FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

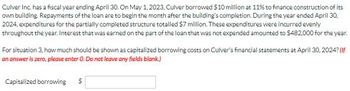

Transcribed Image Text:Culver Inc. has a fiscal year ending April 30. On May 1, 2023, Culver borrowed $10 million at 11% to finance construction of its

own building. Repayments of the loan are to begin the month after the building's completion. During the year ended April 30,

2024, expenditures for the partially completed structure totalled $7 million. These expenditures were incurred evenly

throughout the year. Interest that was earned on the part of the loan that was not expended amounted to $482,000 for the year.

For situation 3, how much should be shown as capitalized borrowing costs on Culver's financial statements at April 30, 2024? (If

an answer is zero, please enter O. Do not leave any fields blank.)

Capitalized borrowing $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bonita Industries is constructing a building. Construction began on January 1 and was completed on December 31. Expenditures were $6440000 on March 1, $5260000 on June 1, and $8850000 on December 31. Bonita Industries borrowed $3190000 on January 1 on a 5-year, 11% note to help finance construction of the building. In addition, the company had outstanding all year a 9%, 3-year, $6440000 note payable and an 10%, 4-year, $12650000 note payable.What are the weighted-average accumulated expenditures? $9860000 $20550000 $8435000 $11700000arrow_forwardThe following selected transactions relate to liabilities of Chicago Glass Corporation for 2024. Chicago's fiscal year ends on December 31. On January 15, Chicago received $7,400 from Henry Construction toward the purchase of $70,000 of plate glass to be delivered on February 6. On February 3, Chicago received $7,100 of refundable deposits relating to containers used to transport glass components. On February 6, Chicago delivered the plate glass to Henry Construction and received the balance of the purchase price. First quarter credit sales totaled $740,000. The state sales tax rate is 4% and the local sales tax rate is 2%. Required: Prepare journal entries for the above transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.arrow_forwardOn December 31, 2019, Pronghorn Inc. borrowed $4,140,000 at 13% payable annually to finance the construction of a new building. In 2020, the company made the following expenditures related to this building: March 1, $496,800; June 1, $828,000; July 1, $2,070,000; December 1, $2,070,000. The building was completed in February 2021. Additional information is provided as follows. 1. Other debt outstanding 10-year, 14% bond, December 31, 2013, interest payable annually $5,520,000 6-year, 11% note, dated December 31, 2017, interest payable annually $2,208,000 2. March 1, 2020, expenditure included land costs of $207,000 3. Interest revenue earned in 2020 $67,620 (a) Determine the amount of interest to be capitalized in 2020 in relation to the construction of the building. The amount of interest %24arrow_forward

- Ajayarrow_forwardOn December 31, 2024, Tamarisk Inc. borrowed $3,960,000 at 13% payable annually to finance the construction of a new building. In 2025, the company made the following expenditures related to this building: March 1, $475,200; June 1, $792,000; July 1, $1,980,000; December 1, $1,980,000. The building was completed in February 2026. Additional information is provided as follows. 1. 2. 3. (a) Other debt outstanding: 10-year, 14% bond, December 31, 2018, interest payable annually 6-year, 11% note, dated December 31, 2022, interest payable annually March 1, 2025, expenditure included land costs of $198,000. Interest revenue of $64,680 earned in 2025. Your answer is correct Determine the amount of interest to be capitalized in 2025 in relation to the construction of the building. The amount of interest $ eTextbook and Media Date Prepare the journal entry to record the capitalization of interest and the recognition of interest expense, if any, at December 31, 2025. (Credit account titles are…arrow_forwardVikramarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education