Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

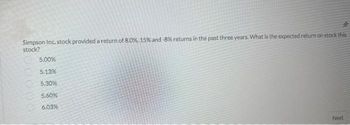

Transcribed Image Text:Simpson Inc. stock provided a return of 8.0%, 15% and -8% returns in the past three years. What is the expected return on stock this

stock?

5.00%

5.13%

5.30%

5.60%

6.03%

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The current market price of stock is $50 and the stock is expected to pay dividend of $2 with a growth rate of 6%. How much is the expected return to stockholders? 6% 10% 4% 5%arrow_forwardA stock had returns of 18.94 percent, 22.58 percent, -15.98 percent, 9.38 percent, and 28.45 percent for the past five years. What is the average return? A) 12.67% B) 19.07% C)6.12% D) 7.19% E) 28%arrow_forwardA stock just paid a dividend of $2.46. The dividend is expected to grow at 24.61% for five years and then grow at 3.55% thereafter. The required return on the stock is 12.30%. What is the value of the stock?arrow_forward

- Stock B is trading $30. Exactly one year ago, stock B was trading $25. Compute the realized return on holding a stock over 1 year. Assume that the stock just paid dividend of $3 per share.arrow_forwardThe common stock of Dayton Repair sells for $43.19 a share. The stock is expected to pay $2.28 per share next year when the annual dividend is distributed. The firm has established a pattern of increasing its dividends by 3.25 percent annually and expects to continue doing so. What is the required rate of return on this stock? O 7.65% O 8.70% 8.53% O 7.53%arrow_forwardFirm A’s stock has an expected total return = 9.2%. The last annual dividend = $2.10/ share. Dividends growth rate = 2.6% annually. Dividend yield = ? A) 3.75%B) 4.20%C) 4.55%D) 5.25%E) 6.60%arrow_forward

- A firm paid its annual dividend of $2.74 per share on its stock yesterday. The dividend is expected to grow at a rate of 3.88 percent per year into the foreseeable future. The expected rate of return on this stock is 18.74 percent. What is the expected price of the stock three years from today? Group of answer choices $441.68 $21.47 $18.44 $15.32 $19.15arrow_forwardA stock just paid a dividend of $1.66. The dividend is expected to grow at 25.42% for three years and then grow at 4.53% thereafter. The required return on the stock is 12.83%. What is the value of the stock?arrow_forwardWhat is the SD for a stock that has annual returns for 4 years 6%,-4%,8% and -12%? 9.0 9.3 9.6 8.3 8.7arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education