FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

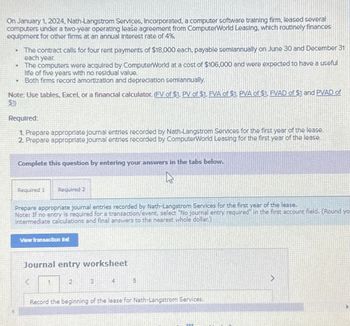

Transcribed Image Text:On January 1, 2024, Nath-Langstrom Services, Incorporated, a computer software training firm, leased several

computers under a two-year operating lease agreement from ComputerWorld Leasing, which routinely finances

equipment for other firms at an annual Interest rate of 4%.

The contract calls for four rent payments of $18,000 each, payable semiannually on June 30 and December 31

each year.

T

The computers were acquired by ComputerWorld at a cost of $106,000 and were expected to have a useful

life of five years with no residual value.

. Both firms record amortization and depreciation semiannually.

Note: Use tables, Excel, or a financial calculator. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of

$1)

Required:

1. Prepare appropriate Journal entries recorded by Nath-Langstrom Services for the first year of the lease.

2. Prepare appropriate Journal entries recorded by ComputerWorld Leasing for the first year of the lease.

Complete this question by entering your answers in the tabs below.

As

Required 1 Required 2

are propriate journal entries recorded by Nath-Langstrom Services for the first year of the lease.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. (Round yo

intermediate calculations and final answers to the nearest whole dollar)

View transaction Bat

Journal entry worksheet

X

3

Record the beginning of the lease for Nath-Langstrom Services.

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Universal Leasing leases electronic equipment to a variety of businesses. The company's primary service is providing alternate financing by acquiring equipment and leasing it to customers under long-term sales-type leases. ⚫ Universal earns interest under these arrangements at a 10% annual rate. • The company leased an electronic typesetting machine it purchased for $36,900 to a local publisher, Desktop Incorporated, on December 31, 2023. The lease contract specified annual payments of $8,353 beginning January 1, 2024, the beginning of the lease, and each December 31 through 2025 (three-year lease term). ⚫ The publisher had the option to purchase the machine on December 30, 2026, the end of the lease term, for $18,700 when it was expected to have a residual value of $22,700, a sufficient difference that exercise seems reasonably certain. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. Show how…arrow_forwardOn January 1, 2024, Nath-Langstrom Services, Incorporated, a computer software training firm, leased several computers under a two-year operating lease agreement from ComputerWorld Leasing, which routinely finances equipment for other firms at an annual interest rate of 4%. The contract calls for four rent payments of $10,000 each, payable semiannually on June 30 and December 31 each year. The computers were acquired by ComputerWorld at a cost of $90,000 and were expected to have a useful life of five years with no residual value. Both firms record amortization and depreciation semiannually. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. Prepare appropriate journal entries recorded by Nath-Langstrom Services for the first year of the lease. 2. Prepare appropriate journal entries recorded by ComputerWorld Leasing for the first year of the lease. Complete this question by entering your answers in the…arrow_forwardSheridan Limited, a public company following IFRS 16, decided to upgrade the coffee machines in all of its office locations. Sheridan leased 53 machines from Coffee Tyme Ltd. on July 1, 2020. (To purchase the coffee machines instead would have cost Sheridan $371 per machine, and the machines would have lasted an estimated five years.) The lease calls for semi-annual payments for the next three years, in the amount of $36 per machine. The payments start on July 1, 2020. At the end of the three-year period, the machines will have to be returned to the lessor. Prepare the entry for the first payment on July 1, 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation July 1 Debit Credit Would your entry for the first payment differ if Sheridan followed ASPE? The entry would be the same under ASPE.arrow_forward

- The Auto Clinic is a wholly owned subsidiary of Fast-Check Equipment Company. Fast-Check Equipment sells and leases 4-wheel alignment machines. The usual selling price of each machine is $35,000; it has a cost to Fast- Check Equipment of $25,000. On January 1, 2015, Fast-Check Equipment leased such a machine to Auto Clinic. The lease provided for payments of $9,096 at the start of each year for five years. The payments include $1,000 per year for maintenance to be provided by the seller. There is a bargain purchase price of $2,000 at the end of the fifth year. The implicit interest rate in the lease is 10% per year. The equipment is being depreciated over eight years.The amortization schedule for the lease prepared by Fast-Check Equipment is as attached:Prepare the eliminations and adjustments, in entry form, that would be required on a consolidated worksheet prepared on December 31, 2015.arrow_forwardTullis Construction enters into a long-term fixed price contract to build an office tower for $10,600,000. In the first year of the contract Tullis incurs $3,000,000 of cost and the engineers determined that the remaining costs to complete the project are $5,000,000. Tullis billed $5,000,000 in year 1 and collected $3,100,000 by the end of the end of the year. How should Tullis report Construction in Progress and Billings on Construction in Progress at the end of year 1 on the balance sheet assuming the use of the completed - contract method? O A. asset of $2,000,000 O B. liability of $1,900,000 O C. asset of $1,900,000 O D. liability of $2,000,000arrow_forwardWildhorse Limited, a public company following IFRS, decided to upgrade the coffee machines in all of its office locations. Wildhorse leased 45 machines from Coffee Tyme Ltd. on July 1, 2023. (To purchase the coffee machines instead would have cost Wildhorse $315 per machine, and the machines would have lasted an estimated five years.) The lease calls for semi-annual payments for the next three years, in the amount of $30 per machine. The payments start on July 1, 2023. At the end of the three-year period, the machines will have to be returned to the lessor. Prepare the entry for the first payment on July 1, 2023. (List debit entry before credit entry. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit July 1 Would the entry for the first payment differ if Wildhorse followed ASPE? The entry ☑…arrow_forward

- es On January 1, 2021, Robertson Construction leased several items of equipment under a two-year operating lease agreement from Jamison Leasing, which routinely finances equipment for other firms at an annual interest rate of 4%. The contract calls for four rent payments of $46,000 each, payable semiannually on June 30 and December 31 each year. The equipment was acquired by Jamison Leasing at a cost of $366,000 and was expected to have a useful life of five years with no residual value. Both firms record amortization and depreciation semi-annually. Required: Prepare the appropriate journal entries for the lessor (Jamison Leasing) from the beginning of the lease through the end of 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheetarrow_forwardKingbird Company manufactures a check-in kiosk with an estimated economic life of 12 years and leases it to National Airlines for a period of 10 years. The normal selling price of the equipment is $304,659, and its unguaranteed residual value at the end of the lease term is estimated to be $19.400. National will pay annual payments of $40,800 at the beginning of each year. Kingbird incurred costs of $164,100 in manufacturing the equipment and $3,900 in sales commissions in closing the lease. Kingbird has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 8%. Click here to view factor tables. (a) Discuss the nature of this lease in relation to the lessor. This is a sales-type lease Compute the amount of each of the following items. (Round present value factor calculations to 5 decimal places, eg. 1.25124 and the final answers to O decimal places, eg. 5.275) (1) Lease receivable S (2) Sales price S (3) Cost of sales $arrow_forwardWildhorse, Inc. manufactures machinery used in the mining industry. On January 2, 2021 it leased equipment with a cost of $570000 to Silver Point Co. The 5-year lease calls for a 10% down payment and equal annual payments of $190966 at the end of each year. The equipment has an expected useful life of 5 years. Silver Point's incremental borrowing rate is 9%, and it depreciates similar equipment using the double - declining balance method. The selling price of the equipment is $870000, and the rate implicit in the lease is 7%, which is known to Silver Point Co. What is the book value of the leased asset at December 31, 2021? $696000 $522000 $870000 $556800arrow_forward

- Gordon Inc., a private company that follows ASPE, entered into a lease agreement with Canada Leasing Corporation to lease a warehouse for six years. Annual lease payments are $21,000, payable at the beginning of each lease year. Gordon Inc. signed the lease agreement on January 1, 2021, and made the first payment on that date. At the end of the lease, the machine will revert back to Canada Leasing Corporation. The normal useful life of the warehouse is 10 years. At the time of the lease, the warehouse could be purchased for $108,000. Gordon does not know the implicit rate of the lease; Gordon's incremental borrowing rate is 10%. Gordon uses straight-line depreciation for this type of asset. Required: Using the three criteria under ASPE, prove whether this is an operating or capital lease. Prepare a lease amortization schedule for the lease. Round all amounts to the nearest dollar. Prepare the journal entries for 2021 and 2022 for Gordon Inc. Round amounts to the nearest…arrow_forwardHardevarrow_forwardWildhorse Company manufactures a check-in kiosk with an estimated economic life of 10 years and leases it to Sheffield Chicken for a period of 9 years. The normal selling price of the equipment is $172,124, and its unguaranteed residual value at the end of the lease term is estimated to be $26,200. Sheffield will pay annual payments of $20,800 at the beginning of each year. Wildhorse incurred costs of $141,100 in manufacturing the equipment and $2,400 in sales commissions in closing the lease. Wildhorse has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 5%. Sheffield Chicken has an incremental borrowing rate of 5%. The lessor's implicit rate is unknown to the lessee.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education