EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Accurate Answer

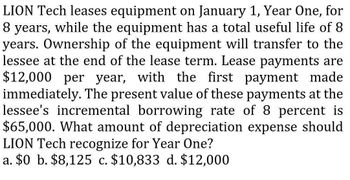

Transcribed Image Text:LION Tech leases equipment on January 1, Year One, for

8 years, while the equipment has a total useful life of 8

years. Ownership of the equipment will transfer to the

lessee at the end of the lease term. Lease payments are

$12,000 per year, with the first payment made

immediately. The present value of these payments at the

lessee's incremental borrowing rate of 8 percent is

$65,000. What amount of depreciation expense should

LION Tech recognize for Year One?

a. $0 b. $8,125 c. $10,833 d. $12,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Using the information provided, what transaction represents the best application of the present value of an annuity due of $1? A. Falcon Products leases an office building for 8 years with annual lease payments of $100,000 to be made at the beginning of each year. B. Compass, Inc., signs a note of $32,000, which requires the company to pay back the principal plus interest in four years. C. Bahwat Company plans to deposit a lump sum of $100.000 for the construction of a solar farm In 4 years. D. NYC Industries leases a car for 4 yearly annual lease payments of $12,000, where payments are made at the end of each year.arrow_forwardOn August 1, 2019, Kern Company leased a machine to Day Company for a 6-year period requiring payments of 10,000 at the beginning of each year. The machine cost 40,000 and has a useful life of 8 years with no residual value. Kerns implicit interest rate is 10%, and present value factors are as follows: Present value for an annuity due of 1 at 10% for 6 periods4.791 Present value for an annuity due of 1 at 10% for 8 periods5.868 Kern appropriately recorded the lease as a sales-type lease. At the inception of the lease, the Lease Receivable account balance should be: a. 60,000 b. 58,680 c. 48,000 d. 47,910arrow_forwardElectro Corporation bought a new machine and agreed to pay for it in equal annual installments of 5,000 at the end of each of the next 5 years. Assume a prevailing interest rate of 15%. The present value of an ordinary annuity of 1 at 15% for 5 periods is 3.35. The future amount of an ordinary annuity of 1 at 15% for 5 periods is 6.74. The present value of 1 at 15% for 5 periods is 0.5. How much should Electro record as the cost of the machine? a. 12,500 b. 16,750 c. 25,000 d. 33,700arrow_forward

- LION Tech leases equipment on January 1, Year One, for 8 years, while the equipment has a total useful life of 8 years. Ownership of the equipment will transfer to the lessee at the end of the lease term. Lease payments are $12,000 per year, with the first payment made immediately. The present value of these payments at the lessee's incremental borrowing rate of 8 percent is $65,000. What amount of depreciation expense should LION Tech recognize for Year One? a. $0 b. $8,125 c. $10,833 d. $12,000arrow_forwardAt the beginning of the year, Cazenovia, Inc. entered into a five-year lease for equipment that was valued at $95,000. The company will be required to make annual lease payments of $22,000 for 5 years at year-end.The implicit interest rate is 5% and the company classified the lease as a finance lease. What is the total expense if straight-line amortization is used for the leased asset?Round answer to the nearest whole number.$arrow_forwardOn January 1, 2020, Bacarra Company leased an asset for a term of six years. Annual rentals of P500,000 is payable every yearend. The cost of the leased asset is P2,100,000. Initial direct costs paid by Bacarra totaled P6,360. The asset will revert to Bacarra at the end of the lease term, when its residual value would amount to P100,000. Assume it is a direct finance lease with an implicit rate of 12% and the residual value is guaranteed, how much is the interest income for 2020?arrow_forward

- Courtland Company leased a new machine from Brendan Company. The lease term is 5 years; the estimated life of the machine is 8 years. Payments of $60,000 are due at the beginning of each year. The interest rate is 9%. The present values of an annuity due at 9% for 5 periods and 8 periods are, respectively 4.24 and 6.03. Courtland has the option to purchase the machine at the end of the lease term for $75,000, which is well below the expected fair value on that date. The present value of 1 for 5 periods and 8 periods are, respectively 0.65 and 0.50. Courtland should record a ROU asset of $254,400 $303,150 $361,800 $399,300arrow_forwardOn January 1, 2020, Narra Company leased an asset for a term of six years. Annual rentals of P500,000 is payable every yearend. The cost of the leased asset is P2,100,000. Initial direct costs paid by Bacarra totaled P6,360. The asset will revert to Bacarra at the end of the lease term, when its residual value would amount to P100,000. Assume it is a direct finance lease with an implicit rate of 12% and the residual value is guaranteed, how much is the interest income for 2020? Assume it is a direct finance lease with an implicit rate of 12% and the residual value is unguaranteed, how much is the net lease receivable as of yearend 2022? Assume it is a sales-type lease with an implicit rate of 10% and the residual value is guaranteed, how much should be credited to sales resulting from the lease? Assume it is a sales-type lease with an implicit rate of 10% and the residual value is guaranteed, how much is cost of sales resulting from the lease? Assume it is a sales-type lease with an…arrow_forwardOn January 1, 2020, Bacarra Company leased an asset for a term of six years. Annual rentals of P500,000 is payable every yearend. The cost of the leased asset is P2,100,000. Initial direct costs paid by Bacarra totaled P6,360. The asset will revert to Bacarra at the end of the lease term, when its residual value would amount to P100,000. 1. Assume it is a sales-type lease with an implicit rate of 10%, how much is the net lease receivable as of yearend 2020? 2. Assume the residual value is unguaranteed and the fair value of the leased asset at the end of the lease term is P80,000, how much is the loss on finance lease?arrow_forward

- ABC Company leased equipment to Best Corporation under a lease agreement that qualifies as a finance lease. The cost of the asset is $129,000. The lease contains a bargain purchase option that is effective at the end of the fifth year. The expected economic life of the asset is 10 years. The lease term is five years. The asset is expected to have a residual value of $2,600 at the end of 10 years. Using the straight-line method, what would Best record as annual amortization?arrow_forwardThe lessor company signs a lease agreement on December 31, 2020 to lease equipment to the lessee company. The term of the non-cancelable lease is 8 years, and yearly rental payment of $87,000 is required at the end of each year, beginning on December 31, 2020. The agreement specifies that the unguaranteed residual value is $42,000. The lessor expects to earn a return of 10% on its investment. The equipment has a useful economic life of 10 years. What is the amount of lease receivable the lessor will record on December 31, 2020? (You must choose from the following present/future values. Please do not use the tables in the textbook, tables posted on the Blackboard, or values from a financial calculator.) Future Value Single Sum Present Value Single Sum Future Value Ordinary Annuity Present Value Ordinary Annuity Present Value Annuity Due 10%, 8 periods 2.14 0.47 11.44 5.33 5.87 10%, 10 periods 2.59 0.39 15.94 6.14 6.76arrow_forwardCullumber Corporation, which uses ASPE, enters into a 6-year lease of equipment on September 1, 2023, that requires 6 annual payments of $38,000 each, beginning September 1, 2023. In addition, Cullumber guarantees the lessor a residual value of $27,000 at lease end. The equipment has a useful life of seven years. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY DUE OF 1. (a) Using (1) tables, (2) a financial calculator, or (3) Excel functions, calculate the amount of the capital lease and prepare Cullumber's September 1, 2023 journal entry assuming an interest rate of 12%. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round factor values to 5 decimal places, e.g. 1.25124 and final answers to O decimal places, e.g. 5,275.)…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning