you know which project to select? Explain.arrow_forwardA project has initial costs of $3,000 and subsequent cash inflows of $1350,275,875 and 1525 . The company's 10% cost of capital is an appropriate discount rate for this average risk project. Calculate the following: NPV IRR Profitability Index Please number/label each of your answers as shown above. Be sure to show your TVM function calculator inputs, and four decimal places.arrow_forwardConsider the following projects, X and Y where the firm can only choose one. Project X costs $600 and has cash flows of $400 in each of the next 2 years. Project Y also costs $600, and generates cash flows of $500 and $275 for the next 2 years, respectively. Which investment should the firm choose if the cost of capital is 15 percent? Project X, since it has a higher NPV than Project Y Project Y, since it has a higher NPV than Project X neither, since both the projects have negative NPV neither, since both the projects have positive NPVarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT