FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Computing Subsequent Carrying Amount of Patents

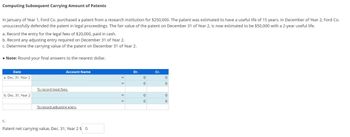

In January of Year 1, Ford Co. purchased a patent from a research institution for $250,000. The patent was estimated to have a useful life of 15 years. In December of Year 2, Ford Co.

unsuccessfully defended the patent in legal proceedings. The fair value of the patent on December 31 of Year 2, is now estimated to be $50,000 with a 2-year useful life.

a. Record the entry for the legal fees of $20,000, paid in cash.

b. Record any adjusting entry required on December 31 of Year 2.

c. Determine the carrying value of the patent on December 31 of Year 2.

• Note: Round your final answers to the nearest dollar.

Date

a. Dec. 31, Year 2

b. Dec. 31, Year 2

C.

Account Name

To record legal fees.

To record adjusting entry.

Patent net carrying value, Dec. 31, Year 2 $ 0

>

>

Dr.

0

0

0

0

Cr.

0

O

O

O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- These are selected 2022 transactions for Blossom Company. Jan. 1 Mar. 1 Sept. 1 Purchased a copyright for $108,000. The copyright has a useful life of 6 years and a remaining legal life of 30 years. Purchased a patent with an estimated useful life of 4 years and a legal life of 20 years for $58,800. Purchased a small company and recorded goodwill of $150,000. Its useful life is indefinite. Prepare all adjusting entries at December 31 to record amortization required by the events. (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Dec. 31 Debit Credit Dec. 31 (To record copyrights amortization) Dec. 31 (To record patent amortization) (To record goodwill amortization)arrow_forwardAmortization Entries Kleen Company acquired patent rights on January 10 of Year 1 for $360,000. The patent has a useful life equal to its legal life of eight years. On January 7 of Year 4, Kleen successfully defended the patent in a lawsuit at a cost of $18,000. If required, round your answers to the nearest dollar. Question Content Area a. Determine the patent amortization expense for Year 4 ended December 31.$fill in the blank bc4756fc8040fa8_1 Question Content Area b. Journalize the adjusting entry on December 31 of Year 4 to recognize the amortization. If an amount box does not require an entry, leave it blank. blank - Select - - Select - - Select - - Select -arrow_forwardanswer in text form please (without image), Note: .Every entry should have narration pleasearrow_forward

- Kleen Company acquired patent rights on January 10 of Year 1 for $881,100. The patent has a useful life equal to its legal life of eight years. On January 7 of Year 4, Kleen successfully defended the patent in a lawsuit at a cost of $49,200. Required: a. Determine the patent amortization expense for Year 4 ended December 31. b. Journalize the adjusting entry on December 31 of Year 4 to recognize the amortization. Refer to the Chart of Accounts for exact wording of account titlesarrow_forwardAmortization Entries Kleen Company acquired patent rights on January 10 of Year 1 for $472,000. The patent has a useful life equal to its legal life of eight years. On January 7 of Year 4, Kleen successfully defended the patent in a lawsuit at a cost of $23,500. If required, round your answers to the nearest dollar. a. Determine the patent amortization expense for Year 4 ended December 31. $236,000 X b. Journalize the adjusting entry on December 31 of Year 4 to recognize the amortization. If an amount box does not require an entry, leave it blank. Amortization Expense-Patents Patents 29,500 X 29,500 Xarrow_forwardAa.38.arrow_forward

- In January of Year 1, Ford Co. purchased a patent from a research institution for $600,000. The patent was estimated to have a useful life of 15 years. In December of Year 2, Ford Co. defended the patent in legal proceedings and successfully retained rights of ownership of the patent. The estimated life of the patent did not change from its original estimate. Legal expenses on December 31 were $48,000. Determine the (1) amortization for Year 2, and (2) carrying value of the patent on December 31 of Year 2.arrow_forwardWhat would the correct entries for this bearrow_forward5carrow_forward

- Befort Company filed for a patent on a new type of machine. The application costs totaled $15,000. R&D costs incurred to create the machine were $75,000. In the year in which the company filed for and received the patent, it spent $25,000 in the successful defense of a patent infringement suit. Required 1. At what amount should the company capitalize the patent? 2. What are the factors used to determine the economic life of a patent?arrow_forwardRecording Asset Retirement Obligation BPP Company maintains underground storage tanks for its operations. A new storage tank was installed and made ready for use at a cost of $2,000,000 on January 1 of the current year. The tank's useful life is estimated at 15 years, at which time the company is legally required to remove the tank and restore the area at an estimated cost of $200,000. The appropriate discount rate for the company is 12%. Required a. On January 1, record the entry for (1) the purchase and installation of the storage tank and (2) the related asset retirement obligation. b. Record adjusting entries on December 31 of the current year for (1) depreciation and (2) accretion. c. Assume that on December 31, fifteen years later, the tank is safely removed at a cost of $230,000. Record the required journal entry. Note: Round answers to the nearest whole dollar. a. 1. Jan. 1 a. 2. Jan. 1 b. 1. Dec. 31 M b. 2. Dec. 31 Account Name Equipment Cash To record purchase of storage tank…arrow_forwardjagdisharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education