Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

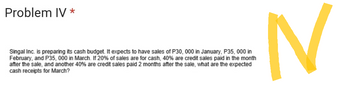

Transcribed Image Text:Problem IV *

Singal Inc. is preparing its cash budget. It expects to have sales of P30, 000 in January, P35, 000 in

February, and P35, 000 in March. If 20% of sales are for cash, 40% are credit sales paid in the month

after the sale, and another 40% are credit sales paid 2 months after the sale, what are the expected

cash receipts for March?

N

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume that sales and expenses forecasts for months April, May, June, and July are as follows. month, 60% are paid in the next month, and 20% are paid in the second month after. All expenses in a month are paid in the same month. There is a $20,000,000 minimum required cash balance at the end of each month, and any shortage from this minimum requirement will be covered by obtaining a loan. Any excess over $20,000,000 will be used to reduce or pay off cumulative loan. Initial cash balance in June is $6,000,000 and there is no cumulative loan at this time. Monthly prorated tax rate is 2%, and monthly interest rate on cumulative loan is 1%. Requirements: Prepare cash budget proforma for months June and July and interpret the result in detail.arrow_forwardLeaning Tower of Pizza, Inc. is preparing its master budget for its first quarter of business. It expects to sell 8,000 pizzas at $7 per pizza per month. It expects to collect 90% of the sales in the month of the sale and 10% in the following month. Calculate its accounts receivable balance at the end of its first quarter.arrow_forwardJanus Inc. needs to prepare a cash budget. The following are actual and forecasted sales figures: Actual Forecast November December January February March April $200,000 $220,000 $280,000 $320,000 $340,000 $330,000 Thirty percent of each month's sales are in cash, 50% are paid the month after sale and 20% are paid two months after sale. Materials cost 30% of sales and are purchased one month prior to sale and paid for 30 days later. Labor expense is 40% of sales, selling and administrative expenses are 5% of sales and both are paid in the month of sale. Overhead is $28,000 per month, depreciation expense is $10,000 per month. Taxes of $8,000 will be paid in January and dividends of $2,000 will be paid in March. Cash on hand at the beginning of January is $80,000 and the desired cash balance is $75,000. Prepare the cash budget for January – March.arrow_forward

- How would this be solved ?arrow_forwardKingbird needs to calculate the company’s expected cash receipts for the upcoming month to determine whether additional financing is needed. Typically, the company’s sales consist of 40% cash sales and 60% credit sales. Of the credit sales, 55% are collected in the same month, and 42% are collected in the following month. The remainder is generally uncollected. Total budgeted sales in June are $136,000 and in July are $186,000. What amount of total cash receipts would Kingbird expect to collect in July? Total cash receipts $enter the total cash receipts in dollarsarrow_forwardNorthWest Itd has prepared its master budget. The sales budget states that sales will be £82,000 in May 2024, £153, 500 in June, £137,200 in July and £165, 500 in August. 50% of sales will be credit sales. 70% of customers are expected to pay in the month after the sale, 20% in the second month after the sale, while the remaining 10% are expected to be bad debts. Customers who pay in the month after the sale can claim an 8% early settlement discount. What level of sales receipts should be shown in the cash budget for July 2024 (to the nearest £) ? A. £ 57,627 B. £ 183, 854 C. £ 126, 227 D. £ 122, 981 E. £ 81,098 F. £ 115, 254arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education