FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

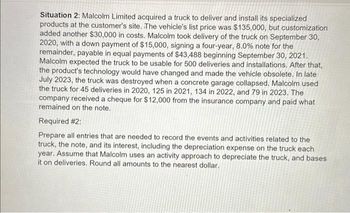

Transcribed Image Text:Situation 2: Malcolm Limited acquired a truck to deliver and install its specialized

products at the customer's site. The vehicle's list price was $135,000, but customization

added another $30,000 in costs. Malcolm took delivery of the truck on September 30,

2020, with a down payment of $15,000, signing a four-year, 8.0% note for the

remainder, payable in equal payments of $43,488 beginning September 30, 2021.

Malcolm expected the truck to be usable for 500 deliveries and installations. After that,

the product's technology would have changed and made the vehicle obsolete. In late

July 2023, the truck was destroyed when a concrete garage collapsed. Malcolm used

the truck for 45 deliveries in 2020, 125 in 2021, 134 in 2022, and 79 in 2023. The

company received a cheque for $12,000 from the insurance company and paid what

remained on the note.

Required #2:

Prepare all entries that are needed to record the events and activities related to the

truck, the note, and its interest, including the depreciation expense on the truck each

year. Assume that Malcolm uses an activity approach to depreciate the truck, and bases

it on deliveries. Round all amounts to the nearest dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2024, Nath-Langstrom Services, Incorporated, a computer software training firm, leased several computers under a two-year operating lease agreement from ComputerWorld Leasing, which routinely finances equipment for other firms at an annual interest rate of 4%. The contract calls for four rent payments of $10,000 each, payable semiannually on June 30 and December 31 each year. The computers were acquired by ComputerWorld at a cost of $90,000 and were expected to have a useful life of five years with no residual value. Both firms record amortization and depreciation semiannually. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. Prepare appropriate journal entries recorded by Nath-Langstrom Services for the first year of the lease. 2. Prepare appropriate journal entries recorded by ComputerWorld Leasing for the first year of the lease. Complete this question by entering your answers in the…arrow_forwardArctic Cat sold Seneca Motor Sports a shipment of snowmobiles. The snowmobiles were delivered on January 1, 2024, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $43,500 on a future date. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 9%. Required: Assume the note indicates that Seneca is to pay Arctic the $43,500 due on the note on December 31, 2024. Prepare the journal entry for Arctic to record the sale on January 1, 2024. Assume the same facts as in requirement 1, and prepare the journal entry for Arctic to record collection of the payment on December 31, 2024. Assume instead that Seneca is to pay Arctic the $43,500 due on the note on December 31, 2025. Prepare the journal entry for Arctic to record the sale on January 1, 2024. Assume instead that Arctic does not view the time value of money component of this arrangement to be…arrow_forwardOn January 1, 2024, Nath-Langstrom Services, Incorporated, a computer software training firm, leased several computers under a two- year operating lease agreement from ComputerWorld Leasing, which routinely finances equipment for other firms at an annual interest rate of 4%. • The contract calls for four rent payments of $10,000 each, payable semiannually on June 30 and December 31 each year. • The computers were acquired by ComputerWorld at a cost of $90,000 and were expected to have a useful life of five years with no residual value. • Both firms record amortization and depreciation semiannually. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. Prepare appropriate journal entries recorded by Nath-Langstrom Services for the first year of the lease. 2. Prepare appropriate journal entries recorded by ComputerWorld Leasing for the first year of the lease. Complete this question by entering your answers…arrow_forward

- Hanshabenarrow_forwardOn January 2, 2020, Bonita Industries began construction of a new citrus processing plant. The automated plant was finished and ready for use on September 30, 2021. Expenditures for the construction were as follows: January 2, 2020 $ 609000 September 1, 2020 1802400 December 31, 2020 1802400 March 31, 2021 1802400 September 30, 2021 1203000 Bonita Industries borrowed $3400000 on a construction loan at 12% interest on January 2, 2020. This loan was outstanding during the construction period. The company also had $13320000 in 9% bonds outstanding in 2020 and 2021.The interest capitalized for 2020 was: A)$505656 B)$108882 C)$145176 D)$289368arrow_forwardAyayai Corporation purchases a patent from Blossom Company on January 1, 2025, for $63,000. The patent has a remaining legal life of 14 years. Ayayai estimates the patent will have a useful life of 10 years, based on expected product innovations in the market. Prepare Ayayai's journal entries to record the purchase of the patent and 2025 amortization. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. List all debit entries before credit entries.) Account Titles and Explanation (To record purchase of patents) (To record amortization of patents) Debit Creditarrow_forward

- 7) Crass Spray Inc. (CSI) purchased equipment costing $60,000 on September 1, 2023. CSI made a $20,000 down payment and took out a loan for the remaining amount. Other cash expenditures related to this purchase included: Insurance during shipping: $500 Annual insurance policy: $2,400 Installation and testing costs: $600 Staff training costs on how to run the new equipment: $700 Required Determine the cost of the new equipment and record all required journal entries related to this equipment (you can ignore depreciation expense for the year).arrow_forwardAmber Mining and Milling, Incorporated, contracted with Truax Corporation to have constructed a custom-made lathe • The machine was completed and ready for use on January 1, 2024. Amber paid for the lathe by issuing a $850,000, three-year note that specified 4% interest, payable annually on December 31 of each year. The cash market price of the lathe was unknown. • It was determined by comparison with similar transactions that 9% was a reasonable rate of interest. Required: 1-a. Complete the table below to determine the price of the equipment. 1-b. Prepare the journal entry on January 1, 2024, for Amber Mining and Milling's purchase of the lathe. 2. Prepare an amortization schedule for the three-year term of the note. 3. Prepare the journal entries to record (a) interest for each of the three years and (b) payment of the note at maturity. Note: Use tables, Excel, or a financial calculator. (EV of $1. PV of $1. FVA of $1. PVA of $1. EVAD of $1 and PVAD of $.1) Complete this question by…arrow_forwardOn October 1, 2023, Blossom sold one of its super deluxe combination gas/charcoal barbecues to a local builder. The builder plans to install it in one of its "Parade of Homes" houses. Blossom accepted a three-year, zero-interest-bearing note with a face amount of $3,940. The barbecue has an inventory cost of $1,998. An interest rate of 10% is an appropriate market rate of interest for this customer. Prepare the journal entries on October 1, 2023, and December 31, 2023. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries. For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to O decimal places, e.g. 5,275.) te 2023 2023 31, 2023 Account Titles and Explanation Notes Receivable…arrow_forward

- On December 31, 2025, Cullumber Company acquired a computer from Plato Corporation by issuing a $614,000.00 zero-interest- bearing note, payable in full on December 31, 2029. Cullumber Company's credit rating permits it to borrow funds from its several lines of credit at 10%. The computer is expected to have a 5-year life and a $76,000 salvage value. Click here to view factor tables. (a) Prepare the journal entry for the purchase on December 31, 2025. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answers to 2 decimal places, eg. 58,971.23. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Date Account Titles and Explanation December 31,2025 eTextbook and Media List of Accounts Debit Creditarrow_forwardKingbird Corporation purchased a special tractor on December 31, 2020. The purchase agreement stipulated that Kingbird should pay $21,960 at the time of purchase and $5,430 at the end of each of the next 8 years. The tractor should be recorded on December 31, 2020, at what amount, assuming an appropriate interest rate of 12%? I got -612501.1859 but it is incorrectarrow_forwardLake Power Sports sells jet skis and other powered recreational equipment. Customers pay one-third of the sales price of a jet ski when they initially purchase the ski, and then pay another one-third each year for the next two years. Because Lake has little information about the ability to collect these receivables, it uses the cost recovery method to recognize revenue on these installment sales. In 2020, Lake began operations and sold jet skis with a total price of $630,000 that cost Lake $315,000. Lake collected $210,000 in 2020, $210,000 in 2021, and $210,000 in 2022 associated with those sales. In 2021, Lake sold jet skis with a total price of $1,380,000 that cost Lake $828,000. Lake collected $460,000 in 2021, $260,000 in 2022, and $260,000 in 2023 associated with those sales. In 2023, Lake also repossessed $400,000 of jet skis that were sold in 2021. Those jet skis had a fair value of $150,000 at the time they were repossessed. In 2020, Lake would recognize realized gross profit…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education