FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

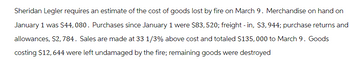

Transcribed Image Text:Sheridan Legler requires an estimate of the cost of goods lost by fire on March 9. Merchandise on hand on

January 1 was $44,080. Purchases since January 1 were $83, 520; freight - in, $3, 944; purchase returns and

allowances, $2,784. Sales are made at 33 1/3% above cost and totaled $135,000 to March 9. Goods

costing $12, 644 were left undamaged by the fire; remaining goods were destroyed

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Similar questions

- Blue Corporation's April 30 inventory was destroyed by fire. January 1 inventory was $155,000, and purchases for January through April totaled $467,300. Sales revenue for the same period was $684,500. Blue's normal gross profit percentage is 25% on sales. Using the gross profit method, estimate Blue's April 30 inventory that was destroyed by fire. Estimated ending inventory destroyed in fire $arrow_forward(i)The inventory costing $ 150,000 being ordered by customers before the year end was excluded from the ending inventory balance as they are set aside for delivery after year end. The ending balance of inventory as on the statement of financial position was $ 600,000. (ii) Inventory list shows 40 boxes of rice but only 38 boxes were found in the warehouse. (iii) The inventory has a cost of $600,000 and realizable value of $540,000 as the items are outdated. The ending balance of inventory as on the statement of financial position was $ 600,000. Q) For each misstatement above, explain which of the above assertions is violated. (Each assertion can only be used once.) Also, give the relevant audit objective the auditor should focus on when detecting the misstatement if the assertion is "Valuation and Allocation "arrow_forwardOn November 21, 2024, a fire at Hodge Company’s warehouse caused severe damage to its entire inventory of Product Tex. Hodge estimates that all usable damaged goods can be sold for $26,000. The following information was available from the records of Hodge’s periodic inventory system: Inventory, November 1, 2024 $ 170,000 Net purchases from November 1, to the date of the fire 154,000 Net sales from November 1, to the date of the fire 234,000 Based on recent history, Hodge’s gross profit ratio on Product Tex is 40% of net sales. Required: Calculate the estimated loss on the inventory from the fire, using the gross profit method.arrow_forward

- A flood destroyed Toshiaki Company's warehouse and all of its inventory. Toshiaki will use the gross profit method to determine its inventory in the warehouse at the time. Toshiaki's management believes that the average of the last two years' gross profit percentage is a good estimate of the gross profit in the current year. Sales last year were $7,700 and $6,100 in the year before. Its cost of goods sold was $4,466 last year and $3,782 the year before. Toshiaki's prior-year balance sheet reported inventory of $450. Before the flood, net sales were $5,200. Toshiaki purchased $3,900 of inventory. Read the requirements. Requirement a. Use the gross profit method to determine Toshiaki's historical gross profit percentage. Identify the appropriate formula and then calculate Toshiaki's historical gross profit percentage for each year. (Round the gross profit percentage to one decimal place, X.X%.) Gross profit % Two Year's Prior % Prior Year % Requirements Round percentages to one decimal…arrow_forwardSandhill Legler requires an estimate of the cost of goods lost by fire on March 9. Merchandise on hand on January 1 was $ 37,240. Purchases since January 1 were $ 70,560; freight-in, $ 3,332; purchase returns and allowances, $ 2,352. Sales are made at 33 1/3% above cost and totaled $ 111,000 to March 9. Goods costing $ 10,682 were left undamaged by the fire; remaining goods were destroyed.arrow_forwardOn January 1, a store had inventory of $48,000. January purchases were $46,000 and January sales were $95,000. On February 1 a fire destroyed most of the inventory. The rate of gross profit was 20% of sales. Merchandise with a selling price of $5,000 remained undamaged after the fire. Compute the amount of the fire loss, assuming the store had no insurance coverage. Label all figures.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education