ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:**Effects of a $40 Tariff on Maize**

**Description:**

The graph illustrates the impact of a $40 tariff on the maize market, showcasing changes in price, quantity, and welfare effects.

**Graph Details:**

- **Axes:**

- X-axis: Quantity (Tons of maize)

- Y-axis: Price (Dollars per ton)

- **Lines:**

- **Domestic Demand**: A downward-sloping blue line.

- **Domestic Supply**: An upward-sloping orange line.

- **World Price Plus Tariff (Pw + Tariff):**

- Represented by the black plus symbol line.

**Areas and Symbols:**

1. **Consumer Surplus (CS)**:

- Shaded with green triangles.

- Represents the area where consumers benefit from lower prices before the tariff.

2. **Producer Surplus (PS)**:

- Shaded with purple diamonds.

- Represents the increased benefit to producers from higher prices due to the tariff.

3. **Government Revenue**:

- Shaded with orange quadrilateral (square symbols).

- Represents the revenue collected from the tariff.

4. **Deadweight Loss (DWL)**:

- Shaded with tan rectangles.

- Shows the loss in total welfare due to the tariff, indicating inefficiencies.

**Table for Summary:**

- **Under Free Trade vs. Under a Tariff:**

| | Under Free Trade (Dollars) | Under a Tariff (Dollars) |

|-----------------------------------|---------------------------|---------------------------|

| Consumer Surplus | | |

| Producer Surplus | | |

| Government Revenue | 0 | |

**Analysis:**

Based on the graph:

- Bangladesh’s consumer surplus decreases by $___.

- Producer surplus increases by $___.

- Government collects $___ in tariff revenue.

- The net welfare effect is a decrease of $___ due to the deadweight loss.

This information helps analyze the redistribution of welfare between consumers, producers, and the government due to the tariff, and highlights the inefficiencies introduced in the market.

Transcribed Image Text:**Welfare Effects of a Tariff in a Small Country**

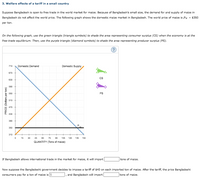

Suppose Bangladesh is open to free trade in the world market for maize. Because of Bangladesh's small size, the demand for and supply of maize in Bangladesh do not affect the world price. The following graph shows the domestic maize market in Bangladesh. The world price of maize is \( P_w = \$350 \) per ton.

On the following graph, use the green triangle (triangle symbols) to shade the area representing consumer surplus (CS) when the economy is at the free-trade equilibrium. Then, use the purple triangle (diamond symbols) to shade the area representing producer surplus (PS).

**Graph Explanation:**

- The graph displays a supply and demand model for the domestic maize market in Bangladesh.

- The y-axis represents the price in dollars per ton, ranging from 310 to 710.

- The x-axis represents the quantity in tons of maize, ranging from 0 to 150.

- The blue line labeled 'Domestic Demand' slopes downward from left to right.

- The orange line labeled 'Domestic Supply' slopes upward from left to right.

- \( P_w = \$350 \) is the horizontal black line indicating the world price.

**Key Points:**

- Green triangle: Indicates the consumer surplus (CS) at free-trade equilibrium.

- Purple triangle: Indicates the producer surplus (PS) at free-trade equilibrium.

**Scenario:**

If Bangladesh allows international trade in the market for maize, it will import _______ tons of maize.

Now suppose the Bangladeshi government decides to impose a tariff of $40 on each imported ton of maize. After the tariff, the price Bangladeshi consumers pay for a ton of maize is $ _______, and Bangladesh will import _______ tons of maize.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- The United States has historically imposed import tariffs on goods that include tobacco, canned tuna, steel, and aluminum. Suppose the market for tobacco is illustrated by the accompanying graph. a. As shown, the world price is $2 per pound. Suppose the U.S. imposes a tariff of $1 per pound. Adjust the price line labeled "World price with tariff" (at the top of the graph) to reflect this tariff. b. Use the letters and values in the graph to fill in the following table. Without tariff With import tariff Price Quantity demanded Quantity supplied Domestic consumer surplus Domestic producer surplus Government revenue Total economic surplus c. If the government decides to replace the tariff with a quota that will have the same effect on the market as the tariff, the quota should restrict imports to____________________( 1million pounds, 2 million…arrow_forwardNonearrow_forwardSuppose a large country A initially imposed a tariff on its imports and is now considering removing its tariff. Use a domestic-market graph to a) show the effect of country A’s tariff removal on the world’s price, country A’s import price, import quantity, consumer surplus, producer surplus, and government revenue. b) identify country A’s net welfare change as a result of its tariff removal. Is country A unambiguously better off? c) Use a different graph to show how foreign producers will be affected by country A’s tariff removal? d) What factor determines the level of optimal tariff for country A? Please make sure to graph fpr both parts "a" and "c"arrow_forward

- 2. Welfare effects of a tariff in a small country Suppose Guatemala is open to free trade in the world market for oranges. Since Guatemala is small relative to the international market, the demand for and supply of oranges in Guatemala have no impact on the world price. The following graph shows the domestic market for oranges in Guatemala. The world price of a ton of oranges is Pw = $350. On the following graph, use the green triangle (triangle symbols) to shade the area representing consumer surplus (CS) when the economy is at the free-trade equilibrium. Then, use the purple triangle (diamond symbols) to shade the area representing producer surplus (PS). PRICE (Dollars per ton) 710 Domestic Demand Domestic Supply 670 630 590 550 510 470 430 28 8 8 8 8 8 8 8 390 350 P. 310 0 15 30 45 60 75 90 105 120 135 150 QUANTITY (Tons of oranges) CS PS Because Guatemala participates in international trade in the market for oranges, it will import tons of oranges. Now suppose the Guatemalan…arrow_forward3. Welfare effects of a tariff in a small country Suppose Ronduras is open to free trade in the world market for soybeans. Because of Honduras's small size, the demand for and supply of soybeans in Honduras do not affect the world price. The following graph shows the domestic soybeans market in Honduras. The world price of soybeans is Pw = $400 per ton. On the following graph, use the green triangle (triangle symbols) to shade the area representing consumer surplus (CS) when the economy is at the free-trade equilibrium. Then, use the purple triangle (diamond symbols) to shade the area representing producer surplus (PS). 1200 Domestic Demand Domestic Supply 1100 CS 1000 900 PS 800 700 600 500 400 300 200 100 120 140 160 180 200 20 40 60 80 QUANTITY (Tons of soybeans) PRICE (Dollars pe: ton)arrow_forwardSuppose you have the following for white t-shirts market:Market demand is P=125-(3/8)QMarket supply is P=5+(1/8)Q. there is now a global supply that is horizontal at $15. But the government now imposes a tariff of $5 per unit of t-shirt.a. Obviously the world price and domestic price will now be $20. Calculate the quantityproduced and demanded domestically? b. Using graphs show the changes in CS (Consumer Surplus) and PS (Producer Surplus) comparedto Free Trade. Show also the government revenue, which is tariff per t-shirt times the new level of imports. Who gains in comparison to Free Trade scenario? Who loses? What is the welfare gain or loss? Show by using graphs.arrow_forward

- Economics Questionarrow_forwardThe answer is 7875 please show math and explain whyarrow_forwardIf Indonesia (which is a small country) imposes an import tariff on textile imports, we can conclude that:(a) The world price of textile rises, and Indonesia imports less.(b) The world price of textile stays constant, and Indonesia imports less.(c) The world price of textile falls, and Indonesia imports less.(d) The world price of textile stays constant, and Indonesia imports the same as before. Explain why.arrow_forward

- Use the following graph to show the effects of the $200 tariff. Use the black line (plus symbol) to indicate the world price plus the tariff. Then, use the green points (triangle symbols) to show the consumer surplus with the tariff and the purple triangle (diamond symbols) to show the producer surplus with the tariff. Lastly, use the orange quadrilateral (square symbols) to shade the area representing government revenue received from the tariff and the tan points (rectangle symbols) to shade the areas representing deadweight loss (DWL) caused by the tariff. PRICE (Dollars per ton) 1200 1100 1000 900 800 700 600 500 400 300 200 Domestic Demand 0 20 40 Domestic Supply 60 80 100 120 140 QUANTITY (Tons of wheat) 160 P -0 W 180 200 World Price Plus Tariff CS PS Government Revenue DWL ?arrow_forward. Identify people and organizations that benefit from and suffer because of the tariff (2 points). Include how the tariff will impact your companarrow_forwardHow does the tariff affect (i) the consumer surplus, (ii) the producer surplus, and (iii) government's revenue on the market where the import tariff is applied? Briefly explain your result. Assume a country that is small and does not affect the world market implements an import tariff. How does the tariff affect the overall welfare of the country?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education