Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

This is general account problem

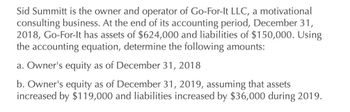

Transcribed Image Text:Sid Summitt is the owner and operator of Go-For-It LLC, a motivational

consulting business. At the end of its accounting period, December 31,

2018, Go-For-It has assets of $624,000 and liabilities of $150,000. Using

the accounting equation, determine the following amounts:

a. Owner's equity as of December 31, 2018

b. Owner's equity as of December 31, 2019, assuming that assets

increased by $119,000 and liabilities increased by $36,000 during 2019.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Can you please correct solution for this general accounting question?arrow_forwardDorah, the sole stockholder of Barnie Inc., runs a home-cleaning service in the suburb of a large city. Her balance sheet as at January 31, 2019 is as follows: Barnie Inc.Balance SheetAs at January 31, 2019AssetsCash $4,600Accounts Receivable $15,300Equipment $9,000Accumulated Depreciation $-2,400Total Assets $26,500LiabilitiesAccounts Payable $2,400Notes Payable $12,100Total Liabilities $14,500Stockholder's Equity $12,000Total Liabilities & Stockholder's Equity $26,500 In the upcoming year, Dorah expects the following events to occur:Total revenues of $26,000 and total expenses of $16,800100% of accounts receivable from the prior year will be collected in the following yearCredit sales will represent 40% of revenues for the year100% of accounts payable owing from 2019 will be paid off in 2020By the end of January, 2020, Barnie will owe its suppliers $3,700No principal payments will be made on the bank loan during 2019Purchase of new equipment for $1,500. The entire purchase will…arrow_forwardSelected accounts from the ledger of Restoration Arts for the fiscal year ended April 30, 2019, are as follows: Prepare a statement of owners equity for the year.arrow_forward

- You are the new controller for Moonlight Bay Resorts. The company CFO has asked you to determine the company's interest expense for the year ended December 31, 2021. Your accounting group provided you the following information on the company's debt. (EV of $1. PV of 51. EVA of S1. PVA ofS1 EVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) 1. On July 1, 2021, Moonlight Bay issued bonds with a face amount of $2.300,000. The bonds mature in 15 years and interest of 11% is payable semiannually on June 30 and December 31. The bonds were issued at a price to yield investors 12%. Moonlight Bay records interest at the effective rate 2 At December 31, 2020, Moonlight Bay had a 10% installment note payable to Third Mercantile Bank with a balance of $670,000. The annual payment is $145,000, payable each June 30 3, On January 1, 2021, Moonlight Bay leased a building under a finance lease calling for four annual lease payments of $70,000 beginning January 1, 2021.…arrow_forwardCharles Whyte commenced business on May 1 2019, making up his accounts to September 30 annually. The statement of the Profit or Loss Account for the first 17 months ended September 30,2020 is as follows: Gross Profit Less: Repairs and maintenance. Local transport and travelling Salaries and wages Provision for bad debts Preliminary expenses Depreciation Bank interest and charges Legal and professional charges General expenses (Allowable) Clearing expense on motor vehicle Bad debt Amounts written off Loan to absconded employee (ii) (iii) (iv) (1) You are also given the following additional information. Bad debt £ (v) £'000 30/10/2018 1/1/2019 1/5/2019 1,500 2,450 6,500 1,350 960 1,630 1,520 1,380 1,870 685 2,800 Building Motor Vehicle Furniture and fittings Legal and professional charges were: Salaries and wages: The following qualifying capital expenditures were acquired on: Fines for contravention of the law Legal expenses for tax appeal Audit and accountancy charges £'000 19,300…arrow_forwardPhil Corp. had the following transactions during 2019: -Sales of $8820 on account. -Collected $3920 for services to be performed in 2020. -Paid $3680 cash in salaries for 2019. -Purchased airline tickets for $490 in December for a trip to take place in 2020. What is Phil's 2019 net income using accrual accounting?arrow_forward

- During the course of your examination of the financial statements of the Hales Corporation for the year ended December 31, 2021, you discover the following: a. An insurance policy covering three years was purchased on January 1, 2021, for $7,500. The entire amount was debited to insurance expense and no adjusting entry was recorded for this item. b. During 2021, the company received a $925 cash advance from a customer for merchandise to be manufactured and shipped in 2022. The $925 was credited to sales revenue. No entry was recorded for the cost of merchandise. c. There were no supplies listed in the balance sheet under assets. However, you discover that supplies costing $1,005 were on hand at December 31. d. Hales borrowed $28,000 from a local bank on October 1, 2021. Principal and interest at 12% will be paid on September 30, 2022. No accrual was recorded for interest. e. Net income reported in the 2021 income statement is $43,000 before reflecting any of the above items. Required:…arrow_forwardThe amounts of the assets and liabilities of Nordic Travel Agency at December 31, 2019, the end of the year, and its revenue and expenses for the year follow. The capital of Ian Eisele, owner, was $670,000 on January 1, 2019, the beginning of the year. During the year, an withdrew $42,000arrow_forwardDuring the course of your examination of the financial statements of the Hales Corporation for the year ended December 31, 2021, you discover the following:a. An insurance policy covering three years was purchased on January 1, 2021, for $6,000. The entire amount was debited to insurance expense and no adjusting entry was recorded for this item.b. During 2021, the company received a $1,000 cash advance from a customer for merchandise to be manufactured and shipped in 2022. The $1,000 was credited to sales revenue. No entry was recorded for the cost of merchandise.c. There were no supplies listed in the balance sheet under assets. However, you discover that supplies costing $750 were on hand at December 31.d. Hales borrowed $20,000 from a local bank on October 1, 2021. Principal and interest at 12% will be paid on September 30, 2022. No accrual was recorded for interest.e. Net income reported in the 2021 income statement is $30,000 before reflecting any of the above…arrow_forward

- Tony Ling was reviewing his business activities at the end of the year (February 28, 2019) and decided to prepare a statement of Owner's Equity. At the beginning of the year his assets were. $600,000 and his liabilities were 165,000. At the end of the year the assets had grown to $1075,000 but liabilities had also increased to 310,000. The profit for the year was 440,000 Tony had withdrawn 110,000 during the year for his personal use. Prepare a Statement of owner's Equityarrow_forwardWhite Cleaning Services was established by Mr. Mansoor early in 2021. On 1/1/2022, business hac total assets of $ 85,000, and total liabilities of $ 13,000. During the year 2022, total revenue was $ 62,000, while total expenses amounted to $ 35,000. Also, during the year, Mr. Mansoor withdrew 12,000 from the business for personal use. On 31/12/2022, total business assets amounted to $ 136,000. Calculate the total liabilities on 31/12/2022. Please note to insert only a number. NO signs or commas are to be used. الرجاء كتابة الرقم فقط، بدون فواصل او اشارة دولار أو غيرها Answer:arrow_forwardThe owner's equity of FDNACCT was P190,000 at January 1, 2020. The assets and liabilities on December 31, 2020, the end of the accounting year, and its revenue and expenses for the year are listed below. Accounts Payable 1,200 Accounts Receivable 12,340 Building 143,670 Cash 32,990 |Cleaning Expense 560 Fees Earned 82,350 Land 65,000 Miscellaneous Expense 220 Office Supplies 1,670 Owner's Drawings 3,000 Wages Expense 35,770 How much is the net income for the year ended December 31, 2020?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College