FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

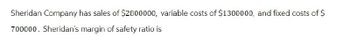

Transcribed Image Text:Sheridan Company has sales of $2800000, variable costs of $1300000, and fixed costs of $

700000. Sheridan's margin of safety ratio is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- A firm has the capacity to produce 599,374 units of a product each year. At present, it is operating at 21 percent of capacity. The firm's annual revenue is $1,054,613. Annual fixed costs are $346,003 and the variable costs are $.51 cents per unit. The following equations will be useful. Profit = Revenue - Costs Revenue = Price each * quantity Costs = Fixed Cost + Variable Costs Variable Cost = Variable Cost per unit * number of units At the break even point, Profit = 0 What is the price for each unit?arrow_forwardBaird company makes a product that sells for $32 per unit. The company pays $14 per unit for the variable costs of the product and incurs annual fixed costs of $147600. Baird expects to sell 21300 units of product. Required Determine Baird margin of safety expressed as a percentage: Margin of safety%arrow_forwardConcord Corporation has a weighted-average unit contribution margin of $30 for its two products, Standard and Supreme. Expected sales for Concord are 10000 Standard and 90000 Supreme. Fixed expenses are $2100000. How many Standards would Concord sell at the break- even point? 63000. O 10000. 70000. 7000.arrow_forward

- Assume the following (1) selling price per unit = $30, (2) variable expense per unit = $18, and (3) total fixed expenses = $31,800. Given these three assumptions, the unit sales needed to achieve a target profit of $11,700 is: Multiple Choice O O 3,625 units. 15,325 units. 58,825 units. 43,500 units.arrow_forwardOn the CVP graph, the intersection between the total costs line and the Y axis represents: O a The loss area Ob. The profit area Oc The margin of safety Od. The total fixed cost Oe None of the given answers XYZ company expects the following in the next month: sales volume 50,000 units, contribution margin ratio 60%, the selling price $2per unit, and the total fixed costs $10,000. What will be the degree of operating leverage in the next month? O a 6 O b. 12 Oc 3 Od. None of the choices given O e 25 onarrow_forwardIf fixed costs are $332,000, the unit selling price is $72, and the unit variable costs are $45, the old and new break-even sales (units), respectively, if the unit selling price increases by $8 arearrow_forward

- Bonita Industries has sales of $1200000, variable costs of $550000, and fixed costs of $300000. Bonita’s degree of operating leverage is 1.86. 1.18. 1.33. 2.17.arrow_forwardCompany G has the following information on its management books: Price per Unit: $8 Variable Costs per Unit: $2 Total Fixed Costs: $24,000 How many units must Company G sell to make a profit of $12,000?arrow_forwardThe total cost formula for a company can be modeled by TC = 12570+ 50x where x represents the number of items sold. A formula for the company's total income is modeled with TR 80x, where a represents the number of items sold. This company will breakeven when its total costs equal its total income. - How many items must this company sell to breakeven? Answer:arrow_forward

- Carla Vista Company has a unit selling price of $384, unit variable costs of $254, and fixed costs of $201,500. Compute the break-even point in units using (a) the mathematical equation and (b) unit contribution margin. (a) Break-even point (b) Break-even point units unitsarrow_forwardSolomon company has total fixed cost of $15,000, variable cost per unit of $6, and a price of $8. If Solomon wants to earn a target profit of $3,600, how many units must be sold? 2,500 7,500 9,300 18,600 18,750arrow_forwardPenny Corporation desires to earn target net income of $15,000. If the selling price per unit is $51, unit variable cost is $31, and total fixed costs are $685,000, the number of units that the company must sell to earn its target net income isarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education