FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

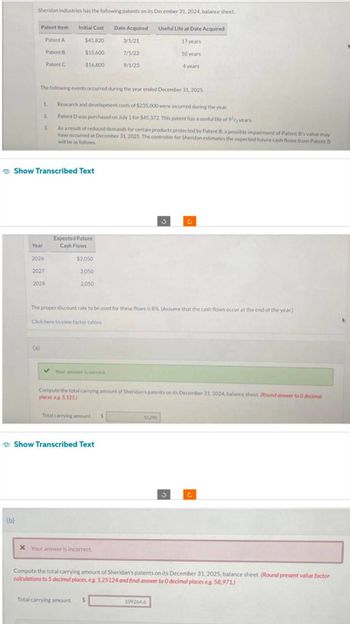

Transcribed Image Text:Sheridan Industries has the following patents on its December 31, 2024, balance sheet.

(b)

Patent Item

Year

Patent A

2

2026

Patent B

2027

(a)

Patent C

The following events occurred during the year ended December 31, 2025.

1 Research and development costs of $235,000 were incurred during the year.

Patent D was purchased on July 1 for $45,372. This patent has a useful life of 91/2 years.

As a result of reduced demands for certain products protected by Patent B, a possible impairment of Patent B's value may

have occurred at December 31, 2025. The controller for Sheridan estimates the expected future cash flows from Patent B

will be as follows.

3.

Show Transcribed Text

2028

Initial Cost

$41,820

$15,600

$16,800

Expected Future

Cash Flows

$2,050

2,050

2,050

✓ Your answer is correct.

Total carrying amount

The proper discount rate to be used for these flows is 8%. (Assume that the cash flows occur at the end of the year)

Click here to view factor tables.

Total carrying amount $

Show Transcribed Text

Date Acquired

3/1/21

7/1/22

9/1/23

x Your answer is incorrect.

Compute the total carrying amount of Sheridan's patents on its December 31, 2024, balance sheet. (Round answer to O decimal

places eg 5,125)

Useful Life at Date Acquired

17 years

10 years

4 years

S

55290

3

109264,6

Ć

3

Compute the total carrying amount of Sheridan's patents on its December 31, 2025, balance sheet. (Round present value factor

calculations to 5 decimal places, eg. 1.25124 and final answer to 0 decimal places eg. 58,971.)

C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Post Company purchased a patent on January 1, 200X for $50,000. The patent has a useful life of 10 years. The accounting entry to record the patent amortization expense for the first year would be: Debit patent $5,000; credit accounts payable $5,000. Debit patent amortization expense $5,000; credit patent $5,000. Debit patent $50,000; credit accounts payable $50,000. Debit patent amortization expense $50,000; credit patent $50,000.arrow_forwardHi there, can help with answering the attached questions, thanks so much.arrow_forwardCullumber Limited organized late in 2022 and set up a single account for all intangible assets. The following summary shows the entries in 2023 (all debits) that have been recorded in Intangible Assets since then: Jan. 2: Purchased patent (8-year life) - $342,000 Mar. 31: Costs to search for new ways to apply patent that was purchased on Jan. 2 - $21,000 Apr. 1: Purchased goodwill (indefinite life) - $315,000 July 1: Purchased franchise with 10-year life; expiration date July 1, 2033 - $248,000 July 1: Promotional costs to increase the future economic benefit of the goodwill that was purchased on Apr. 1 - S 33,000 Aug. 1: Payment for copyright (5-year life) - $132,000 Aug. 1: Purchased trademark (3-year life) - $14,400 Aug. 1: Purchased customer lists (2-year life) S9, 600 Sept. 1: Research costs - $234,000 Total: $1,349,000arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardOn December 31, it was estimated that a goodwill of $1,500,000was impaired. I addition on October 1, a patent with an estimated useful life of 10 years was acquired for $750,000. Required: Given the above transactions, make the following journal entries: a. An adjusting entry on December 31, for impaired goodwill b. An adjusting entry on December 31, for the amortization of the patent rights.arrow_forwardRakesharrow_forward

- Ivanhoe Company, organized in 2022, has these transactions related to intangible assets in that year: Jan. Purchased a patent (5-year life) $305,500. Apr. 1. Goodwill purchased (indefinite life) $338,400. July Acquired a 9-year franchise; expiration date July 1, 2031, $676,800. Sept. 1 Research and development costs $173,900.arrow_forwardam. 1111.arrow_forward! Required information [The following information applies to the questions displayed below.] Bethany incurred $20,800 in research and experimental costs for developing a specialized product during July 2023. Bethany went through a lot of trouble and spent $10,400 in legal fees to receive a patent for the product in August 2025. Bethany expects the patent to have a remaining useful life of 10 years. Note: Do not round intermediate calculations. b. How much patent amortization expense would Bethany deduct in 2025? Deductible patent amortization expensearrow_forward

- Computing Impairment of Intangible Assets Stiller Company had the following information for its three intangible assets. 1. Patent: A patent was purchased for $140,000 on June 30 of Year 1; Stiller estimated the useful life of the patent to be 15 years. On December 31 of Year 3, the estimated future cash flows attributed to the pat were $119,000. The fair value of the patent was $105,000. 2. Trademark: A trademark was purchased for $7,000 on August 31 of Year 2. The trademark is considered to have an indefinite life. The fair value of the trademark on December 31 of Year 3 is $3,500. 3. Goodwill: Stiller recorded goodwill in January of Year 2, related to a purchase of another company. The carrying value of goodwill is $42,000 on December 31 of Year 3. On December 31 of Year 3, the segment for which the goodwill relates had a fair value of $812,000. The book value of the net assets of the segment (including goodwill) is $840,000. a. Classify each of the intangible assets above as a…arrow_forwardSubject : Accountingarrow_forwardOn July 10, 20X8, your firm purchases for $126,000 a machine with an estimated useful life of 8 years and a salvage value of $6,000. Your firm uses SYD depreciation and depreciates assets purchased between the 1st and 15th of the month for the entire month and assets purchased after the 15th as though they were acquired the following month. What is 20X1 depreciation expense $13,333 $11,111 $26,667 $13,889arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education