FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

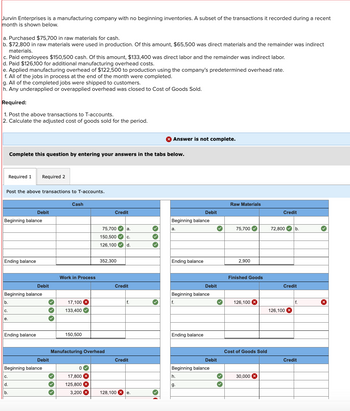

Transcribed Image Text:Jurvin Enterprises is a manufacturing company with no beginning inventories. A subset of the transactions it recorded during a recent

month is shown below.

a. Purchased $75,700 in raw materials for cash.

b. $72,800 in raw materials were used in production. Of this amount, $65,500 was direct materials and the remainder was indirect

materials.

c. Paid employees $150,500 cash. Of this amount, $133,400 was direct labor and the remainder was indirect labor.

d. Paid $126,100 for additional manufacturing overhead costs.

e. Applied manufacturing overhead of $122,500 to production using the company's predetermined overhead rate.

f. All of the jobs in process at the end of the month were completed.

g. All of the completed jobs were shipped to customers.

h. Any underapplied or overapplied overhead was closed to Cost of Goods Sold.

Required:

1. Post the above transactions to T-accounts.

2. Calculate the adjusted cost of goods sold for the period.

Post the above transactions to T-accounts.

Ending balance

b.

Complete this question by entering your answers in the tabs below.

Required 1

Beginning balance

C.

e.

Required 2

Beginning balance

Ending balance

C.

d.

b.

Debit

Debit

Beginning balance

✓

✔

Debit

› › ›

✓

Cash

✓

Work in Process

17,100 X

133,400✔

150,500

Manufacturing Overhead

0

17,800 X

125,800 X

3,200 x

Credit

75,700 a.

150,500✔ C.

126,100✔ d.

352,300

Credit

f.

Credit

128,100 (X)|e.

Answer is not complete.

›››

Beginning balance

a.

Ending balance

|f.

Beginning balance

Ending balance

Debit

h.

Debit

g.

Beginning balance

Debit

✓

✓

✓

Raw Materials

75,700✔

2,900

Finished Goods

126,100 x

Cost of Goods Sold

30,000 X

Credit

72,800✔ b.

Credit

126,100 X

f.

Credit

x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Introduce to T-accounts and Underapplied Overhead :

VIEW Step 2: Working for indirect materials, indirect labor and under-applied overhead :

VIEW Step 3: Working for actual manufacturing overhead

VIEW Step 4: Working for underapplied overhead

VIEW Step 5: Working for adjusted cost of goods sold

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- (Multiple Choice) A multi-step income statement ________. A. separates cost of goods sold from operating expenses B. considers interest revenue an operating activity C. is another name for a simple income statement D. combines cost of goods sold and operating expensesarrow_forward7. Consider the following: Code: A= Gross Profit to Net Sales Ratio B= Gross Profit to Cost of Goods Sold Ratio Which equation is correct? B = A a. 1 - A b. B = 1 + A A с. B = 1 - A A d. B = A 1 + Aarrow_forwardLopez Corporation incurred the following costs while manufacturing its product. Materials used in product Depreciation on plant Property taxes on store Labor costs of assembly-line workers Factory supplies used $121,000 61,000 7,600 111,000 24,000 Advertising expense Property taxes on plant Delivery expense Sales commissions Salaries paid to sales clerks $46,000 15,000 22,000 36,000 51,000 Work in process inventory was $13,000 at January 1 and $16,600 at December 31. Finished goods inventory was $61,000 at January 1 and $45,700 at December 31.arrow_forward

- 10. Choose the options to correctly complete the following statement. Some balance sheet and income statement accounts that vary directly with sales include: 1. Cost of goods sold II. Depreciation III. Accounts payable IV. Accounts receivable O I, II, III only O I, II, IV only O I, III, IV only O I, II, III, and IVarrow_forwardThe amount recorded for net cost of purchases includes all of the following EXCEPT: Purchase discounts. Freight costs paid by the seller. Returns and allowances. Freight costs paid by the buyer.arrow_forward3. As product costs expire(expensed), they become part of a. selling expenses. b. inventory. C. cost of goods sold. d. sales revenue.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education